Gold Steadies As Traders Look Past Geopolitical Risk To US Data

While the geopolitical landscape remains fragile, traders are turning their attention to a busy lineup of US economic data, including the December jobs report due Friday.

Gold steadied after three days of gains, with traders looking beyond heightened geopolitical tensions to US economic data due this week.

Bullion was near $4,490 an ounce, having risen more than 4% over the previous three sessions. After the capture of Venezuelan leader Nicolás Maduro, the White House said Tuesday that President Donald Trump won’t rule out military force to acquire Greenland. China, meanwhile, imposed controls on exports to Japan with any military use, intensifying a dispute between Asia’s top economies.

While the geopolitical landscape remains fragile, traders are turning their attention to a busy lineup of US economic data, including the December jobs report due Friday. A gauge of manufacturing activity came in weaker than expected on Tuesday, bolstering hopes that the Federal Reserve will cut interest rates again.

Adding to these expectations, Fed Governor Stephen Miran said the US central bank would need to cut interest rates by more than a percentage point in 2026, arguing that monetary policy is restraining the economy. Three successive rate cuts last year were a tailwind for precious metals, which don’t pay interest.

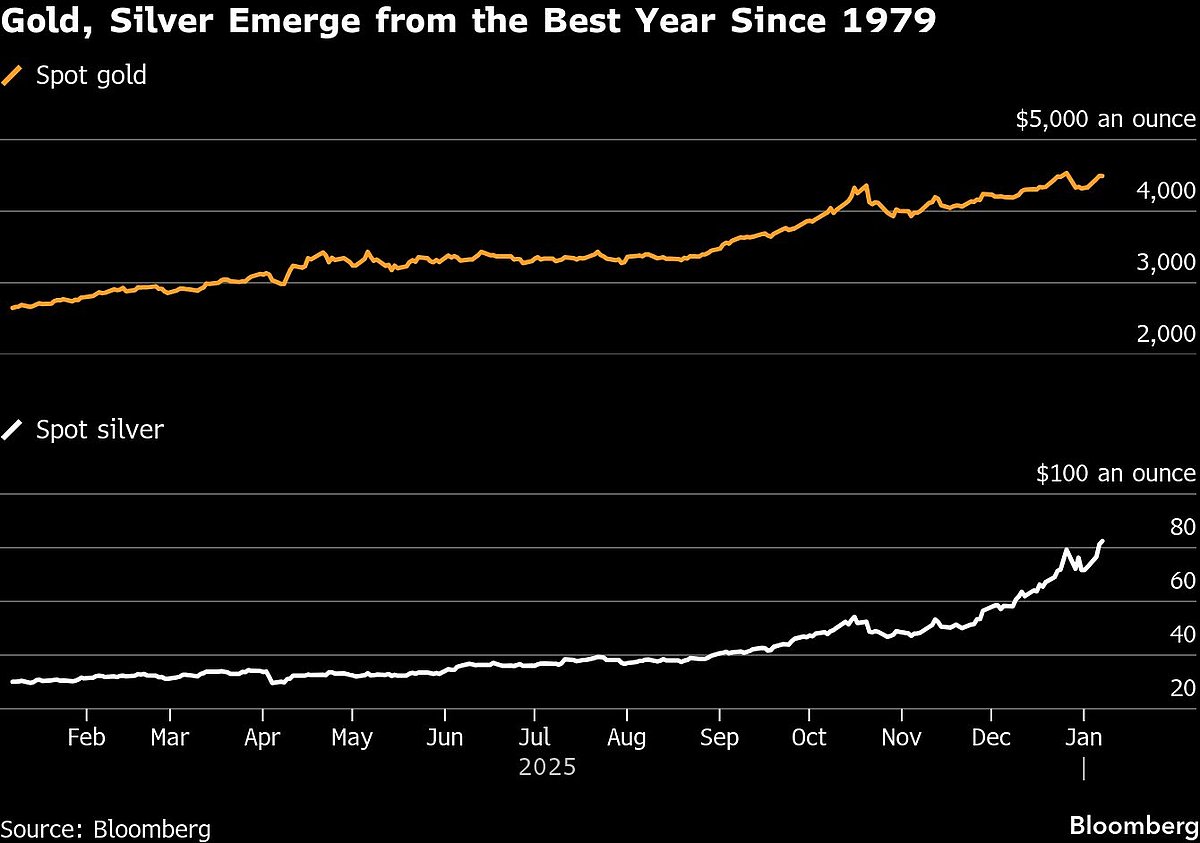

Gold is fresh from posting its best annual performance since 1979, hitting a series of record highs throughout last year with support from central-bank buying and inflows to bullion-backed exchange-traded funds. Silver’s rally was even more spectacular — the white metal gained nearly 150% — as it also benefited from a shortage of metal and the potential of US import tariffs that’s keeping significant supplies locked up in New York.

On Wednesday, silver rose for a fourth straight day, building momentum toward an all-time high of $84.01 an ounce hit on Dec. 29. The metal rose as much as 1.8%, having gained more than 13% across the three previous sessions. The appetite of retail investors, especially in China, has also been a driver of silver’s spectacular growth.

There are some near-term concerns, however, that a broad rebalancing of commodity indexes may drag on precious metals, with passive tracking funds prompted to sell some contracts to match new weightings. Citigroup Inc. estimated outflows of $6.8 billion from gold futures contracts and roughly the same amount from silver as a result of the reweighting of the two largest commodity indexes.

Gold edged down 0.1% to $4,490.51 an ounce as of 8:41 a.m. in Singapore. Silver rose 1.6% to $82.61 an ounce. Platinum and palladium made small gains. The Bloomberg Dollar Spot Index, a gauge of the US currency’s strength, was flat.