- Stocks rebounded as investors anticipated Federal Reserve interest-rate cuts after weak US jobs data

- S&P 500 futures rose 0.6% and Europe’s Stoxx 600 index increased about 0.5% led by UK banks

- US 10-year Treasury yields climbed three basis points to 4.25% after falling sharply on Friday

A renewed wave of dip buying lifted stocks, with traders wading through solid earnings amid bets the Federal Reserve will soon cut rates. Treasuries wavered ahead of a heavy slate of US debt sales.

Equities halted a four-day slide, with the S&P 500 up over 1% and set for its biggest gain since May. Tech megacaps, which bore the brunt of the recent selling, led the bounce. Corporate results also buoyed sentiment, with 82% of the companies in the US stock benchmark so far beating estimates.

Investors should buy into the selloff in US stocks because of the robust earnings outlook for the coming year, said Morgan Stanley's Michael Wilson. At Goldman Sachs Group Inc., David Kostin noted executives had so far sounded confident in their ability to mitigate the impact of tariffs on profits.

S&P 500 firms are on track to post a 9.1% jump in profits, far above analysts' projection of 2.8%, according to data compiled by Bloomberg Intelligence. The share of companies beating estimates is also the highest in four years.

“This week is a quiet one on the economic calendar, so traders may be taking their cues from earnings, along with any new tariff and trade developments,” said Chris Larkin at E*Trade from Morgan Stanley.

Larkin also noted that a key question now is whether traders will view any signs of economic weakness as a market negative, or as a catalyst for the Fed to cut rates sooner rather than later.

For now, though, bond traders remain on hold as the US is set to auction $125 billion of new three-, 10- and 30-year debt. The yield on 10-year Treasuries slid two basis points to 4.20%. The dollar was little changed. Oil fell as OPEC+'s latest bumper supply increase weighed on a choppy market.

“This week will be a telling one: a tug-of-war is unfolding between traditional institutional seasonality, which suggests weakness, and retail investors who may see a dip as a buying opportunity,” said Mark Hackett at Nationwide. “It's a good test for who's really in control.”

Looking ahead, the setup into fall favors the bull case with potential rate cuts and strong corporate earnings laying the groundwork for a renewed rally into year-end and a fresh slate for 2026, Hackett added.

Following a broad flight from risk assets at the end of last week, equities bounced amid bets the Fed will cut rates this year. Investors see around 85% odds that the Fed will lower rates by a quarter point in September, based on swaps tied to policy-meeting dates. While that's down from Friday's peak of 90%, it was around 40% before the Friday's weak payroll data was published.

“If the Fed starts to cut rates at its September meeting, we believe this would be supportive for markets,” said David Lefkowitz at UBS Global Wealth Management. “In combination with our positive view on earnings, we expect further upside for US stocks over the next 12 months.”

Societe Generale strategists Manish Kabra and Charles de Boissezon see US stocks extending their climb into next year, lifted by the Fed's looming rate cuts.

“Fed cuts to shape the index,” they wrote, adding that gradual cutting would be positive, while aggressive cuts could drive markets to a valuation bubble.

While Friday's jobs report doesn't mean we are entering a recession, it shows that companies are freezing hiring and firing until there is more policy certainty and business confidence, according to Robert Ruggirello at Brave Eagle Wealth Management.

“The slowing labor market makes a Federal Reserve rate cut easier than it was a week ago, and echoes some of the warnings that Jerome Powell has been sounding about how tariffs could slow the economy and cause too much uncertainty for small business hiring plans,” he said.

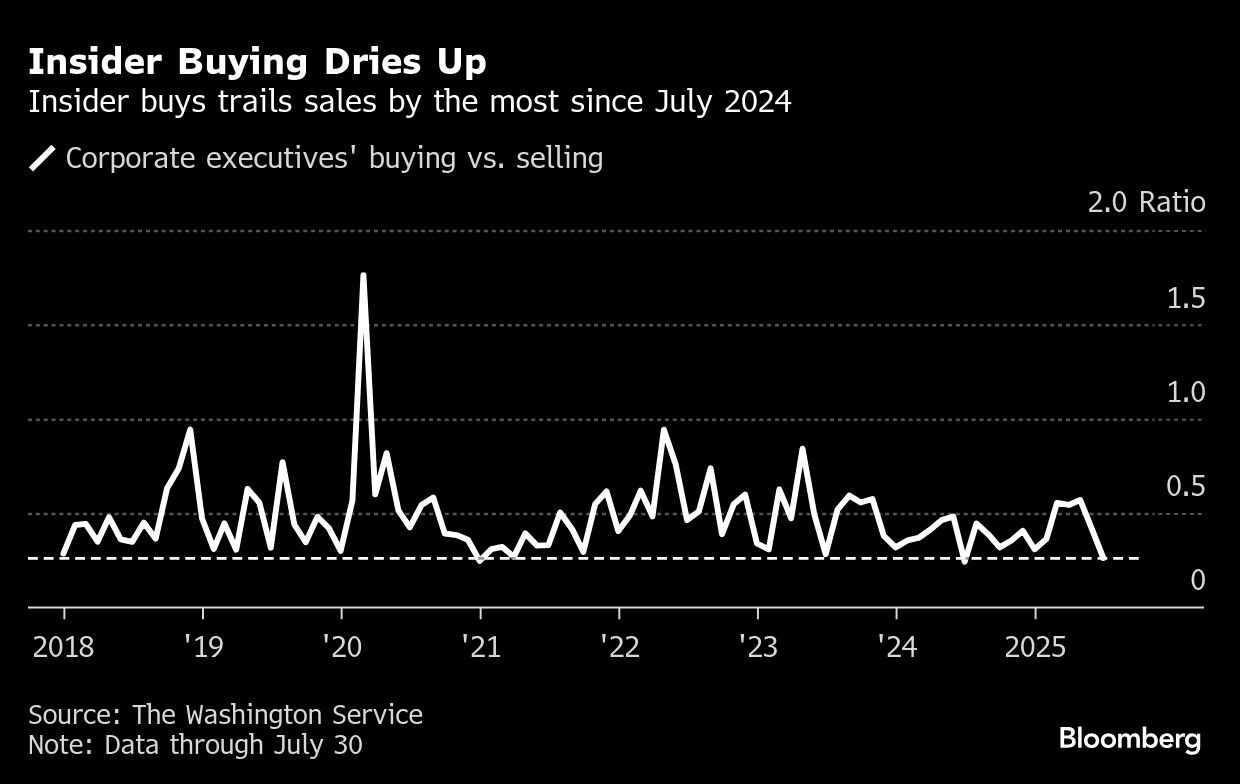

As investors across Wall Street eagerly piled into US stocks in July, sending the S&P 500 to 10 all-time highs in a month, a notable group was heading in the opposite direction: corporate executives.

Insiders at just 151 S&P 500 companies bought their own stocks last month, the fewest since at least 2018, according to data compiled by the Washington Service. And while July's selling by corporate insiders slowed from June's pace, purchases dropped even more, pushing the ratio of buying-to-selling to the lowest level in a year, the data shows.

“In the near term, risk-on sentiment may need to contend with an economic outlook of slowing growth, elevated inflation, and ongoing policy uncertainty. So far, companies have navigated the tariff noise without much visible strain, but pressures are likely to grow,” said Seema Shah at Principal Asset Management.

Tariffs

On the tariff front, President Donald Trump said he would be “substantially raising” the tariff on Indian exports to the US over New Delhi's purchases of Russian oil, ramping up his threat to target a major trading partner.

Meantime, the European Union is expecting Trump to announce executive actions this week to formalize the bloc's lower tariffs for cars and grant exemptions from levies for some industrial goods such as aviation parts, according to people familiar with the matter.

Corporate News:

UBS Group AG fell more than 2% after the Swiss banking group agreed to poay $300 million to settle a mortgage-related case in the US

BYD Co. shares fell in Hong Kong as sputtering monthly sales growth raised doubts about whether the Chinese electric-vehicle maker will meet its annual target.

Hong Kong eased some of its rules to list in the city, potentially bolstering what's already been one of the hottest markets in the world for initial public offerings this year.

Some of the main moves in markets:

Stocks

The S&P 500 rose 1.3% as of 12:04 p.m. New York time

The Nasdaq 100 rose 1.6%

The Dow Jones Industrial Average rose 1.1%

The Stoxx Europe 600 rose 0.9%

The MSCI World Index rose 1.1%

Bloomberg Magnificent 7 Total Return Index rose 1.9%

The Russell 2000 Index rose 1.4%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.2% to $1.1566

The British pound was little changed at $1.3284

The Japanese yen rose 0.2% to 147.07 per dollar

Cryptocurrencies

Bitcoin rose 0.4% to $114,935.84

Ether rose 4.7% to $3,657.62

Bonds

The yield on 10-year Treasuries declined two basis points to 4.20%

Germany's 10-year yield declined five basis points to 2.62%

Britain's 10-year yield declined two basis points to 4.51%

The yield on 2-year Treasuries advanced one basis point to 3.69%

The yield on 30-year Treasuries declined three basis points to 4.79%

Commodities

West Texas Intermediate crude fell 0.8% to $66.79 a barrel

Spot gold rose 0.4% to $3,375.61 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.