Godrej Properties Ltd. share price was up over 5%, with Jefferies maintaining its 'buy' call on the stock, but cutting its target price for the company, citing mixed performance in the third quarter of FY25. Despite strong overall performance, certain metrics fell short of expectations, prompting the brokerage to adjust its outlook.

Godrej Properties reported a net profit of Rs 160 crore for Q3 FY25, marking a 161% year-on-year increase. Revenue surged 193% YoY to Rs 969 crore, driven by the delivery of 2.6 million square feet of projects. For the first nine months of FY25, the company delivered 11.9 million square feet, achieving 79% of its annual delivery guidance.

Third quarter pre-sales amounted to Rs 5,450 crore, a 5% quarter-on-quarter increase, but a 5% year-on-year decline, missing Jefferies' estimate of Rs 6,500 crore. The company attributed this to the postponement of project launches in Noida and Hyderabad. However, GPL's 9M pre-sales reached Rs 19,280 crore, up 48% YoY, indicating strong market demand.

Jefferies has revised its target price to Rs 3,525, based on an 18 times embedded PAT to December 2026 pre-sales, down from the previous 20 times multiple. The brokerage maintained its buy call on GPL, citing potential upside as both P&L and operating cash flow improvement.

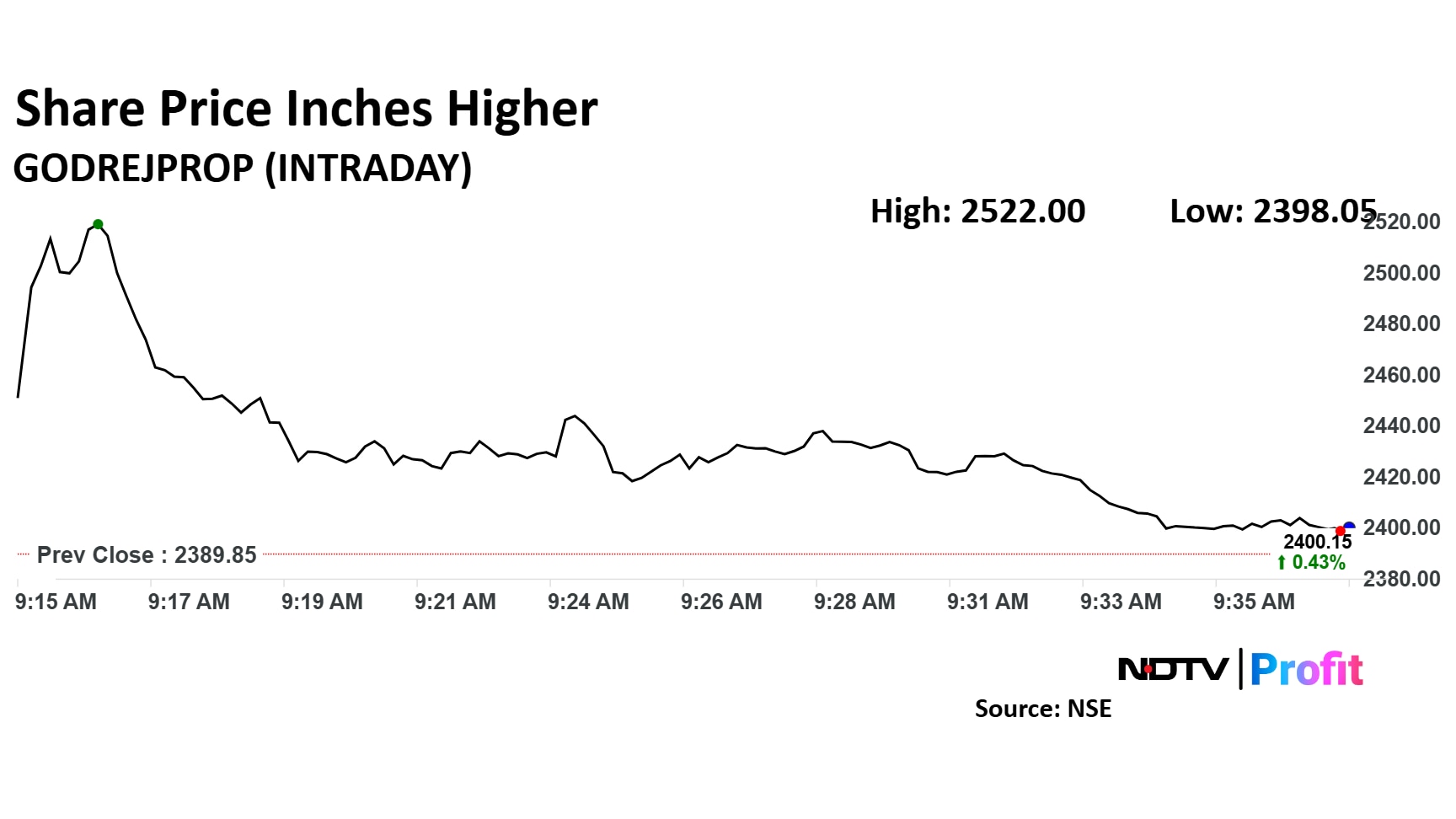

Godrej Properties Share Price

Shares of Godrej Properties rose as much as 5.53% to Rs 2,522 apiece. It pared gains to trade 1.29% higher at Rs 2,420 apiece, as of 09:35 a.m. This compares to a 0.18% advance in the NSE Nifty 50.

The stock has risen 4.21% in the last 12 months. Total traded volume so far in the day stood at 8.4 times its 30-day average. The relative strength index was at 49.

Out of 20 analysts tracking the company, 17 maintain a 'buy' rating, one recommends a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 28.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.