Gold and silver wavered, after suffering their steepest selloffs in years on Tuesday as concern their dizzying rallies in recent weeks had left them overvalued.

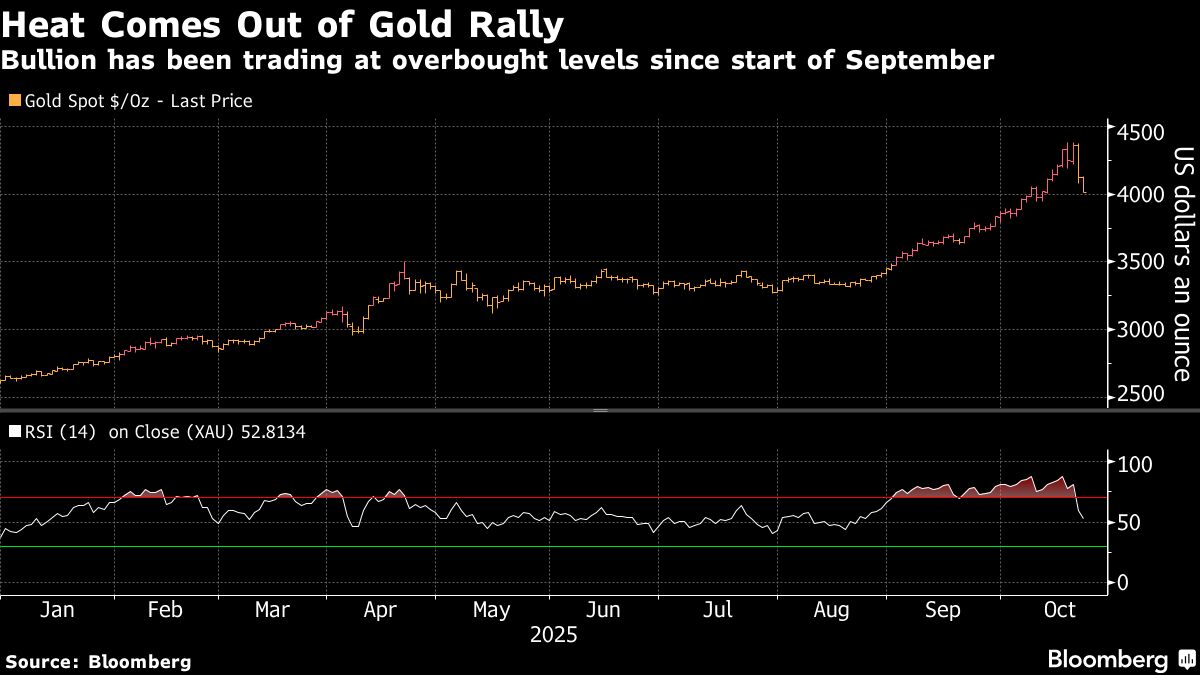

Spot gold traded near $4,140 an ounce after tumbling as much as 6.3% in the previous session, the biggest intraday drop in more than a dozen years. Silver edged higher after being down 8.7% at one point on Tuesday. The slumps came after technical indicators showed scorching rallies for both metals were likely overstretched.

The pullback brought an abrupt halt to rapid advances that have been underway since mid-August. The so-called debasement trade, in which investors avoid sovereign debt and currencies to protect themselves from runaway budget deficits, and bets the Federal Reserve will make at least one outsized rate cut by the end of the year have been the main drivers in recent months. Gold is still up almost 60% this year.

The volume of gold futures contracts traded in New York on Friday surged to the highest since 2020, while open interest eased. The moves suggest some investors were liquidating long positions rather than engaging in short-selling, according to Nicholas Frappell, global head of institutional markets at ABC Refinery in Sydney.

“It could also be that people thought — what the hell, most of us are long and at great averages, so it's a good time to take profit,” he said.

President Donald Trump's aggressive moves to try and reshape global trade and heightened geopolitical uncertainty have underlined the move higher in precious metals this year. Central banks keen to diversify away from the dollar have kept buying bullion, while there's also been flows into exchange-traded funds as retail investors tried to get in on the rally.

That's pushed gold's 14-day relative strength index into overbought territory for most of the time since the beginning of September.

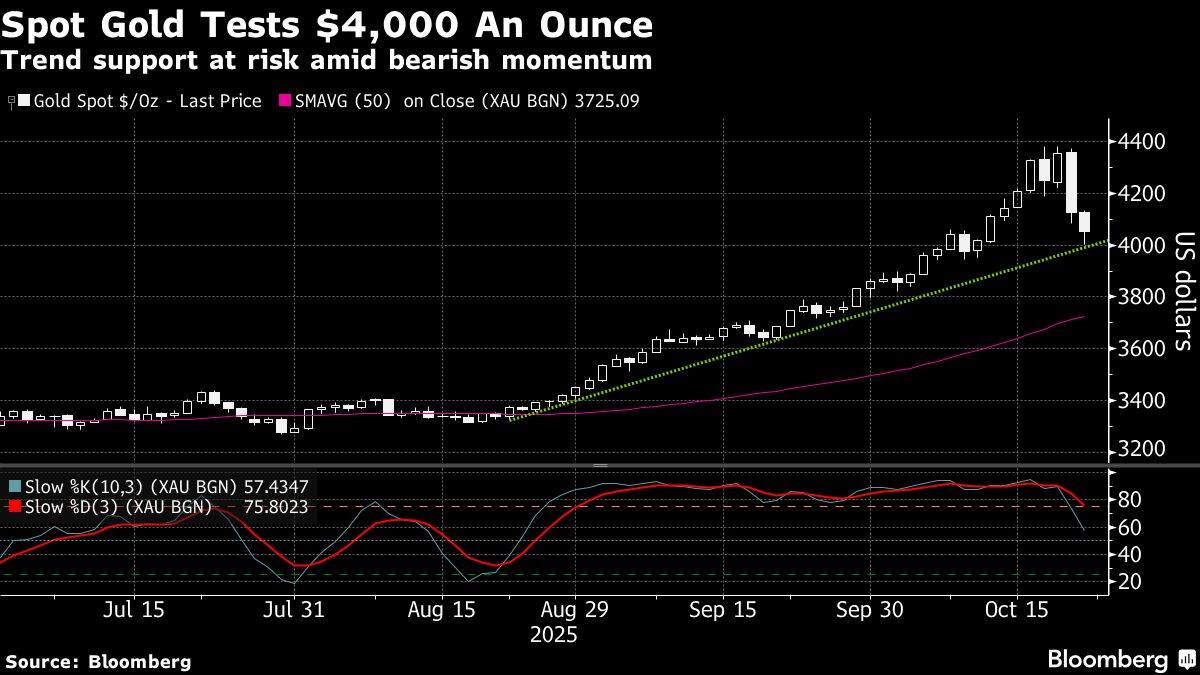

Citigroup Inc. cut its overweight gold recommendation after the slump on Tuesday, citing concerns about stretched positioning. The bank expects further consolidation around $4,000 an ounce in the coming weeks, strategists including Charlie Massy-Collier said in a note.

“Eventually the older part of the gold bull story — continued central bank demand to diversify away from the US dollar — may come back, but at current levels there is no rush to position for that,” they wrote, adding that prices had “run ahead of the ‘debasement' story.”

The declines also came as investors weighed potential progress in talks between the US and China, following a recent resurgence in tensions that had bolstered demand for haven assets. Trump on Tuesday predicted an upcoming meeting with Chinese President Xi Jinping would yield a “good deal” on trade — while also conceding the talks may not happen.

The US government shutdown has also meant traders have been left without one of their most valuable tools: a weekly report from the Commodity Futures Trading Commission that indicates how hedge funds and other money managers are positioned in US gold and silver futures. Without the data, speculators may be more likely to build abnormally large positions one way or another.

On a technical basis, the move in gold is a correction for now — albeit “a huge one,” said Nick Twidale, chief market analyst at AT Global Markets in Sydney.

“My simple explanation is — the market has been driven by huge reallocation flows and there was some big players taking profit, and that would have triggered stops on the way down,” he said. “If it breaks cleanly through $4,000, we could see an even bigger capitulation.”

Volatility in precious metals has surged in recent sessions, with traders seeking to hedge against potential price drops in other parts of their portfolios, or profit from the decline. A record amount of options contracts linked to the world's largest gold-backed exchange traded fund were traded on both Thursday and Friday of last week.

The setback in gold is so far “not massively contagious,”said Anna Wu, a cross-asset strategist at Van Eck Associates Corp. in Sydney. “Gold, despite its strong run recently, still shoulders an important haven role. Central banks have not stopped buying, nor private capital.”

Silver's recent moves have been even more dramatic than gold, with a historic squeeze in the London market last week driving prices beyond the record set in 1980. Benchmark prices traded above New York futures, prompting traders to ship metal to the UK capital to ease tightness. On Tuesday, silver in vaults linked to the Shanghai Futures Exchange saw the biggest one-day outflow of silver since February, while New York stockpiles have also fallen.

Spot gold rose 0.3% to $4,138.87 an ounce as of 11:45 a.m. in Singapore, after falling as much as 2.9% earlier in the session. Silver rebounded from a loss of as much as 2.4% to trade 0.5% higher at $48.9539 Platinum declined, after tumbling more than 5% on Tuesday, while palladium advanced 1%. The Bloomberg Dollar Spot Index dipped 0.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.