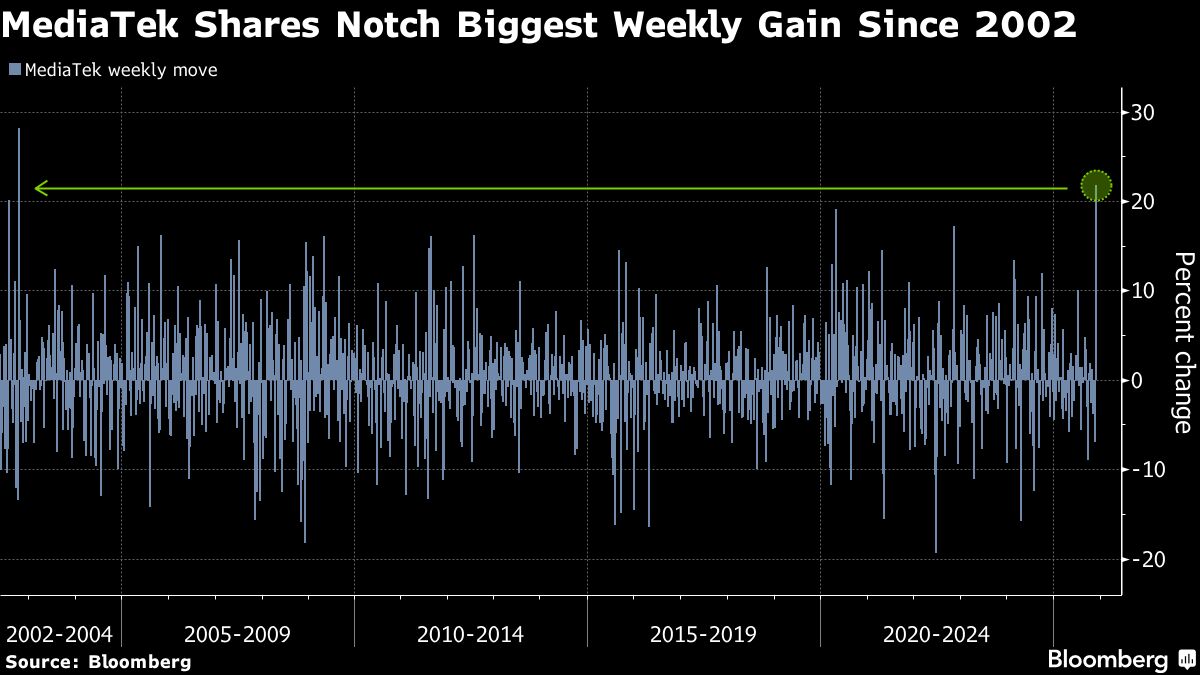

- MediaTek shares rose 22% this week, marking their best performance since 2002

- The rise follows AI advances at Google and a partnership on tensor processing units

- Morgan Stanley upgraded MediaTek to overweight, citing TPU potential vs smartphone headwinds

MediaTek Inc. shares posted their best week since 2002, as artificial intelligence advances at its client Google help reshape the growth outlook for the Taiwanese chipmaker.

The stock rose for a fifth-straight day Friday in Taipei, taking its weekly gain to 22%, on investor enthusiasm over Google's latest Gemini model and AI chip deals. MediaTek has reportedly partnered with the Alphabet Inc. unit on design of tensor processing units, seen as a potential rival to Nvidia Corp. chips in AI applications.

Known for its smartphone chips, MediaTek has suffered from a cloudy outlook for end-product demand as well as margin pressure due to competition and high development costs. The AI news has brought relief for the shares, which are still down 1% on the year.

China business remains tough into 2026, yet “Google TPU upside should offset the smartphone headwind in the longer term,” according to Morgan Stanley analysts Charlie Chan and Daniel Yen. They upgraded the stock to overweight from equal-weight on Thursday.

The early days of AI centered on training of large language models, which requires the massive computing power provided by graphic processing units such as those from Nvidia. The shift in focus to inference — or how LLMs respond to user queries — is putting a spotlight on application-specific integrated circuits such as TPUs.

UBS Group AG analysts led by Sunny Lin raised their estimate for MediaTek's sales contribution from TPUs in 2027 to $4 billion from $1.8 billion. The analysts see the chips accounting for 20% of the company's operating profit by 2028, “depending on execution by MediaTek and Google,” they wrote in a note dated Thursday.

Part of this week's excitement was due to news that Meta Platforms Inc. is in discussions to use Google TPUs in data centers in 2027. UBS sees further potential upside for MediaTek from additional ASIC projects with Meta.

The sell-side overall is bullish on MediaTek, with 23 buy recommendations, 10 holds and no sells. The consensus price target projects a further 9% rise in the stock over the next year.

In terms of future AI stock investing, Macquarie Group Ltd. analysts including Arthur Lai say they “lean more” toward MediaTek and other Google partners over the Nvidia supply chain.

“We view the current AI surge as less a speculative bubble but rather a necessary, capital-intensive build-out of a new, foundational technology layer,” they wrote in a report this week.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.