- Silver surpassed $40 an ounce for the first time since 2011, rising 2.6% to $40.7599

- Gold rose 1.2%, trading just below its April record above $3,500 an ounce

- Expectations of US Federal Reserve rate cuts are driving the rally in precious metals

Silver surged above $40 an ounce for the first time since 2011 and gold rose closer to an all-time high as the prospect of Federal Reserve rate cuts gave fresh impetus to the multi-year bull run in precious metal markets.

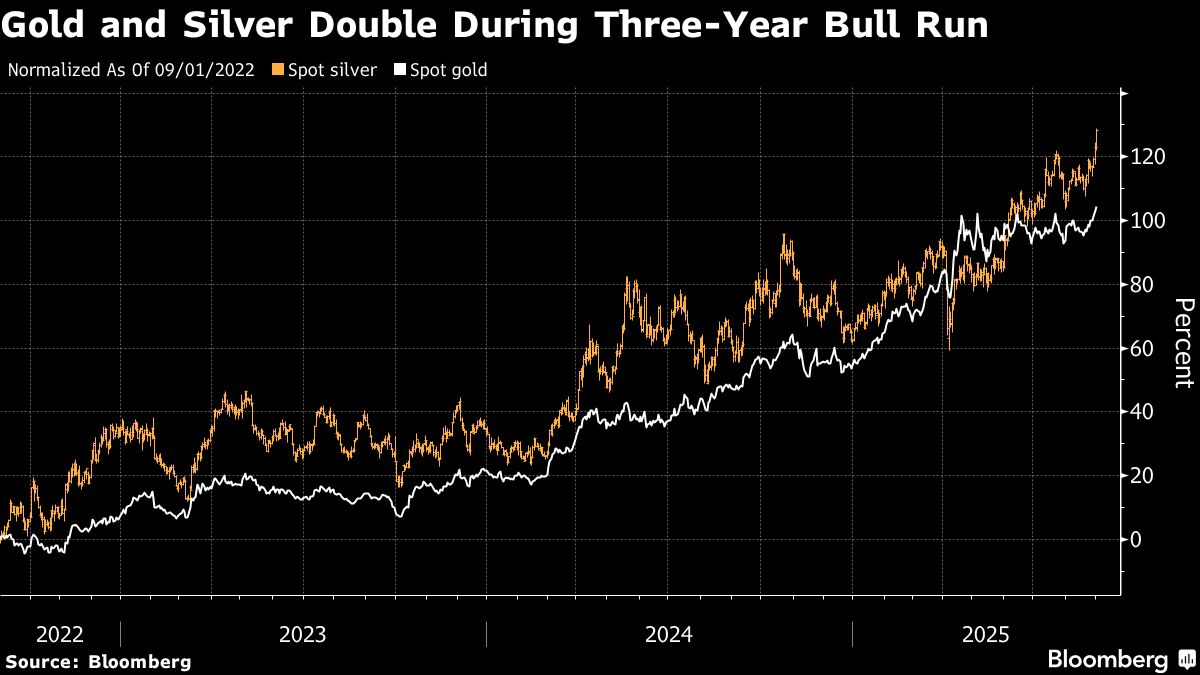

Spot silver rose as much as 2.6% to $40.7599 an ounce — taking gains this year to about 40% — while gold jumped as much as 1.2% to trade just below its April record above $3,500 an ounce. Both metals have more than doubled over the past three years, propelled by mounting risks in the spheres of geopolitics, business, and global trade.

The latest leg of the rally has been fueled by expectations that the US central bank will reduce interest rates when officials gather for their next meeting later in September, with a key US jobs report this Friday likely to add to signs of an increasingly subdued labor market — supporting the case for cuts.

“Gold and silver have suddenly sprung to life as both fundamentals and technicals aligned,” said Saxo Capital Markets Pte. strategist Charu Chanana, adding that worries about the Fed's future underpinned the gains. “On top of that, key resistance levels around $3,450 for gold and $40 for silver were breached, triggering momentum buying.”

The prospect of lower borrowing costs has boosted the allure of the non-yielding precious metals, which saw added support from growing haven demand as US President Donald Trump's repeated criticism of Fed policymakers have sown concerns over the central bank's independence.

Trump's move to fire Fed Governor Lisa Cook concluded without a judge's decision on Friday and a ruling on whether she can continue her duties is not expected to arrive before at least Tuesday. The decision is likely to have huge implications for global financial markets and investors' confidence in the US.

Separately, a federal appeals court ruled that the US president's global tariffs were illegally imposed under an emergency law, upholding a May ruling by the Court of International Trade. But the judges let the levies stay in place while the case proceeds, suggesting that any injunction could be narrowed.

Gold spiked to a record above $3,500 an ounce in April after Trump unveiled an initial plan to introduce his tariffs. Since then prices have remained largely range bound as haven demand cooled after the president walked back some of his most aggressive trade proposals.

Silver, meanwhile, has outpaced year-to-date gains in gold as investors piled into exchange traded funds backed by the white metal, with holdings in silver exchange-traded funds expanding for a seventh consecutive month in August. The dollar has also been weakening, boosting buying power in major consuming countries like China and India.

“Fed rate cuts, a weakening USD, rising ETF inflows and better Indian imports should all be supportive for gold and silver,” Morgan Stanley analysts Amy Gower and Martijn Rats said in an emailed note. “We see ~10% further upside for gold, while silver is trading almost at our forecast, with potential to overshoot.”

That's drawn down the stockpile of freely available metal in London, leading to persistent tightness in the market. Lease rates — which reflect the cost of borrowing metal, generally for a short period of time — remain elevated at around 2%, well above their normal levels of close to zero.

Precious metals have also found support on concerns they could face US tariffs, after silver was added last week to Washington's list of critical minerals, which already includes palladium.

Spot gold was up 0.7% to $3,471.04 an ounce as of 11:37 a.m. London time, on track for a fifth daily gain. Silver was up 2.3%, palladium climbed 1.7%, and platinum rose 1.8%. The Bloomberg Dollar Spot Index was 0.1% lower.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.