- Shares of Hindustan Construction Company fell nearly 5% after recent rights issue news

- The board approved issuing 79.99 crore rights equity shares to raise Rs 1,000 crore

- Rights shares offered at 277 shares per 630 held, with December 5 set as record date

Shares of Hindustan Construction Company Ltd (HCC) fell as much as 4.93% as the stock traded lower compared to its previous close indicating that some investors are booking profits or reacting cautiously after the recent rights issue news and the upcoming record date.

The drop in HCC's share price comes amidst the news of the company;s board approving the issuance of 79.99 crore rights equity shares to raise up to Rs 1,000 crore.

In a regulatory filing, the company said the rights equity shares are being offered to eligible equity shareholders in the ratio of 277 rights equity shares for every 630 fully paid-up equity shares held on the record date.

HCC has fixed December 5 as the record date for the rights issue.

A rights issue is a fundraising instrument for a company, where it issues shares at a discount to the current price to raise funds without increasing the debt burden.

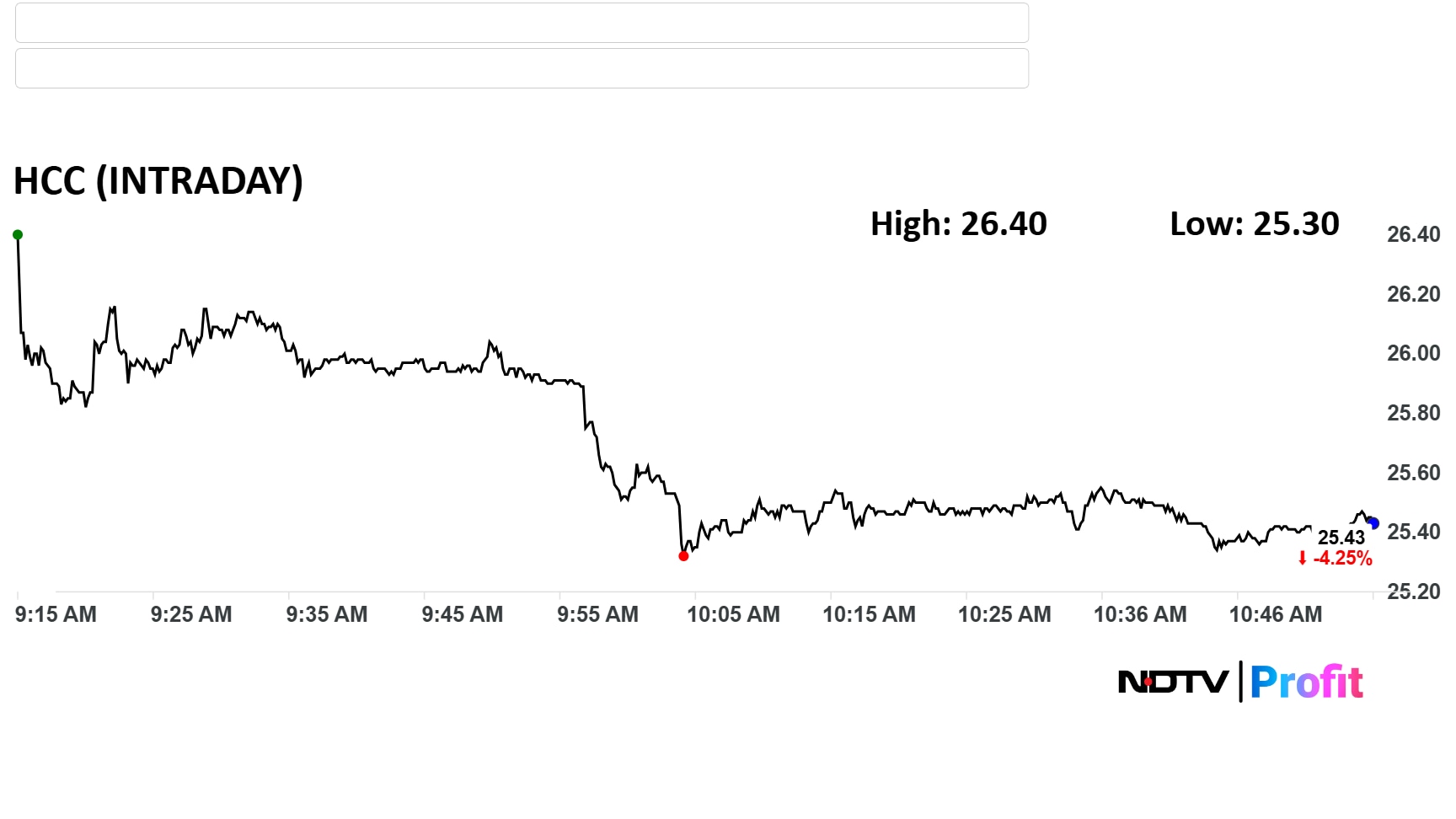

HCC Share Price Today

The scrip fell as much as 4.25% to Rs 25.3 apiece, to trade % higher at Rs 25.30 apiece, as of 11:00 a.m. The total traded volume was 17.39.

It has dropped to 32.51% on a year-to-date basis. The relative strength index was at 61.47.

Out of eight analysts tracking the company, four maintain a 'buy' rating, four recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upsideof 5.3%.

Watch LIVE TV, Get Stock Market Updates, Top Business, IPO and Latest News on NDTV Profit.