Treasuries jumped as weak jobs and manufacturing data bolstered bets on Federal Reserve rate cuts. Stocks extended their weekly slide, with investors also weighing the impacts of President Donald Trump's sweeping tariffs on the economy.

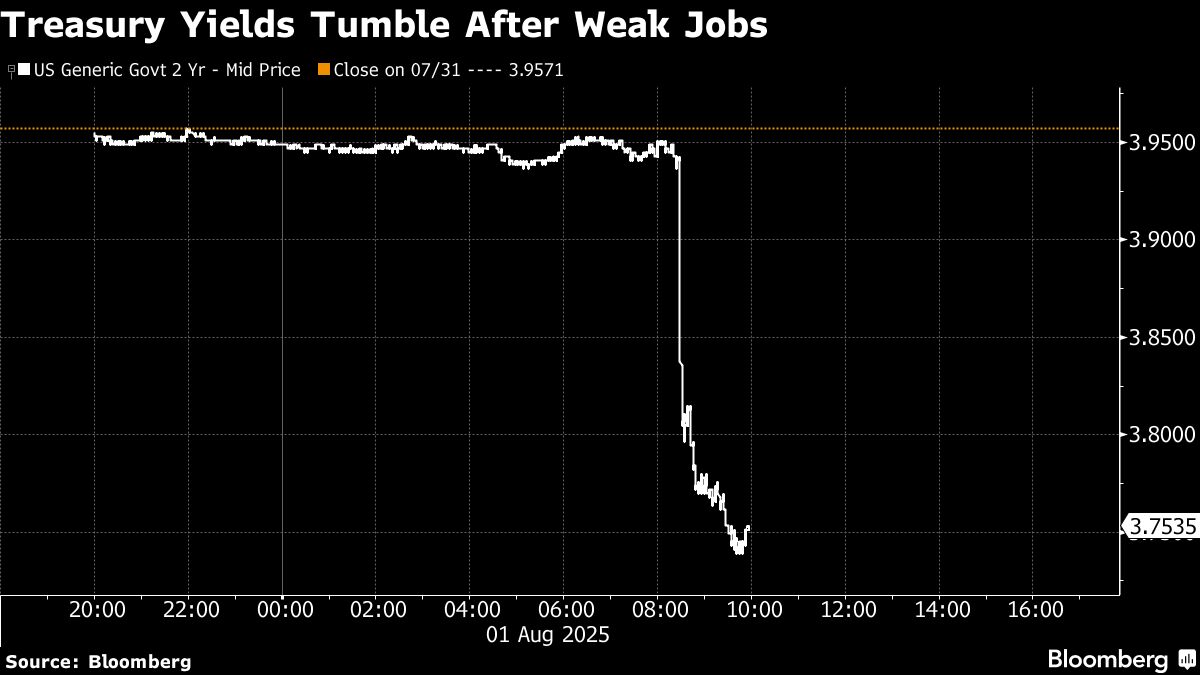

US two-year yields plunged 23 basis points to 3.72%, set for the biggest tumble since August 2024. Money markets are now fully pricing in two rate cuts this year, with a 76% chance of the first one coming in September. The dollar sank. The S&P 500 fell 1.8%, with Amazon.com Inc. leading losses in megacaps on an underwhelming profit outlook. Wall Street's “fear gauge” - the VIX - topped 20.

Wall Street parses jobs data.

Job growth cooled by more than forecast, further evidence that the labor market is shifting into a lower gear amid widespread economic uncertainty. Payrolls increased 73,000 last month after sharp downward revisions to the prior two months. The jobless rate ticked up to 4.2%.

“This is was an ugly report,” said Michael O'Rourke at JonesTrading, adding the Fed should be considering resuming rate cuts next month. “This report is very equity-bearish and bond-bullish.”

Separate data showed US factory activity contracted in July at the fastest pace in nine months, dragged down by a faster decline in employment as orders continued to shrink. Meantime, US consumer sentiment rose to a five-month high in July on optimism about current conditions tied to a stock-market rally, while inflation expectations eased.

Fed Governors Christopher Waller and Michelle Bowman expressed concerns that policymakers' hesitance to lower interest rates could risk unnecessary damage to the labor market.

“The debate now is whether the White House was right, and the Fed was too late,” said Scott Helfstein at Global X.” The Fed was probably right to wait, but job growth and the economy is slowing from a blistering rate.

To Alexandra Wilson-Elizondo at Goldman Sachs Asset Management, the jobs miss directly challenges the Fed's hawkish posture from this week's meeting.

“The burden of proof has shifted and continued labor weakness could force the Fed's hand despite inflation concerns,” she said.

To Jamie Cox at Harris Financial Group, Fed Chair Jerome Powell might “regret” holding rates steady this week.

“September is a lock for a rate cut and it might even be a 50-basis point move to make up the lost time,” he said.

At eToro, Bret Kenwell says the most-obvious question is: How would the Fed handle a slowdown in the labor market alongside a rise in inflation?

“While neither is at an extreme right now, inflation is moving higher and the labor market is losing steam. When push comes to shove, the Fed would likely step in by easing financial conditions if the labor market truly begins to deteriorate, but it may not be as fast or as accommodating if inflation remains stubbornly high,” he said.

Downward Revisions

To Jeff Roach at LPL Financial, the downward revisions were the most revealing in this month's job report.

“The monster downward revisions to the past two months inflicts a major blow to the picture of labor market robustness,” said Seema Shah at Principal Asset Management. “With negative impact of tariffs only just starting to be felt, the coming months are likely to see even clearer evidence of a labor market slowdown.”

To Charlie Ripley at Allianz Investment Management, today's data signals labor market conditions continue to cool and while the softer conditions don't warrant a warning signal for investors, it should put market participants including the Fed on notice that economic conditions are shifting.

“Friday's jobs report was weaker than expected, which shows that employers still seem to be sitting on the sidelines amid elevated macro uncertainty,” said Glen Smith at GDS Wealth Management. “The slowdown in job gains has been taking place for several months now and this trend could push the Federal Reserve to cut interest rates as soon as this fall.

Corporate Highlights:

Apple Inc. reported its fastest quarterly revenue growth in more than three years, easily topping Wall Street estimates, after demand picked up for the iPhone and products in China.

Amazon.com Inc. projected weaker-than-expected operating income and trailing the sales growth of its cloud rivals, leaving investors searching for signs that the company's huge investments in artificial intelligence are paying off.

Exxon Mobil Corp. and Chevron Corp. posted better-than-expected results after record oil production cushioned the impact of lower crude prices.

Days before a new ownership team takes control of the company, Paramount Global reported second-quarter earnings that beat analysts' estimates, crediting lower costs and growth in streaming profit.

Coinbase Global Inc., the largest US crypto exchange, reported lower-than-estimated second-quarter revenue amid a drop in digital-asset market volatility.

Some of the main moves in markets:

Stocks

The S&P 500 fell 1.8% as of 10:06 a.m. New York time

The Nasdaq 100 fell 2.1%

The Dow Jones Industrial Average fell 1.7%

The Stoxx Europe 600 fell 2.1%

The MSCI World Index fell 1.5%

Bloomberg Magnificent 7 Total Return Index fell 2.6%

The Russell 2000 Index fell 3%

Amazon fell 6.6%

Apple fell 0.5%

Currencies

The Bloomberg Dollar Spot Index fell 0.8%

The euro rose 1.3% to $1.1563

The British pound rose 0.4% to $1.3266

The Japanese yen rose 1.8% to 147.98 per dollar

Cryptocurrencies

Bitcoin fell 1.7% to $114,491.12

Ether fell 3.9% to $3,587.48

Bonds

The yield on 10-year Treasuries declined 13 basis points to 4.24%

Germany's 10-year yield declined five basis points to 2.65%

Britain's 10-year yield declined five basis points to 4.52%

The yield on 2-year Treasuries declined 23 basis points to 3.72%

The yield on 30-year Treasuries declined eight basis points to 4.82%

Commodities

West Texas Intermediate crude fell 1.9% to $67.92 a barrel

Spot gold rose 1.8% to $3,347.78 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.