Gold extended a decline as progress in talks between the US and key trading partners eased demand for haven assets.

Bullion edged lower to trade near $3,365 an ounce — following a 1.3% loss in the previous session — after Bloomberg News reported the European Union could be ready to accept a 15% tariff on most of its goods going to the US. That followed a similar agreement with Japan that included a $550 billion investment pledge by the Asian country. The progress on trade has helped drive Treasury yields higher, weighing on gold as it doesn't pay interest.

Still, the positive sentiment was tempered by US President Donald Trump's continued threats to impose between 15% and 50% duties on other countries, like South Korea and India, that are still trying to clinch agreements before the duties come into effect on Aug. 1.

Traders were also seeking clarity on the progress of negotiations with China, the world's biggest metals consumer. Copper on the London Metal Exchange rose 0.2% to $9,948 a ton at 10:47 a.m., while other base metals also ticked higher.

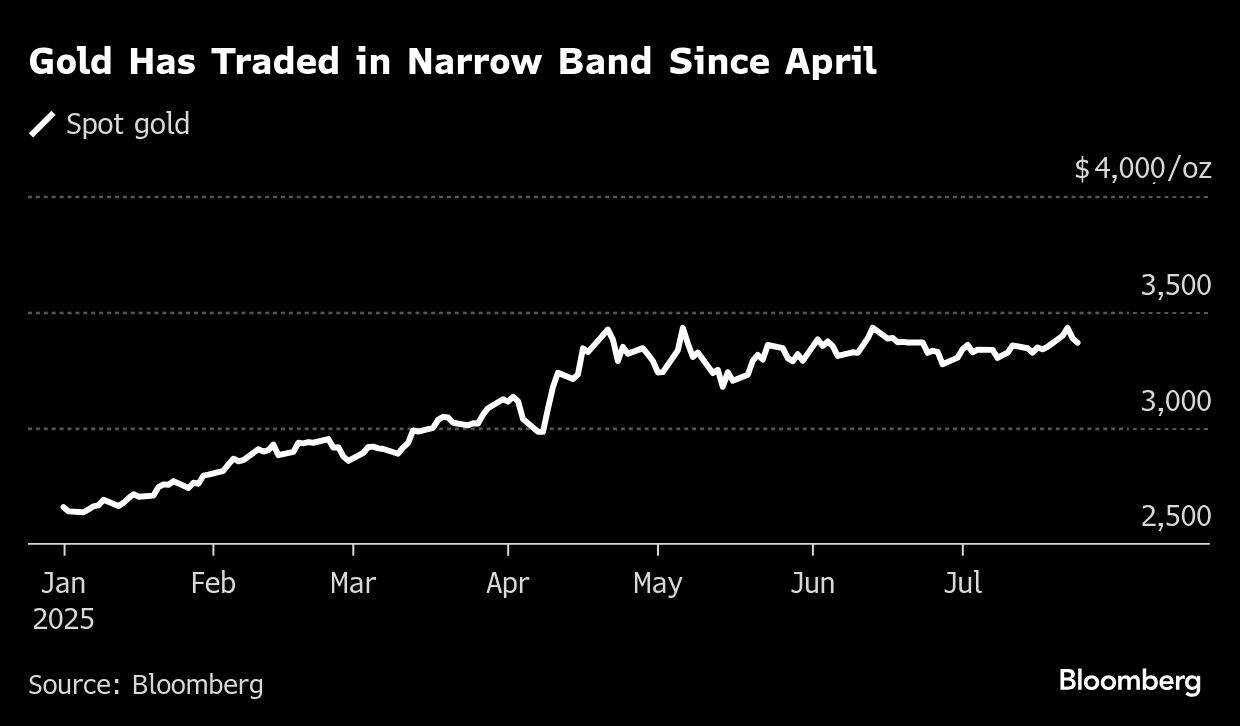

Gold has climbed more than a quarter this year, as uncertainty around Trump's aggressive attempts to reshape global trade and conflicts in Ukraine and the Middle East sparked a flight to havens. The precious metal has been trading within a tight range over the past few months after hitting an all-time high above $3,500 an ounce in April.

Elsewhere, money markets are betting the Federal Reserve will keep interest rates on hold next week when officials gather for their July meeting. However, traders expect at least one quarter-point reduction by October, with a roughly 60% chance of a cut at the September meeting. Lower borrowing costs tend to benefit non-yielding gold.

Spot gold was down 0.7% to $3,363.88 an ounce at 10:47 a.m. in London. The Bloomberg Dollar Spot Index rose 0.1%. Silver declined, after touching the highest since 2011 on Wednesday. Platinum and palladium also fell.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.