A slide in most megacaps hit stocks in the final stretch of US trading, with Wall Street gearing up for a pulse check from Nvidia Corp. on the artificial-intelligence technology that has powered the bull market.

The S&P 500 broke below 6,000 and the Nasdaq 100 lost over 1%. Just days ahead of Nvidia's earnings, hedge funds' net exposure to “Magnificent Seven” megacaps hit the lowest level since April 2023. The chipmaker lost 3.1%. Microsoft Corp. fell as an analyst said the software giant dropped some AI data-center leases. Apple Inc. rose.

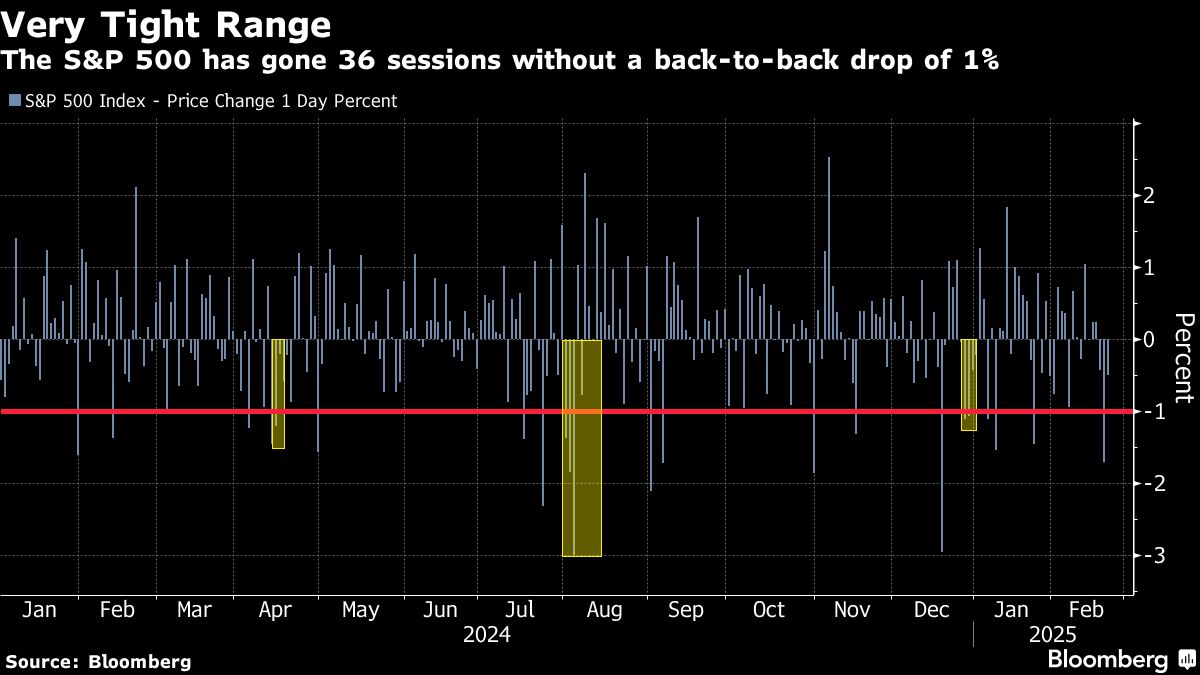

Investors have started to boost bets that volatility will come back as Nvidia's earnings on Wednesday could be the first in a whirlwind of events with the potential to send the market into conniptions. That's after the US equity benchmark spent 36 sessions without posting consecutive declines of more than 1%.

“There is very little room for Nvidia to disappoint analyst profit expectations this year, given its assumed leadership position in AI, already elevated valuations, and new developments and entrants in the space that could threaten its dominance over time,” said Anthony Saglimbene at Ameriprise.

The S&P 500 lost 0.5%. The Nasdaq 100 fell 1.2%. The Dow Jones Industrial Average wavered.

Among individual stock movers, Alibaba Group Holding Ltd. tumbled in US trading amid a $53 billion AI spending pledge and as The Trump administration took aim at China with a series of moves involving investment and trade. Berkshire Hathaway Inc. jumped on a surge in operating profit.

The yield on 10-year Treasuries slid three basis points to 4.4%. Bonds remained higher after a $69 billion sale of two-year notes drew record demand. Canada's dollar and Mexico's peso fell as President Donald Trump expects tariffs planned to take effect on both countries to go ahead next month.

To Chris Larkin at E*Trade from Morgan Stanley, this could be a key week for a stock market that's mostly been trading sideways for more than two months.

The S&P 500 has been in a tight trading range since the election, remaining in a 4% range over the past three months, the narrowest range since 2017, according to Mark Hackett at Nationwide

“The market is churning sideways, driven by investor confusion, a natural consolidation period following recent gains, and seasonal weakness in February,” he said. “However, the strong macro backdrop, robust earnings, and healthy fund flows argue for a breakout to the upside once momentum returns.”

Positioning in mega-cap growth and tech remains very elevated heading into Nvidia's earnings release due this week, in the 97th percentile and well above levels implied by earnings growth, according to Deutsche Bank AG strategists including Parag Thatte.

Fourth-quarter earnings are on pace to significantly exceed earnings estimates across capitalizations — nearly doubling the pre-season forecasts — but it hasn't been enough to satisfy investors as stocks are responding with unusually sour returns, according to Gina Martin Adams and Wendy Soong at Bloomberg Intelligence.

“Disappointments in guidance, revisions and operating margin all share the blame,” the strategists noted. “Nvidia could still move the needle as the large-cap season wraps up.”

US equities won't remain unpopular for long given the robust outlook for economic growth and corporate earnings, according to some of Wall Street's top strategists.

Morgan Stanley strategist Michael Wilson — a bearish voice on US stocks until mid-2024 — said he expects capital to return to US stocks, calling the S&P 500 “the highest quality index” with “the best earnings growth prospects.”

“It's premature to conclude the rotation away from the US is sustainable,” Wilson wrote in a note.

JPMorgan Chase & Co. strategist Mislav Matejka said a more subdued outlook for big tech was indeed a “meaningful impediment” for a renewed US outperformance more broadly. However, US earnings growth would need to undershoot the rest of the world to support an outright bearish view, he added.

“Recent economic and survey data do raise some warning flags, but S&P 500 companies delivered strong growth along with continued record profitability last quarter,” said Scott Helfstein at Global X. “Fundamentals will ultimately win out, but waning sentiment could well lead broad equity indexes sideways for a little while.”

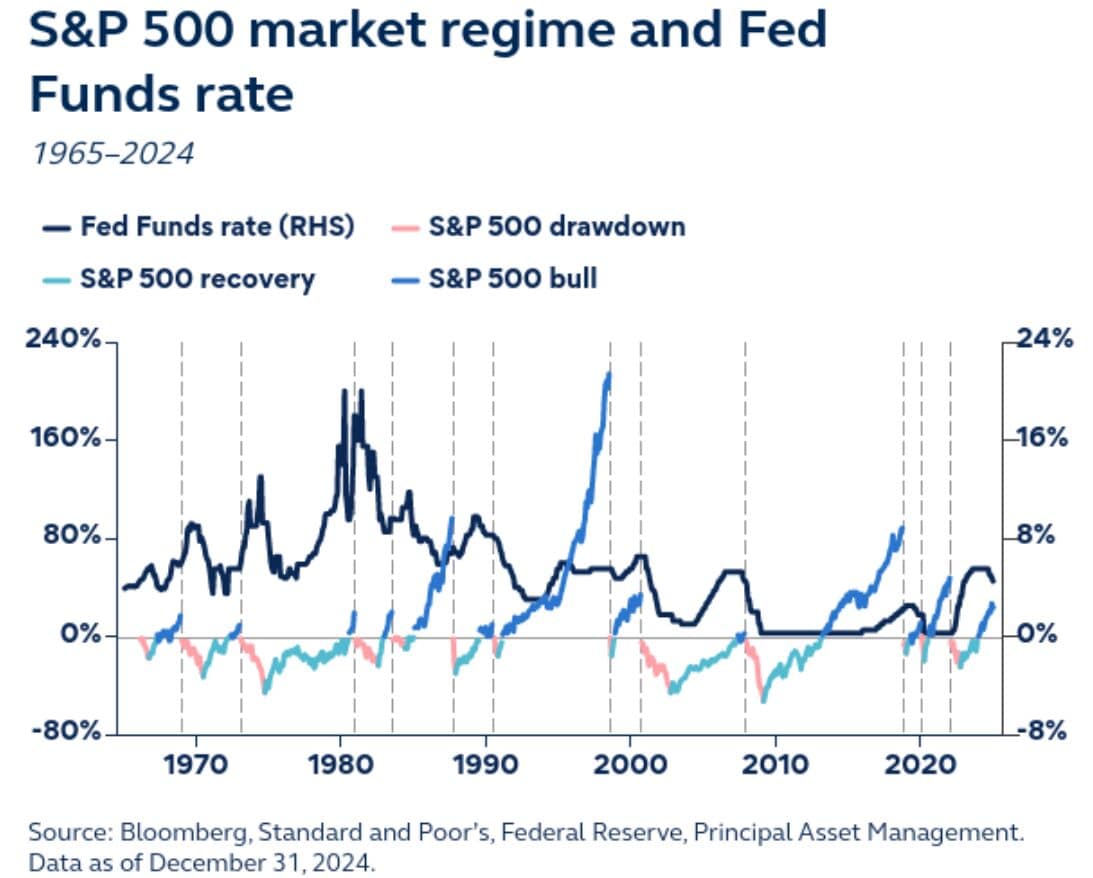

Following double-digit returns for US equities over the past two years, and with valuations now incredibly expensive, investors are increasingly concerned about whether markets have peaked, according to Christian Floro at Principal Asset Management.

“Bull markets don't just die of old age, however, and history suggests that the Federal Reserve tends to play an outsized role in determining the prevailing market regime based on its monetary policy stance,” he noted.

Most market selloffs larger than 10% since 1965 were triggered by either the Fed pivoting aggressively to a hawkish stance or the Fed staying restrictive for too long, he said. Floro noted that the current macroeconomic landscape differs meaningfully from past market peaks, particularly as data show little sign of a hard landing.

“A narrow but viable path remains for markets to grind higher, especially if earnings growth continues to deliver as expected,” he noted. “However, uncertainty around future policy decisions poses a significant risk. Prudent investors should remain vigilant, balancing optimism with a strategic approach to risk in today's evolving market environment.”

Key events this week:

Eurozone CPI, Monday

Israel rate decision, Monday

Singapore CPI, Monday

BOE Deputy Governors Clare Lombardelli and Dave Ramsden speak, Monday

Germany GDP, Tuesday

South Korea rate decision, Tuesday

Taiwan industrial production, Tuesday

US consumer confidence, Tuesday

ECB Governing Council member Joachim Nagel delivers Bundesbank's annual report, Tuesday

Richmond Fed President Tom Barkin speaks, Tuesday

Taiwan GDP, Wednesday

Thailand rate decision, Wednesday

US new home sales, Wednesday

Nvidia earnings, Wednesday

G-20 finance ministers and central bank governors meet in Cape Town though Feb. 27, Wednesday

Atlanta Fed President Raphael Bostic speaks, Wednesday

Brazil unemployment, Thursday

Eurozone consumer confidence, Thursday

Mexico unemployment, trade balance, Thursday

Spain CPI, Thursday

US GDP, durable goods, initial jobless claims, Thursday

ECB publishes account of Jan. 29-30 policy meeting, Thursday

Canada GDP, Friday

Chile industrial production, unemployment, Friday

France CPI, GDP, Friday

Germany CPI, unemployment, Friday

India GDP, Friday

Japan Tokyo CPI, industrial production, retail sales, Friday

Sri Lanka CPI, trade, Friday

US PCE inflation, income and spending, Friday

Chicago Fed President Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

The S&P 500 fell 0.5% as of 4 p.m. New York time

The Nasdaq 100 fell 1.2%

The Dow Jones Industrial Average was little changed

The MSCI World Index fell 0.4%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0462

The British pound fell 0.1% to $1.2619

The Japanese yen fell 0.3% to 149.76 per dollar

Cryptocurrencies

Bitcoin fell 1.9% to $93,977.75

Ether fell 5.9% to $2,642.2

Bonds

The yield on 10-year Treasuries declined three basis points to 4.40%

Germany's 10-year yield was little changed at 2.48%

Britain's 10-year yield was little changed at 4.56%

Commodities

West Texas Intermediate crude rose 0.6% to $70.83 a barrel

Spot gold rose 0.5% to $2,950.91 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.