Wall Street halted its rebound just hours ahead of the highly anticipated results from Nvidia Corp. — the last of the “Magnificent Seven” megacaps to report.

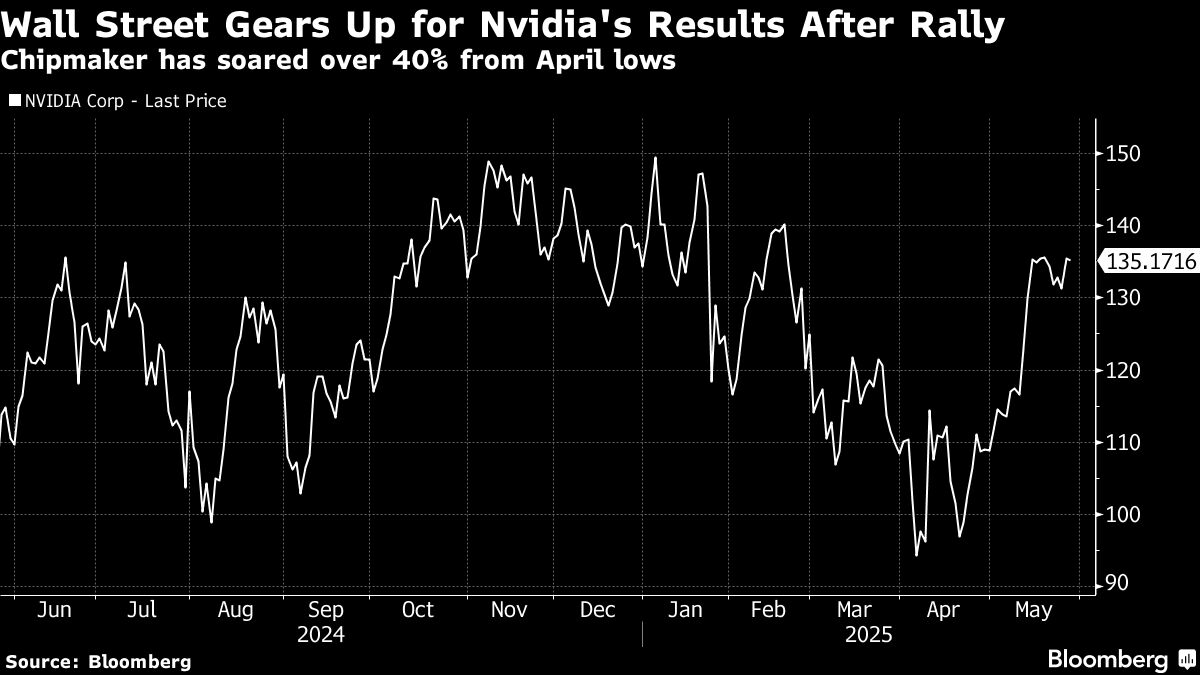

Following a solid rally in the previous session, the S&P 500 edged lower. The world's most-valuable chipmaker, which has soared more than 40% from its April low, fluctuated on Wednesday. The options market implies a post-results move of about 6% in either direction for the $3.3 trillion company that's considered a bellwether for artificial-intelligence demand.

Jensen Huang.

“Wednesday's Nvidia earnings report is pivotal not just for Nvidia but for the entire stock market, as it can rejuvenate investor optimism across the board and help investors to focus on the power of AI and less on headlines out of Washington on tariffs and taxes,” said James Demmert at Main Street Research.

Treasuries slipped as attention turned to a fresh wave of supply after recent offerings signaled softer demand for government paper. A 40-year bond sale in Japan met the weakest demand since July. US auctions Wednesday are focused at the shorter end of the curve, including a $70 billion sale of five-year notes.

Traders will also keep an eye on the upcoming Federal Reserve minutes, which are likely to continue reflecting officials' “wait-and-see” approach to monetary policy.

The S&P 500 fell 0.3%. The Nasdaq 100 was little changed. The Dow Jones Industrial Average lost 0.4%.

The yield on 10-year Treasuries rose five basis points to 4.49%. A dollar gauge added 0.3%. Oil climbed as the market assessed the risk of additional US sanctions on Russia and the chance that nuclear talks with Iran would fail to produce an agreement.

“It's hard to recall a time when so many investors were so focused on the earnings outcome of a single stock,” said Ryan Grabinski at Strategas Securities. “We have no clear view on how Nvidia's earnings will land given the many variables at play, but what is certain is the persistent attacks from both the US and China leaves the company highly sensitive to headline risk.”

Nvidia and other technology giants were among the biggest decliners in last month's rout that sent the S&P 500 to the brink of a bear market. Many of the stocks have recouped much of the losses after President Donald Trump temporarily paused the stiffest levies and earnings showed demand remains intact.

Nvidia's surge from its April lows hasn't been accompanied by particularly high volumes, suggesting some investors might have missed out on the rally. An upbeat earnings report would bode well for a rally in US stocks as investors have about $7 trillion parked in cash funds, BBVA strategists have recently said.

American equities lost steam in the wake of a rally triggered by signs the US and the European Union were speeding up trade talks.

The EU's trade chief, Maros Sefcovic, said he plans to speak to US Commerce Secretary Howard Lutnick and US Trade Representative Jamieson Greer on Thursday, seeking to fast-track negotiations to reach a deal ahead of a July 9 deadline.“It's hard to recall a time when so many investors were so focused on the earnings outcome of a single stock,” said Ryan Grabinski at Strategas Securities. “We have no clear view on how Nvidia's earnings will land given the many variables at play, but what is certain is the persistent attacks from both the US and China leaves the company highly sensitive to headline risk.”

Nvidia and other technology giants were among the biggest decliners in last month's rout that sent the S&P 500 to the brink of a bear market. Many of the stocks have recouped much of the losses after President Donald Trump temporarily paused the stiffest levies and earnings showed demand remains intact.

Nvidia's surge from its April lows hasn't been accompanied by particularly high volumes, suggesting some investors might have missed out on the rally. An upbeat earnings report would bode well for a rally in US stocks as investors have about $7 trillion parked in cash funds, BBVA strategists have recently said.

American equities lost steam in the wake of a rally triggered by signs the US and the European Union were speeding up trade talks.

The EU's trade chief, Maros Sefcovic, said he plans to speak to US Commerce Secretary Howard Lutnick and US Trade Representative Jamieson Greer on Thursday, seeking to fast-track negotiations to reach a deal ahead of a July 9 deadline.

“The latest trade developments remain in line with our base case that pragmatism will ultimately prevail over confrontation,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management. “So far, the Trump administration has appeared to temper its more strident tariff policies in response to signs of distress in markets.”

Assuming trade tensions continue to ease, she sees room for the equity market rally to resume into 2026, with the S&P 500 reaching around 6,400 by June of next year. The gauge hovered near 5,900.

Investor exposure to equities is still low enough that the “path of least resistance” for the market is higher, according to strategists at Barclays Plc. The team led by Emmanuel Cau said institutional investors weren't a big part of the stock rebound in May, with positioning remaining broadly underweight.

Absent a volatility shock, “systematic buying could continue to help equities to grind higher,” Cau wrote in a note.

Meantime, the risk of a “major” downturn in the dollar will increase next year if Trump's policies add to the US debt burden but fail to boost the economy, according to Standard Chartered's Steve Englander.

“If the economy or financial markets falter, the downside risk to the USD is higher the greater the accumulation of external liabilities,” Englander said.

Corporate Highlights:

President Donald Trump said that the US government would retain guarantees and an oversight role over Fannie Mae and Freddie Mac even as he pursues a public offering for the mortgage giants.

Macy's Inc. posted better-than-expected quarterly results — a sign the company's strategy of focusing on its best-performing locations is paying off despite weakening consumer sentiment and tariff volatility.

Abercrombie & Fitch Co. upped its full-year outlook, suggesting confidence in its ability to navigate the changing tariff landscape.

Dick's Sporting Goods Inc.'s chairman pushed back on criticism of its pending acquisition of struggling footwear chain Foot Locker Inc.

Honeywell International Inc. agreed to cooperate with Elliott Investment Management and add a member of the activist shareholder to its board as the industrial firm prepares to split into three companies.

The Trump administration issued a stripped-down license to Chevron Corp. to remain in Venezuela, allowing the company to conduct minimal maintenance on equipment but prohibiting it from producing oil in the sanctioned South American nation.

Bank of Montreal topped estimates as net interest income came in higher than expected even as the company set aside more money to cover loans that are still in good standing, highlighting growing concern about the fate of the North American economy.

BCE Inc., Canada's largest telecom company by revenue, will set up a network of artificial intelligence data centers across the country, mirroring the aggressive AI infrastructure build-out happening in the US and abroad.

DeepSeek said it has upgraded the R1 artificial-intelligence model that helped propel the Chinese startup to global prominence earlier this year.

Shein Group Ltd. is considering switching its planned initial public offering to Hong Kong from London, people familiar with the matter said, representing the latest twist in the fast-fashion retailer's turbulent pursuit of going public.

Some of the main moves in markets:

Stocks

The S&P 500 fell 0.3% as of 11:36 a.m. New York time

The Nasdaq 100 was little changed

The Dow Jones Industrial Average fell 0.4%

The Stoxx Europe 600 fell 0.6%

The MSCI World Index fell 0.4%

Bloomberg Magnificent 7 Total Return Index was little changed

The Russell 2000 Index fell 0.8%

Currencies

The Bloomberg Dollar Spot Index rose 0.3%

The euro fell 0.3% to $1.1294

The British pound fell 0.3% to $1.3461

The Japanese yen fell 0.5% to 145.01 per dollar

Cryptocurrencies

Bitcoin fell 2.1% to $107,358.5

Ether fell 1.4% to $2,631.86

Bonds

The yield on 10-year Treasuries advanced five basis points to 4.49%

Germany's 10-year yield advanced two basis points to 2.55%

Britain's 10-year yield advanced six basis points to 4.73%

Commodities

West Texas Intermediate crude rose 1.9% to $62.03 a barrel

Spot gold fell 0.1% to $3,296.43 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.