Stocks pared earlier gains on concerns about the risk of a US government shutdown and confusion regarding President Donald Trump's latest tariff move. Traders are awaiting key labor-market data this week that could provide clues about how fast the Federal Reserve will cut interest rates.

The S&P 500 was 0.2% higher as of 12 p.m. New York time. The Nasdaq 100 rose 0.5%. The Bloomberg dollar index trimmed losses after pending home sales for August jumped to the highest level in five months. The US Treasury 10-year yield fell to 4.14%. Gold hit a record, lifting the US Treasury's holdings of the metal past $1 trillion.

Investors are somewhat worried this week that the threat of a US government shutdown could hinder some important data releases. All eyes will be on Friday's nonfarm payrolls report for further details on how the labor market is holding up, which would help the Fed decide how many more times to cut rates this year. Markets are currently pricing in two rate cuts by January due to recent signs that the jobs market is slowing.

“Given the importance of the job market to the Fed's rate-cutting decisions, risk that the September unemployment report could be delayed could add to the market's anxiety over the direction of policy,” said Kathy Jones, chief fixed income strategist at Schwab.

Uncertainty around trade policies also persists as Trump said he would levy new tariffs to boost the domestic film and furniture industries through a pair of sweeping — yet confusing — plans. Emma Wall, chief investment strategist at Hargreaves Lansdown, wrote that investors should be mindful that the inflationary impact of tariffs is not properly seen in numbers just yet.

“Further tax hikes — such as the 100% pharmaceuticals levy announced last week — are likely to add pricing pressures,” she said.

Apart from Friday's jobs report, there's also the JOLTs report releasing on Tuesday that will offer a picture on job openings while Wednesday's data will shed light on company hiring. Strategists said the recent negative revisions and downtrend in jobs numbers will raise the stakes for Friday's release.

“We could be set for some notable volatility around these prints going forward as the breakeven payroll rate now seems to be around or under 50,000 a month,” wrote Jim Reid, global head of macro research and thematic strategy at Deutsche Bank AG. “We are not really conditioned to negative prints being within that margin of error, so reactions to such prints may be not rational.”

Fed policymakers including Alberto Musalem and Raphael Bostic are speaking on Monday.

Looming Shutdown

Top congressional leaders will meet with President Donald Trump at the White House a day before federal funding would expire if the two parties can't agree on a short-term spending bill. The bill would only fund the government until mid-November and must pass before Oct. 1.

Ulrike Hoffmann-Burchardi, CIO Americas and Global Head of Equities, UBS Global Wealth Management, urges investors to look past shutdown fears and pay attention to other market drivers, such as the Fed's path, strong corporate earnings and robust AI capex.

"We continue to prefer quality fixed income, particularly those with medium-term maturities, which we believe offers a compelling combination of income and resilience in the event of slower growth," Hoffmann-Burchardi said. "Income replacement strategies, such as equity income or yield-generating structured strategies, may also help diversify portfolios."

Valuations

Equities investors have recently been irked about valuations being too high, prompting them to ditch stocks for a few sessions last week. But a growing number of Wall Street analysts are now advising that it may be time to forget what you thought you knew about price-to-earnings ratios, as the average multiple has steadily jumped higher over the course of decades.

“There's something weird going on with valuations from what they used to be — that is, there's an upward trend in the valuation range,” said Jim Paulsen, who now writes a Substack newsletter called Paulsen Perspectives.

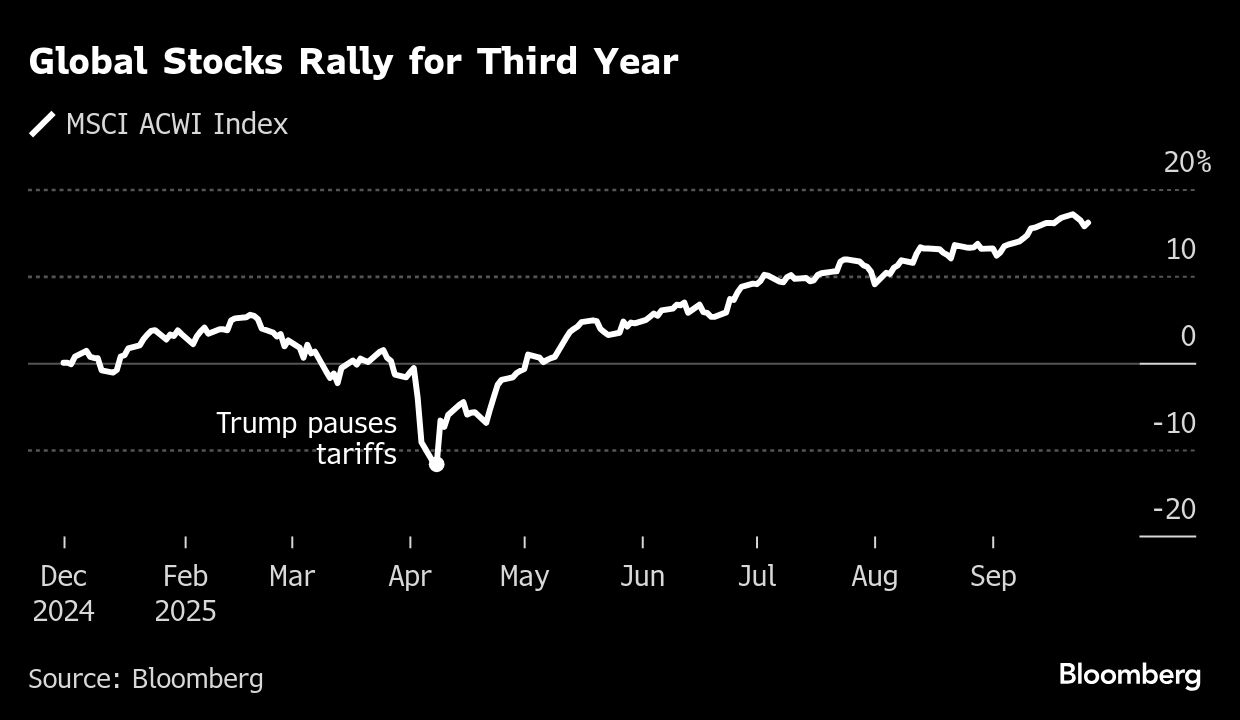

Even so, Goldman Sachs Group Inc. strategists expect global stocks to extend their rally through year-end, driven by a resilient US economy, supportive valuations and a more dovish Fed stance.

“Good earnings growth, Fed easing without a recession and global fiscal policy easing will continue to support equities,” a team led by Christian Mueller-Glissmann wrote in a note. “With anchored recession risk, we would buy dips in equities into year-end.”

In company news, Electronic Arts Inc. agreed to sell itself to Saudi Arabia's sovereign wealth fund and a pair of private equity firms in a deal that values the company at about $55 billion, marking the largest leveraged buyout on record. Huawei Technologies Co. is preparing to sharply ramp up production of its most advanced artificial intelligence chips over the next year.

Key Events This Week:

Some of the main moves in markets:

Stocks

The S&P 500 rose 0.2% as of 12 p.m. New York time

The Nasdaq 100 rose 0.5%

The Dow Jones Industrial Average fell 0.1%

The Stoxx Europe 600 rose 0.2%

The MSCI World Index rose 0.3%

Currencies

The Bloomberg Dollar Spot Index fell 0.3%

The euro rose 0.2% to $1.1729

The British pound rose 0.2% to $1.3432

The Japanese yen rose 0.6% to 148.58 per dollar

Cryptocurrencies

Bitcoin rose 2.8% to $113,945.61

Ether rose 2.9% to $4,168.89

Bonds

The yield on 10-year Treasuries declined four basis points to 4.14%

Germany's 10-year yield declined four basis points to 2.71%

Britain's 10-year yield declined five basis points to 4.70%

Commodities

West Texas Intermediate crude fell 3.7% to $63.27 a barrel

Spot gold rose 1.9% to $3,830.11 an ounce

This story was produced with the assistance of Bloomberg Automation.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.