Jefferies remains bullish on Godrej Properties Ltd., maintaining its 'buy' rating with a target price of Rs 1,750, indicating a potential upside of 32% from the current level. The brokerage highlights an "extended growth horizon" for Godrej Properties, supported by aggressive project acquisitions, robust pre-sales growth, and strong execution capabilities.

Key Positives

Over the past four years, Godrej Properties has expanded aggressively, leveraging acquired projects to multiply asset value by approximately eight times, as per the note. The company's recent Rs 6,000-crore equity raise—representing over 50% of its net worth—will support its ambitious growth plans, it adds.

Jefferies noted that the funds will enable Godrej Properties to surpass its fiscal 2025 pre-sales guidance of Rs 25,000 crore, targeting Rs 30,000 crore instead.

Already, Godrej Properties has achieved pre-sales of Rs 12,750 crore in fiscal 2025-to-date, a 51% year-on-year increase. The addition of new land parcels, coupled with higher asset price realisation, has bolstered margins, with Jefferies projecting robust profitability.

Launch Pipeline And Geographical Expansion

Godrej Properties plans to launch 10 new projects across Tier-I cities like Mumbai, Pune, and Kolkata by the third quarter, further boosting its growth trajectory, stated the report. The pipeline includes expansions into high-growth regions such as Noida and Hyderabad. Jefferies credits the company's strategy of refraining from speculative land deals and prioritising premium locations for its consistent performance.

Valuation and Outlook

At 17 times the price-to-earnings ratio on financial year 2025 pre-sales, Jefferies believes Godrej Properties is undervalued relative to its growth potential.

Godrej Properties Share Price Today

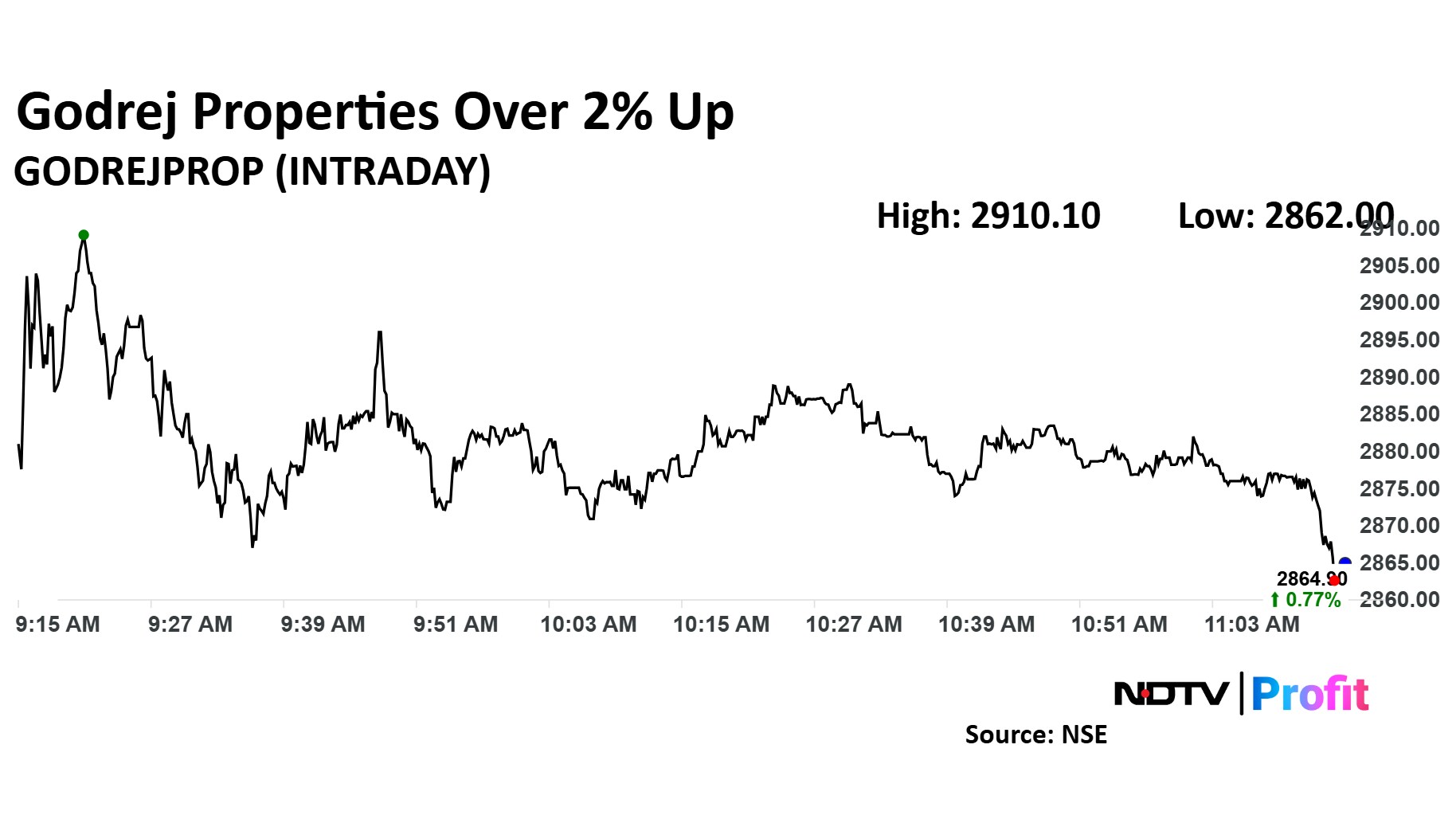

The scrip rose as much as 2.36% to Rs 2,910.10 apiece, the highest level since Dec. 5, 2024. It pared gains to trade 1.20% higher at Rs 2,876.95 apiece, as of 11:09 a.m. This compares to a 0.06% advance in the NSE Nifty 50 Index.

It has risen 42.68% on a year-to-date basis. Total traded volume so far in the day stood at 1.7 times its 30-day average. The relative strength index was at 52.51.

Out of 20 analysts tracking the company, 16 maintain a 'buy' rating, one recommends a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 18.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.