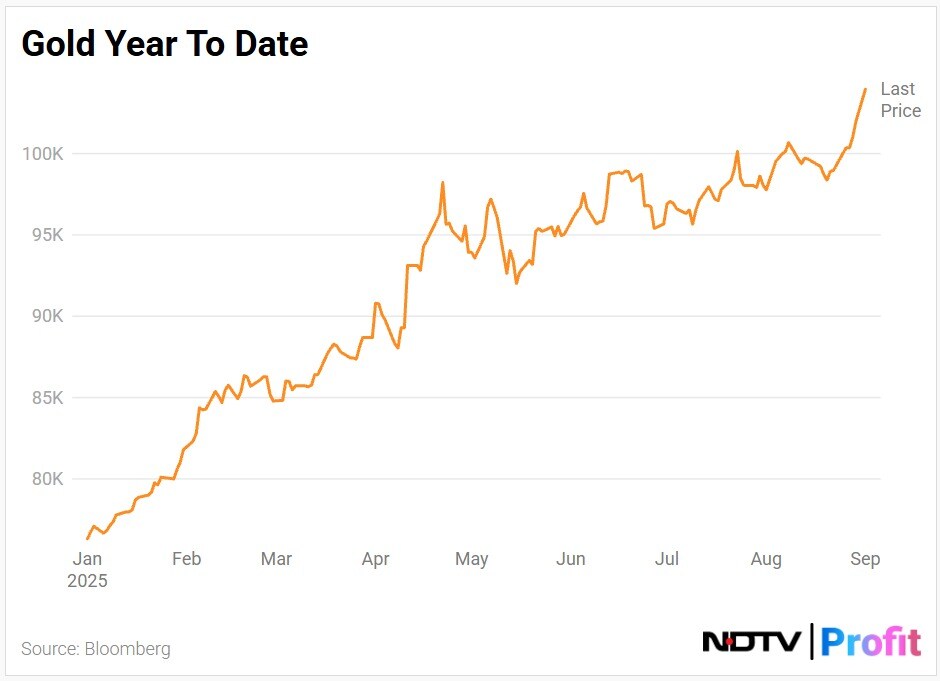

- Gold prices hit a record high of Rs 1,05,140 per 10 gm this week, according to the India Bullions Association

- Rise driven by escalating trade tensions, weakening rupee, and increasing safe-haven demand

- Analysts expect gold to test between Rs 1,06,400 and Rs 1,10,000 amid US political uncertainty

The golden rally of the yellow metal have pushed rates over the Rs 1,05,000 mark this week. Hitting a fresh record high, the run up in rates are driven by escalating trade tensions and the weakening Rupee.

The yellow metal was trading at a fresh record high of at Rs 1,05,140 per 10 gm, according to the India Bullions Association.

Apart from escalating geopolitical tensions and trade war risks, there has also been a trend of several central banks like China buying gold. The rising risks contributed to the metal's safe-haven demand among investors.

Over the past year, the highest price that the yellow metal had achieved was Rs 1,03,910, on Aug. 31, before the prices settled over Rs 1,000 higher today. The price of the commodity went as low as Rs 74,240 on Nov. 15.

Will The Rally Continue? Experts Weigh In

According to a Kedia Advisory Report on Bullion, the bullish sentiment for gold has been boosted by the rising expectations of a September rate cut by the US Federal Reserve.

With traders pricing in an 86% chance of a 25 basis points cut, the outlook for the yellow metal remains positive. The report notes that gold has key resistance at Rs 1,06,400 to Rs 1,08,000, while a strong support level is established at Rs 1,02,000.

Also weighing in on the outlook, Anuj Gupta, the director of YA Wealth Global, points back to the ongoing political uncertainty in the US as a key driver.

He highlights a recent US court ruling that declared major Trump tariffs as illegal, along with the ongoing friction between Donald Trump and the FOMC regarding its independence.

"All the political uncertainty is providing support to gold and silver as safe haven product. Dollar index also correcting against major currencies," Gupta noted.

Talking about the trajectory of prices, Gupta expects gold to test Rs 1,080,00 to Rs 1,10,000. He also added that silver may test Rs 1,30,000 to Rs 1,35,000 by the end of this year.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.