Shares of Gopal Snacks plunged nearly 10% in early trade on Thursday, following news of a significant fire at one of its production facilities in Gujarat. The incident, which occurred at the company's Rajkot I facility, caused immediate concern, with the cause of the fire yet to be determined.

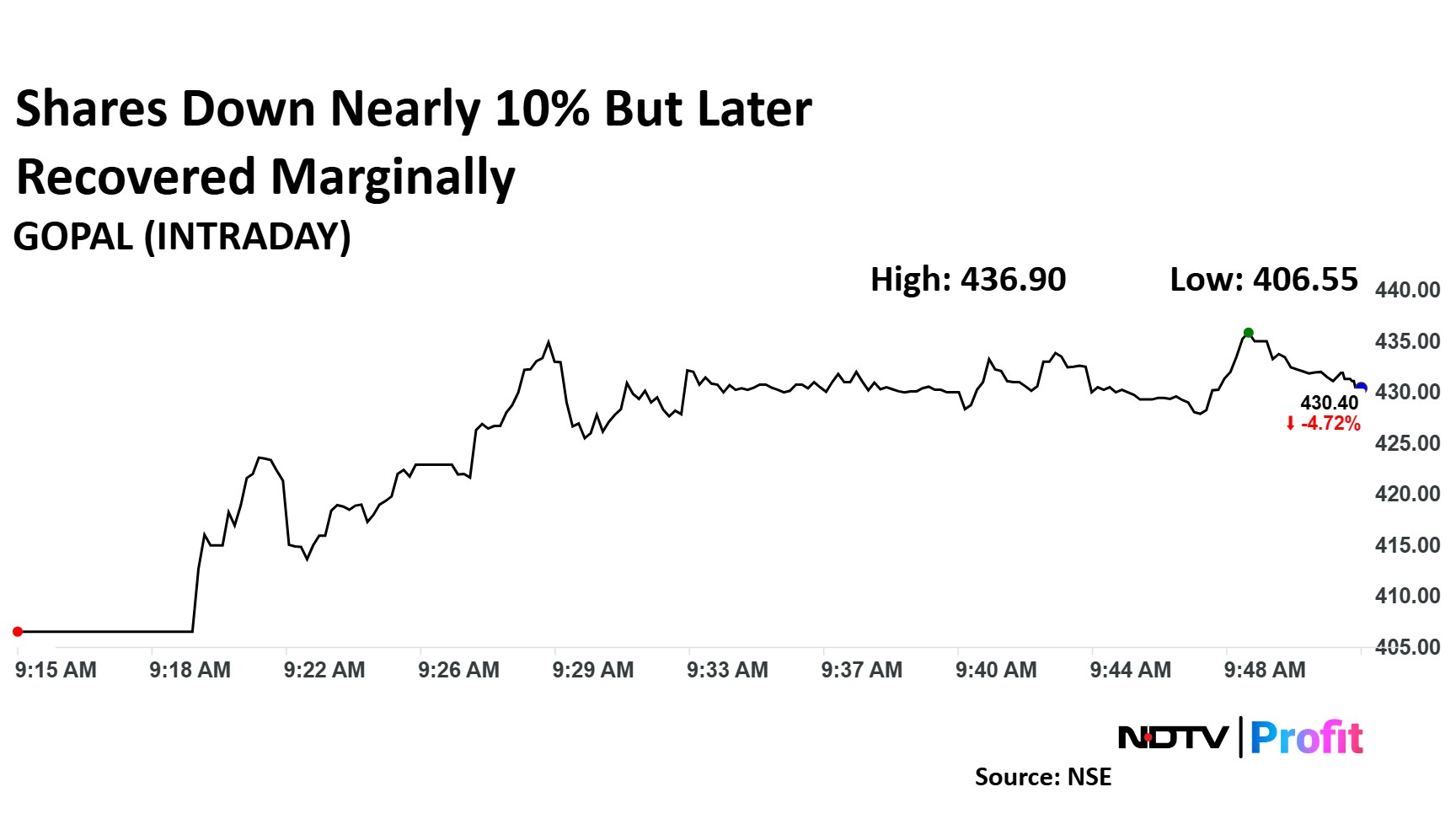

The stock experienced a sharp decline, but later showed signs of recovery after the company issued a statement in response to the incident. Later, the shares regained some ground, trading around 4% lower.

In its exchange filing, Gopal Snacks assured investors that all necessary steps had been taken to manage the situation.

The company has taken the appropriate measures to manage the incident, and there have been no casualties or injuries among its personnel onsite. The safety of Gopal Snacks team members always remains its highest priority, the filing stated.

To address the disruption caused by the fire, the company outlined several key actions:

Production Shift: Production activities have been scaled up at the company's Modasa and Nagpur facilities to compensate for the closure of the Rajkot I unit.

Third-Party Manufacturing: Gopal Snacks is also engaging with third-party manufacturers to meet the increased demand and ensure continuity of supply during this period.

Insurance Coverage: The company's assets are fully insured, and the insurance provider has been notified of the incident, ensuring that financial impacts are mitigated.

Operational Continuity: Gopal Snacks confirmed that all critical business systems, including SAP infrastructure, remain operational and secure, with no data loss or IT disruptions.

Gopal Snacks share price fell nearly 10% to Rs 406.55 apiece. It later pared losses to trade 3.70% lower at Rs 435 apiece.

It has risen 19.93% in the last 12 months. Total traded volume so far in the day stood at 24 times its 30-day average. The relative strength index was at 77.

Two analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 39.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.