Havells India Ltd.'s share price fell nearly 5% as the March quarter performance drew mixed reactions from brokerages, even as the company reported an all-round beat on revenue, Ebitda, and profit—driven primarily by strong growth in its Lloyd brand and cables & wires segments.

While most brokerages acknowledged the earnings growth, they diverged on the stock's valuation and future risks. Jefferies and Citi remain neutral on the counter, while Nomura retains its 'buy' call and Bank of America holds 'underperform'.

Havells India Q4: Where Brokerages Agree

Across the board, brokerages recognised Havells' strong final quarter performance. The company's consolidated revenue rose 20% yearly to Rs 6,530 crore, 1-5% ahead of most estimates, while Ebitda margins at 11.6% were a positive surprise against consensus expectations of 10-10.7%. Ebitda and profit after tax grew 19% and 16% respectively.

The key growth drivers were Lloyd, which posted a sharp 40% year-on-year revenue jump, and Cables & Wires, which saw a 21% rise. Lloyd's operating income margin expanded 347 basis points to 6.2%, aided by primary sales and cost control.

C&W volume growth stood at 10%, with underground cables outpacing wires. Across brokerages, this performance was seen as a sign of the business benefiting from scale and cost efficiencies.

There was also broad consensus on the subdued performance in the Switchgear segment, which grew just 6%, pressured by muted industrial demand and margin compression. Capex plans of Rs 2,000 crore over fiscals 2026 to 2027 and a strategic investment in Goldi Solar were viewed as long-term growth initiatives, especially in addressing supply constraints.

Havells India Q4: Points Of Divergence

Where brokerages diverged significantly was in their stock ratings and valuation outlooks. Jefferies, for instance, retained its 'buy' rating with a revised target price of Rs 1,873, citing increasing competition in C&W.

On the other hand, BofA remains cautious, reiterating an 'underperform' rating with a target price of Rs 1,400, warning that the benefits of the quarter under question may be front-loaded due to early summer stocking. The brokerage flagged delayed summer onset and elevated AC inventory levels as near-term risks that could hit secondary sales and margins.

Citi took a middle path, maintaining a 'neutral' stance while revising its target price upwards to Rs 1,900 from Rs 1,750, citing stronger-than-expected performance in the quarter and upward revisions in EPS estimates. However, it flagged an "adverse mix" due to higher growth in lower-margin businesses like Lloyd and cautioned that overall earnings growth remains constrained.

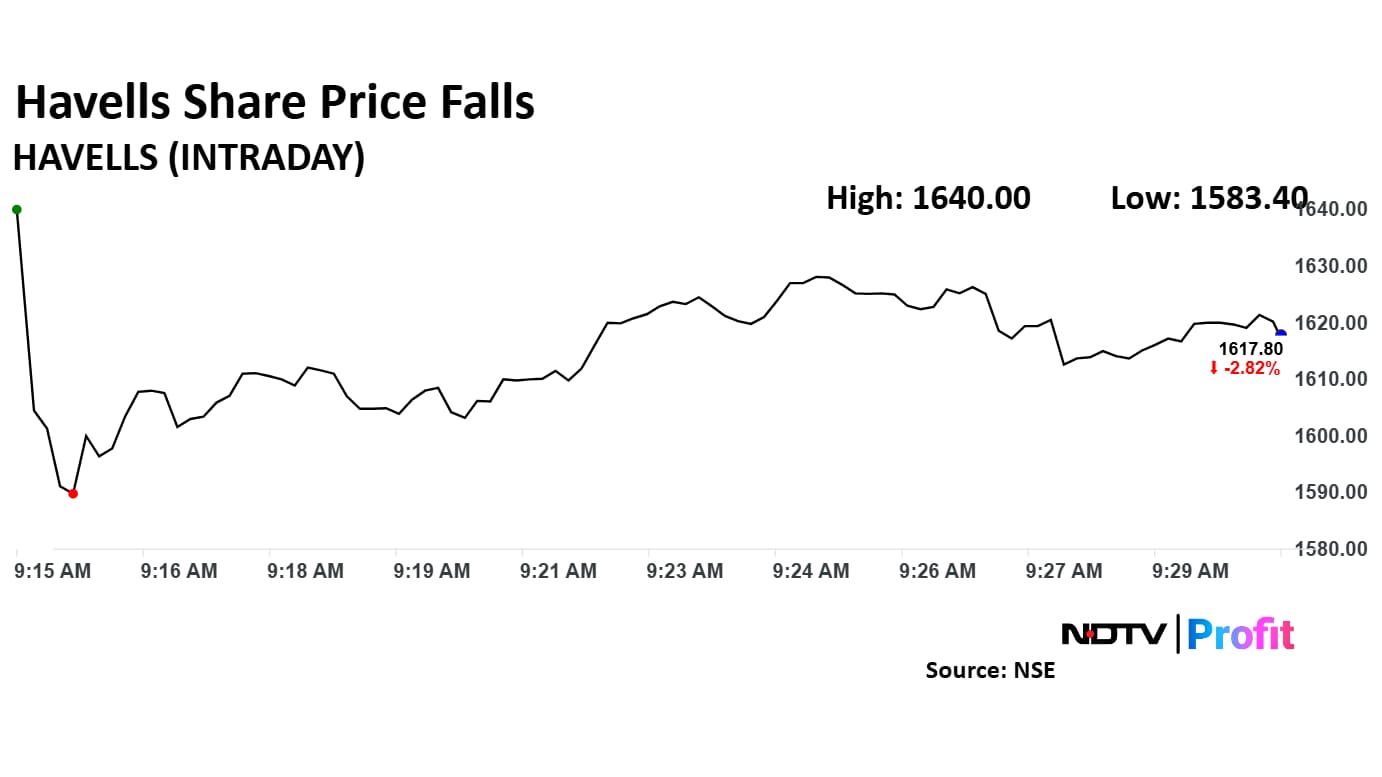

Havells India Share Price Today

The scrip fell as much as 4.88% to 1,583.40 apiece. It pared losses to trade 2.63% lower at Rs 1,621 apiece, as of 09:35 a.m. This compares to a 0.69% advance in the NSE Nifty 50 Index.

It has risen 4.85% on a year-to-date basis. Total traded volume so far in the day stood at 1.87 times its 30-day average. The relative strength index was at 42.01.

Out of 42 analysts tracking the company, 27 maintain a 'buy' rating, nine recommend a 'hold,' and six suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 11.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.