Stocks fluctuated as investors parsed President Donald Trump's decision to delay the start of increased duties on several trading partners amid signs he's open to talks. Treasuries joined a global drop in longer-dated bonds.

As investors assessed the latest trade news, the S&P 500 wavered. Trump said the US will impose a tariff of 50% on copper, lifting futures on the Comex by as much as 17% to a record. Freeport-McMoran Inc. and Southern Copper Corp. jumped. The S&P Composite 1500 Pharmaceuticals sub-index pared gains after Trump threatened a 200% tariff on the sector. In megacaps, Tesla Inc. climbed while Amazon.com Inc. fell at the start of its Prime Day sales event.

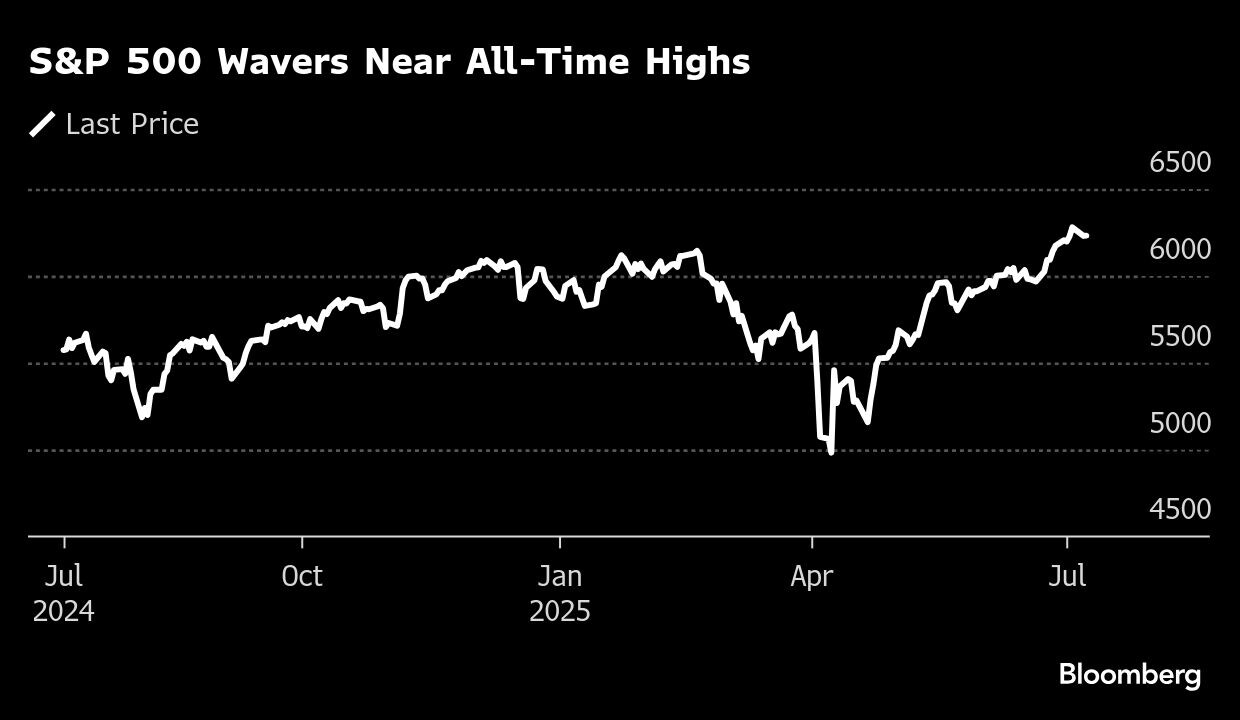

S&P 500 hovers near peak.

As Treasuries slipped, 30-year yields approached 5%, following a rout in longer-dated Japanese bonds and German bunds. A $58 billion US sale of three-year notes drew soft demand. That was the first in a trio of auctions this week. The dollar wavered.

Wall Street is digesting the latest tariff developments after Trump signed an executive order that delayed reciprocal tariffs. He said that “for the most part” he was content to simply impose the duties, even as the president indicated he was continuing negotiations.

“Trade-war headlines are regaining momentum, but that doesn't mean we're in for a repeat of late March and early April,” said Bret Kenwell at eToro. “If there is confidence that negotiations will continue or deadlines will be extended, markets may continue to shake off the headlines.”

However, Kenwell noted that if investors feel the trade situation could become “more bite than bark,” we could very well see another pullback in stocks.

“Unless the situation really unravels, a 5% to 10% pullback will likely be viewed as a buying opportunity by retail investors,” he noted.

“While tariffs will likely remain high — compared with levels at the start of the year — as will the headline risk, we think the US effective tariff rate should end the year at around 15%,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management. “This would be a headwind to growth but not enough to trigger a recession.”

She continue to recommend phasing into global equities or diversified portfolios to navigate volatility ahead.

Meantime, Treasury Secretary Scott Bessent is planning to visit Japan next week for the 2025 World Expo in Osaka, according to people familiar with the matter. The visit would come after Trump sent a letter on Monday stating his intention to raise tariffs on all Japanese imports to 25%, effective Aug. 1, slightly higher than the 24% rate initially announced in April.

Investors should look to reload on hedges ahead of the Aug. 1 tariff deadline as US equity indexes are near record highs with geopolitical risk premium largely dissipated, JPMorgan Chase & Co. strategists led by Bram Kaplan wrote.

While top-down drivers such as macro growth forecasts being slightly up point to solid S&P 500 earnings growth for the second quarter, Deutsche Bank AG strategists led by Binky Chadha expect the idiosyncratic effects of tariffs to reduce profits.

Meantime, Goldman Sachs Group Inc. strategists raised their outlook for US stocks for the second time in two months, saying they expect the Federal Reserve to act sooner to cut rates.

The team led by David Kostin lifted their 12-month forecast for the S&P 500 to 6,900 from 6,500, and increased the year-end target to 6,600 from 6,100. They also cited lower Treasury yields and strength in the largest US companies as reasons to power stocks.

Bank of America Corp. strategists also boosted their outlook for US equities, citing Corporate America's ability to maintain earnings guidance.

Strategists including Savita Subramanian and Jill Carey Hall raised their year-end target for the S&P 500 to 6,300 from 5,600, and established a 12-month target of 6,600.

“We believe the setup for equity markets looks bullish, even in light of renewed trade-war jitters,” said Craig Johnson at Piper Sandler. “While equities may come under some near-term pressure, investors are increasingly becoming numb to the tariff headlines and instead focusing on the trendlines.”

Johnson says technically, measures of market breadth and trends remain constructive, and the weight of the technical evidence supports his bullish outlook as earnings season approaches.

Corporate News

Amazon.com Inc.'s Prime Day sales fell almost 14% in the first four hours of the event compared with the start of last year's sale, according to Momentum Commerce, which manages 50 brands in a variety of product categories.

Boeing Co. said it delivered 60 aircraft in June, its best showing in 18 months that reflects improvements in its factories and the resumption of US jet exports to China.

HSBC is turning cautious on three of the biggest US bank stocks following a record rally that's brought the group within shouting distance of an all-time high.

President Donald Trump called for new rules that would restrict access to tax incentives for solar and wind projects that already had been pared back by his $3.4 trillion budget bill designed to end green energy incentives.

Ciena Corp. was cut to underweight from equal-weight citing at Morgan Stanley, which cited a lack of margin upside in the near term.

Hershey Co. appointed Kirk Tanner to be the chocolate maker's next president and chief executive officer.

Walt Disney Co. and Hearst Corp. are considering a sale of their A+E Global Media joint venture, which includes cable-TV channels such as History and Lifetime, according to a person familiar with the discussions.

Robinhood Markets Inc. Chief Executive Officer Vlad Tenev said the firm is in talks with regulators over its offering of tokenized equities in Europe, after the launch drew rebuke from companies including OpenAI.

Some of the main moves in markets:

Stocks

The S&P 500 was little changed as of 1:13 p.m. New York time

The Nasdaq 100 rose 0.1%

The Dow Jones Industrial Average fell 0.3%

The MSCI World Index was little changed

Bloomberg Magnificent 7 Total Return Index was little changed

The Russell 2000 Index rose 0.9%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1716

The British pound fell 0.1% to $1.3582

The Japanese yen fell 0.5% to 146.77 per dollar

Cryptocurrencies

Bitcoin rose 0.9% to $108,865.51

Ether rose 3.3% to $2,618.67

Bonds

The yield on 10-year Treasuries advanced five basis points to 4.43%

Germany's 10-year yield advanced four basis points to 2.69%

Britain's 10-year yield advanced five basis points to 4.63%

The yield on 2-year Treasuries advanced two basis points to 3.92%

The yield on 30-year Treasuries advanced five basis points to 4.96%

Commodities

West Texas Intermediate crude rose 1.2% to $68.72 a barrel

Spot gold fell 1% to $3,304.13 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.