- MSCI Asia Pacific Index rose 0.2% at the open on Friday

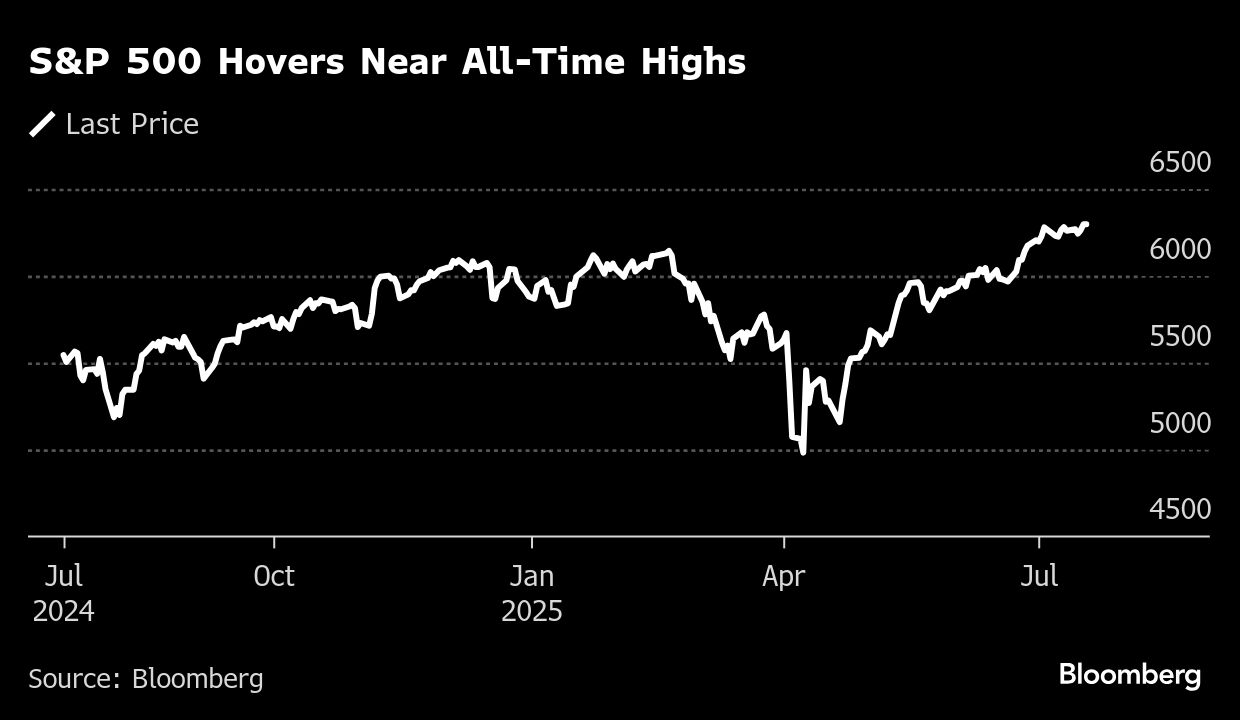

- US equity futures gained after S&P 500 and Nasdaq 100 hit closing highs

- Taiwan Semiconductor's outlook boosted confidence in AI spending

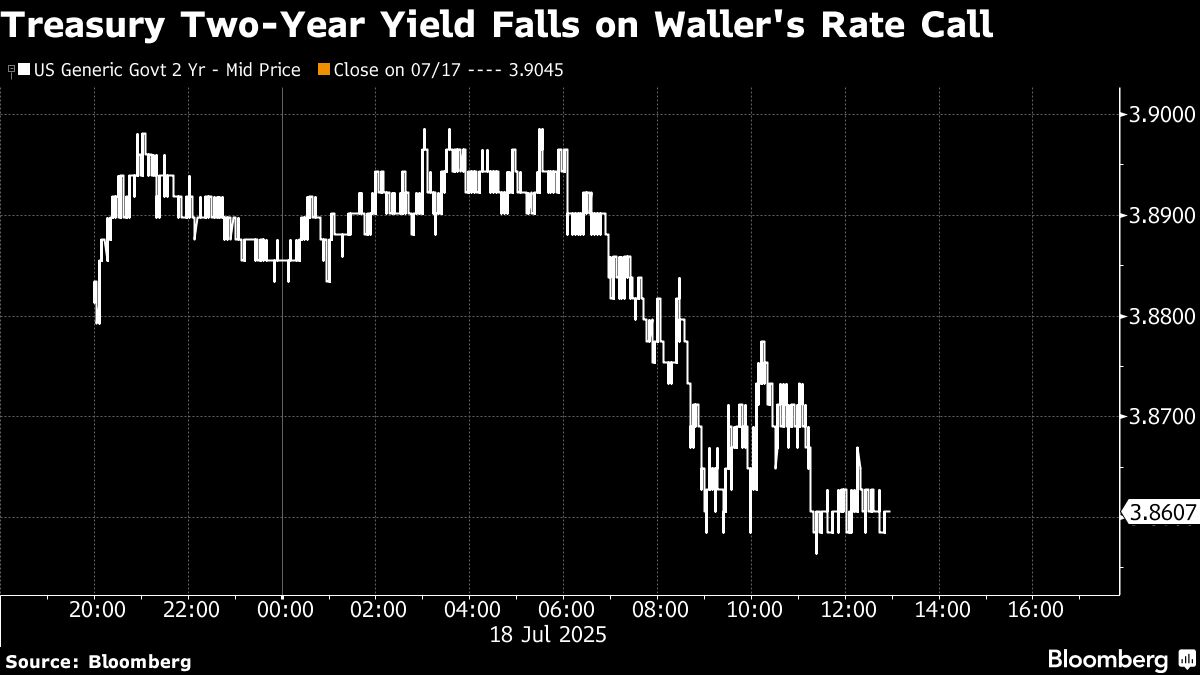

Bond yields fell alongside the dollar as Federal Reserve Governor Christopher Waller reiterated his case for a July rate cut, while data showed an improvement in consumer expectations for inflation. Stocks halted their rally as traders parsed a handful of earnings.

Following an advance to all-time highs, S&P 500 edged lower. Short-dated Treasuries led gains after Waller hinted he would dissent if his colleagues vote to hold rates steady in July. Bonds also rose as University of Michigan data showed consumers expect prices to increase at an annual rate of 4.4% over the next year, down from 5% in the prior month.

Wall Street parses handful of earnings.

“Investors have something to cheer about with signs of improved inflation expectations,” said Jeff Roach at LPL Financial. “According to this report, the trajectory looks encouraging.”

Meantime, Waller said he sees no sign that inflation expectations are on the rise, which allows the Fed to move forward with rate cuts. He also restated the case the Fed should cut when policymakers gather later this month, given data suggesting the US labor market is “on the edge.”

“We think he is correct. The Fed's role is to think ahead, not look behind, which is what Waller is doing concerning the slowing employment situation,” said Andrew Brenner at NatAlliance Securities. “Nonetheless a July cut won't happen.”

Money markets still assign near-zero odds of a cut on July 30. They price in about 45 basis points of easing by year-end, down from more than 65 basis points at the start of the month.

US consumer sentiment rose to a five-month high in early July as expectations about the economy continued to improve. The preliminary July sentiment index rose to 61.8 from 60.7 a month earlier, according to University of Michigan data released Friday.

The report offered further relief after data this week showed US retail sales rebounded in June in a broad advance, tempering some concerns about a retrenchment in consumer spending.

To Mark Hackett at Nationwide, macroeconomic data remains broadly supportive, and the recent strength in markets has been impressive, though perhaps even more noteworthy is the prevailing sense of calm amid a busy and often volatile news cycle.

“Investors have responded positively to robust economic indicators and earnings reports that highlight continued resilience in US consumer spending,” he said. “The rest of earnings season will be a key test given elevated valuations and expectations, though with current momentum and sentiment, the path of least resistance is higher.”

At Wolfe Research, Chris Senyek says economic data releases this week have been consistent with his view that the US economy is coming in better than consensus expects.

“However, we continue to be worried about the risk of inflation remaining stickier than expected in the back half of 2025,” Senyek noted.

Investors also kept an eye on trade headlines.

President Donald Trump is readying plans for industry-specific tariffs to kick in alongside his country-by-country duties in two weeks, ramping up his push to reshape the US's standing in the global trading system by penalizing purchases from abroad.

Trump is pushing for a minimum tariff of 15%-20% in any deal with the European Union, the Financial Times reported. Meantime, Japanese Prime Minister Shigeru Ishiba and US Treasury Secretary Scott Bessent indicated the two nations could reach a “good” trade deal while signaling the process may take more time.

Elsewhere, the total market value of cryptoassets surged past $4 trillion for the first time, driven by a rally in altcoins and momentum from a sweeping US legislative push to regulate the sector.

Corporate Highlights:

Humana Inc. fell after it lost a lawsuit seeking to reverse cuts to its Medicare bonus payments, a blow for the insurer that had hoped the court would restore billions in revenue.

American Express Co.'s expenses grew in the second quarter as the firm made risk-management investments for its affluent consumers, who continued to spend amid economic uncertainty.

Netflix Inc. beat expectations for second-quarter results and continues to trounce rival media companies, yet the shares slipped on Friday as investors took a pause after the stock has nearly doubled over the past year.

3M Co. raised its profit forecast and beat Wall Street's estimates for the second quarter as Chief Executive Officer William Brown's effort to reinvigorate the company gained momentum.

Chevron Corp. has prevailed in a 20-month fight to buy Hess Corp. for $53 billion, overcoming a challenge by arch rival Exxon Mobil Corp. that was unprecedented in the modern history of Big Oil.

SLB, the world's largest oil-services provider, sees resiliency in the industry and remains constructive about the second half of 2025 despite uncertainties in customer demand.

Interactive Brokers Group Inc. reported total net interest income for the second quarter that beat the average analyst estimate.

Charles Schwab Corp. reported earnings per share that topped estimates as the firm said client assets hit a new record and trading revenue rose.

Ally Financial Inc. left most of its forecast unchanged despite strong second-quarter consumer auto-loan originations and earnings.

Meta Platforms Inc. said it won't sign the code of practice for Europe's new set of laws governing artificial intelligence, calling the guidelines to help companies follow the AI Act overreach.

Sarepta Therapeutics Inc. said another patient has died from acute liver failure after receiving one of its gene therapies, putting additional pressure on the biotech company after the recent deaths of two teenage boys.

US Food and Drug Administration Commissioner Marty Makary said he's “taking a hard look” at whether a gene therapy from Sarepta should remain on the market.

Some of the main moves in markets:

Stocks

The S&P 500 fell 0.2% as of 1 p.m. New York time

The Nasdaq 100 fell 0.2%

The Dow Jones Industrial Average fell 0.5%

The MSCI World Index was little changed

Bloomberg Magnificent 7 Total Return Index rose 0.3%

The Russell 2000 Index fell 0.6%

Currencies

The Bloomberg Dollar Spot Index fell 0.1%

The euro rose 0.3% to $1.1628

The British pound was little changed at $1.3419

The Japanese yen was little changed at 148.69 per dollar

Cryptocurrencies

Bitcoin fell 1.5% to $117,653.26

Ether rose 4.5% to $3,576.12

Bonds

The yield on 10-year Treasuries declined three basis points to 4.42%

Germany's 10-year yield advanced two basis points to 2.70%

Britain's 10-year yield advanced two basis points to 4.67%

Commodities

West Texas Intermediate crude fell 0.2% to $67.39 a barrel

Spot gold rose 0.4% to $3,353.58 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.