US stock futures retreated Friday as American trade partners pushed for concessions ahead of a July 9 deadline to finalize trade deals with the Trump administration.

Contracts for the US benchmark fell 0.6% after the gauge ended the trading week at a fresh all-time high. US President Donald Trump dialed up trade tensions after Thursday's close, warning partners he may start setting levies of as much as 70% unilaterally as soon as today.

With less than a week to go before the deadline, European Union carmakers and capitals were pushing for an agreement that would allow for tariff relief in return for increasing US investments, Bloomberg News reported. Meanwhile, a draft US-Swiss trade accord contained assurances about tariffs on pharma exports, according to people familiar with the matter.

Europe's Stoxx 600 closed 0.5% lower, recovering from a steeper intraday decline. Gold rose 0.2% as investors sought havens. The dollar dipped. US stock and Treasury markets were closed for the July 4 holiday.

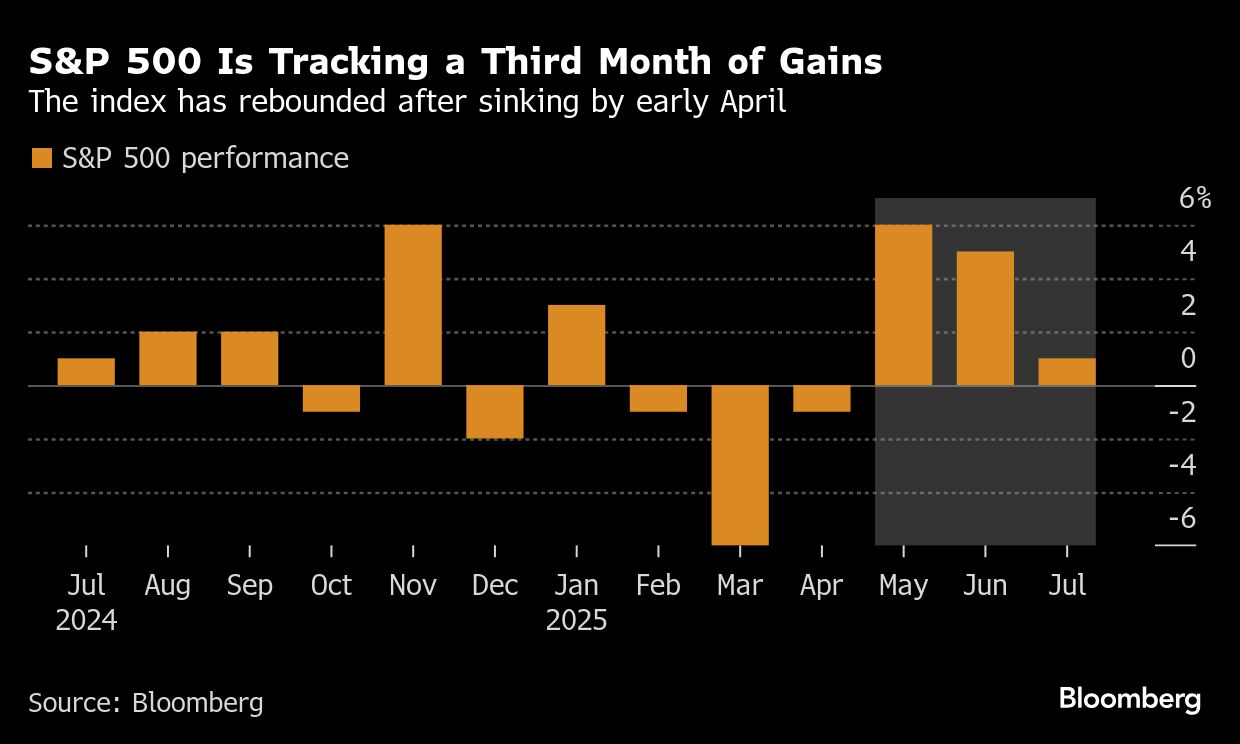

Equity markets have rallied sharply since April's tariff-driven volatility, partly fueled by the ongoing strength of the US economy. Still, some investor caution lingers as the trade war continues to cloud the outlook for inflation and corporate profitability.

“There's a little bit of doubt creeping in, especially after the bump up this week,” said Neil Wilson, investor strategist at Saxo UK. “Today's a good day to take a little bit of risk off. But I don't think there's a fundamental shift, it's all on the margins at the moment.”

What Market Live Strategists Say

“It would take a shocking set of trade outcomes to overwhelm the slew of good news we've recently had. All the more so, given that the bullishness of institutional investors has been tempered by constant threats, leaving them relatively underexposed to a market at record highs.”— Mark Cudmore, Markets Live Executive Editor

The S&P 500's surge has put it on the verge of triggering a sell signal, according to Michael Hartnett of Bank of America Corp.

The strategist advised that investors consider trimming their holdings once the index climbs beyond 6,300, a level just 0.3% above where it closed on Thursday. He also reiterated that bubble risks are mounting into the summer, especially following the House's approval of a $3.4 trillion fiscal package featuring tax cuts.

“Overbought markets can stay overbought as greed is harder to conquer than fear,” Hartnett wrote in a note.

UK gilts resumed their slide after a selloff on Wednesday that was driven by fiscal concerns. The yield on 10-year UK government debt advanced two basis points to 4.56%, compared with 4.45% at the close on Tuesday. The pound was flat.

In signs of diplomatic and trade tensions escalating between China and the EU, Beijing said it intends to cancel part of a two-day summit with EU leaders planned for later this month. China also imposed anti-dumping duties on European brandy for five years, while exempting major cognac makers that meet a price commitment.

In commodities, oil dropped in the lead-up to an OPEC+ meeting that's set to deliver another oversized production hike, threatening to swell a glut forecast for later this year.

Corporate Highlights:

President Donald Trump's administration plans to restrict shipments of AI chips from the likes of Nvidia Corp. to Malaysia and Thailand, part of an effort to crack down on suspected semiconductor smuggling into China.

India's regulator has temporarily barred Jane Street Group LLC from accessing the local securities market, dealing a severe hit to the US firm that allegedly made $4.3 billion in trading gains in the South Asian nation in less than two years.

French train maker Alstom SA has won a €2 billion ($2.4 billion) order from New York's Metropolitan Transportation Authority, which is in the process of modernizing its fleet.

Frasers Group Plc warned Hugo Boss AG it will vote against any dividends, as the British retailer owned by billionaire Mike Ashley exerts its influence after years of building a stake in the German fashion house.

Airlines across Europe have canceled hundreds of flights on the second day of an air traffic controllers' strike in France that's causing chaos just as the busiest travel season of the year gets underway.

Banco Sabadell SA has called two shareholders meetings as it seeks to approve an extraordinary dividend after agreeing to sell it's UK unit — part of its broader attempt to block a takeover by larger rival BBVA SA.

Country Garden Holdings Co.'s sales slid again in June, with the developer faring worse than peers, as a lack of policy support dampened demand.

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.6% as of 11:45 a.m. New York time

Futures on the Dow Jones Industrial Average fell 0.5%

The Stoxx Europe 600 fell 0.5%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index fell 0.1%

The euro rose 0.2% to $1.1784

The British pound was little changed at $1.3645

The Japanese yen rose 0.3% to 144.54 per dollar

Cryptocurrencies

Bitcoin fell 2% to $107,795.75

Ether fell 3.7% to $2,503.19

Bonds

The yield on 10-year Treasuries was little changed at 4.35%

Germany's 10-year yield was little changed at 2.61%

Britain's 10-year yield advanced two basis points to 4.56%

Commodities

West Texas Intermediate crude fell 0.9% to $66.39 a barrel

Spot gold rose 0.2% to $3,333.22 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.