Shares of GMR Airports Infrastructure Ltd. hit a lifetime high on Monday after Rajiv Jain-backed GQG Partners bought 4.7% stake in the company for Rs 1,671 crore, following divestment by two key investors.

The U.S.-based investment firm, through two funds—GQG Partners Emerging Markets Equity Fund and Goldman Sachs-GQG Partners International Opportunities Fund—bought 28.28 crore shares in the airport operator, according to bulk deal data available on BSE.

U.K.-based ASN Investments Ltd. exited GMR Airports by offloading its entire 7.27% stake for Rs 2,555 crore. The shares were sold at Rs 58.21 apiece. Varanium India Opportunity Ltd. also divested its entire 2.3% shareholding for Rs 812.7 crore.

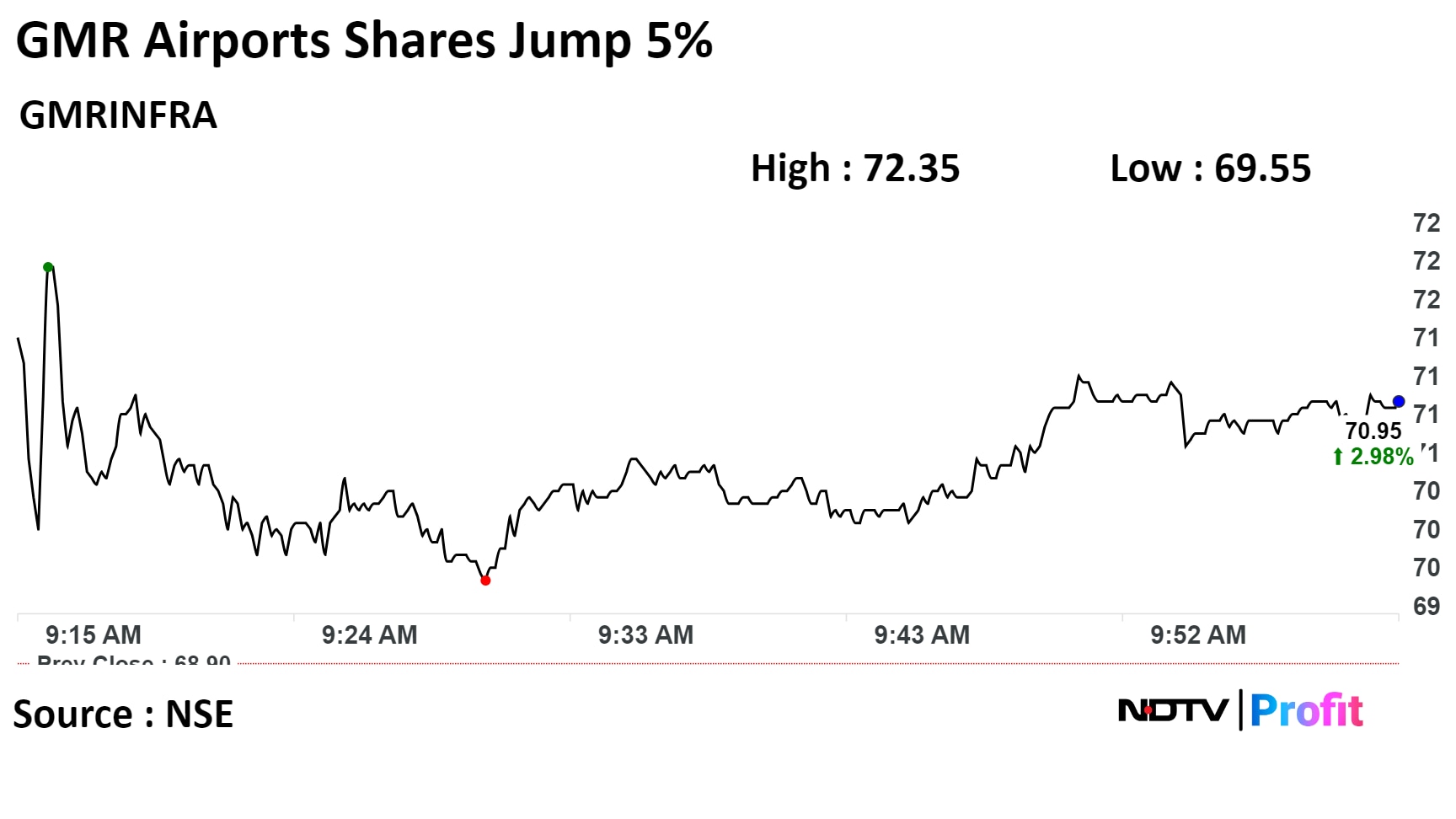

Shares of GMR Airports rose as much as 5%, before paring gains to trade 2.7% higher at 10:05 a.m. compared to a 0.11% advance in the NSE Nifty 50.

The stock has risen 78.49% year-to-date. The total traded volume so far in the day stood at 1.8 times its 30-day average. The relative strength index was at 82.02.

Of the two analysts tracking the company, one maintains a 'buy' rating and one suggests a 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 16.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.