Stocks got hit after weaker-than-expected economic data raised concern about the outlook for Corporate America amid a surge in consumers' long-run inflation views to the highest since 1995.

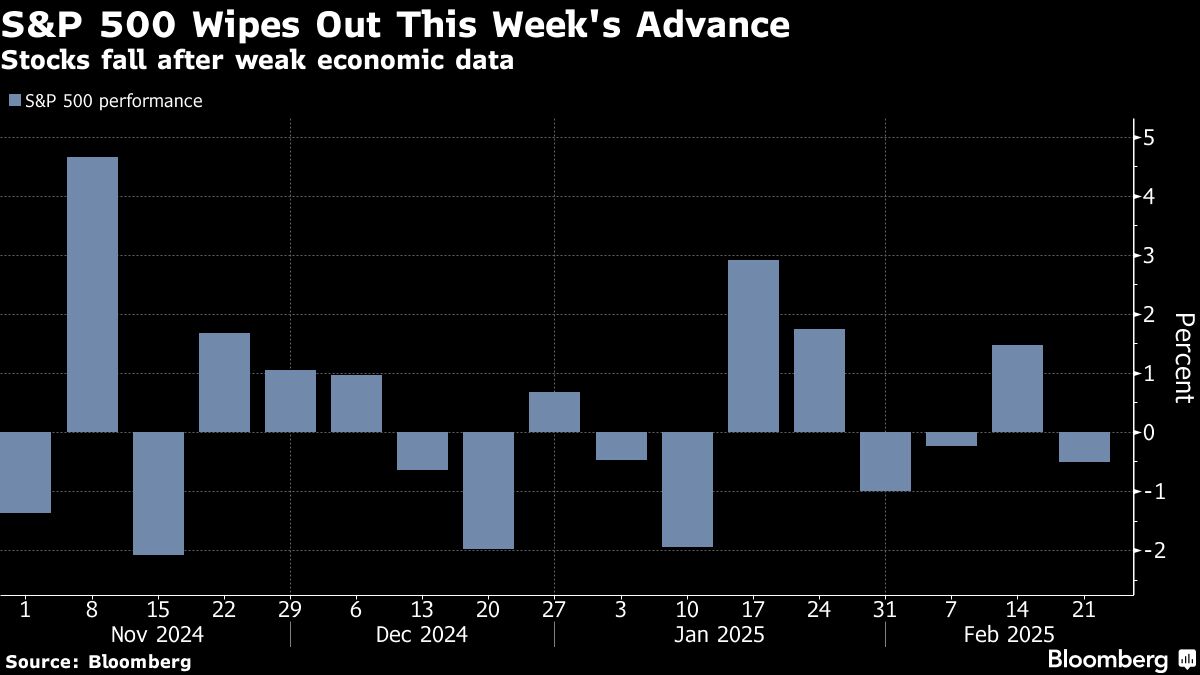

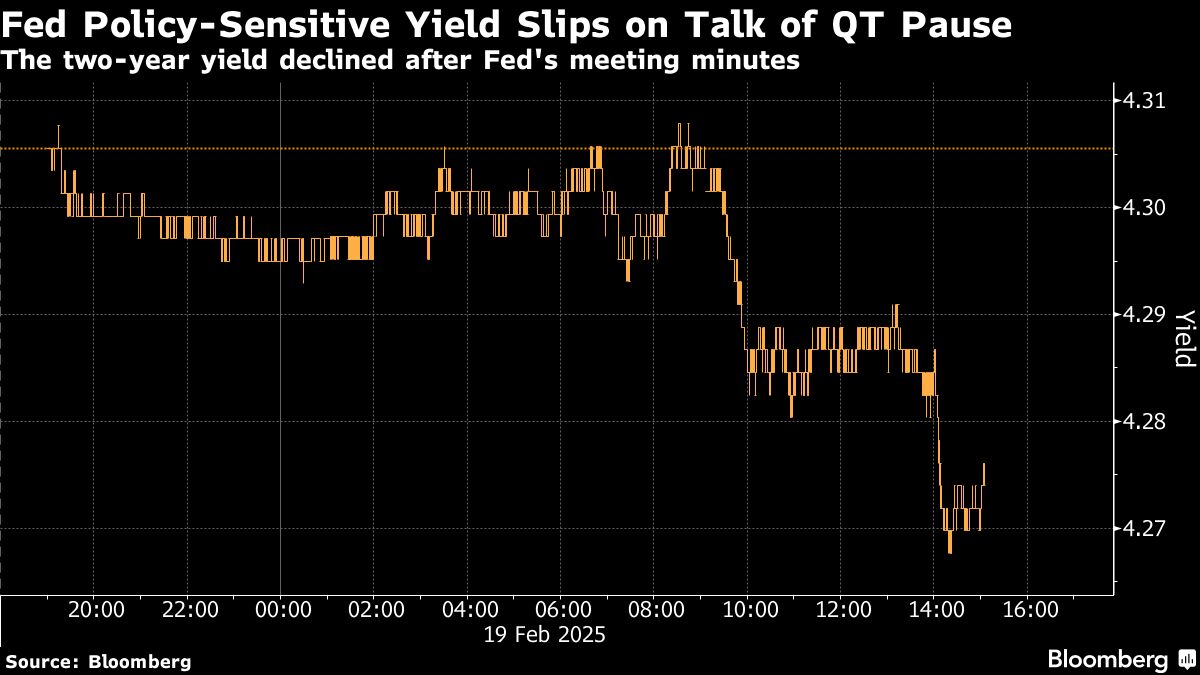

From consumer sentiment to housing and services, Friday's readings left investors questioning growth prospects at a time when the Federal Reserve is signaling no rush to cut rates. Economically sensitive corners of the market bore the brunt of the selling. The S&P 500 erased this week's advance. Despite the rise in inflation expectations, bond yields remained lower.

“Today seems to be a classic risk-off type of day,” Katy Kaminski at AlphaSimplex Group LLC told Bloomberg Radio. “Consumer confidence is down, long-term inflation expectations are up. People are just a little nervous about what all this means.”

A notional $2.7 trillion worth of options tied to equities and exchange-traded funds was set to expire on Friday, according to Goldman Sachs Group Inc. That's usually associated with amplified price swings.

The S&P 500 fell 0.8%. The Nasdaq 100 slid 1.1%. The Dow Jones Industrial Average slipped 1%. The Russell 2000 index of small caps dropped 1.5%. A Bloomberg gauge of the Magnificent Seven megacaps lost 1.5%.

The yield on 10-year Treasuries declined five basis points to 4.46%. The Bloomberg Dollar Spot Index rose 0.2%.

To Mark Hackett at Nationwide, equity markets remain in a period of consolidation following an impressive two-year run, with little change in the S&P 500 since early December.

The index is attempting to break out of the trading range it has been in since the election, remaining in a 4% range over the past three months, the narrowest range since 2017, he noted.

“Beneath the surface, however, there is an interesting shift in market leadership, which could propel markets forward, as the risk/reward dynamics in the international and value space catch the eye of investors,” Hackett said.

Hedge funds have trimmed net positions on most of the the Magnificent Seven stocks, according to Goldman Sachs Group Inc. strategists.

“The latest filings show hedge funds becoming more selective within popular sectors and themes,” the team including Ben Snider and Jenny Ma wrote. Despite the trimming, six companies in the group of megacaps still rank among top positions for hedge funds, with the exception being Tesla Inc.

More broadly, short interest for the median S&P 500 stock has also increased to the highest level since 2020, now at 2% of market cap.

Stocks fell from all-time highs as a disappointing forecast from the world's largest retailer added to concern about the economy's main engine.

Walmart Inc., the first big-box retailer to report results after the holiday season, sank 6.5%. Its chief financial officer acknowledged “uncertainties related to consumer behavior and global economic and geopolitical conditions.” That's just days after retail sales signaled an abrupt pullback by consumers. A slide in banks also weighed on trading, with JPMorgan Chase & Co. and Goldman Sachs Group Inc. each falling over 3.8%.

Retailers like Walmart tend to perform well during tough economic times. It's also true that Walmart usually starts the year with a conservative guidance. But the fact is consumers are dealing with stubborn prices and high borrowing costs, and many are turning to credit cards and other debt to support their spending — with a rising number of those loans starting to go bad.

“This news out of Walmart raises even more concerns about the state of the consumer,” said Matt Maley at Miller Tabak + Co. “We have already seen some very disappointing numbers on consumer confidence and last week's retail sales data was much lower than expected. It raises some questions about how strong growth will be over the rest of this year.”

Those uncertainties hit a market dealing with risks ranging from tariffs to inflation, geopolitics and valuations. After rallying over 20% last year, US stocks have trailed global counterparts — with the S&P 500 failing to achieve meaningful breakouts during the three times it closed at a record in 2025.

“A correction may soon be necessary to restore a more attractive valuation for US stocks,” said Fawad Razaqzada at City Index and Forex.com. “While there are no overt warning signs just yet, it pays to be alert to signals that would put the S&P 500 forecast on a downward trajectory in the short-term.”

The S&P 500 slipped 0.4%. The Nasdaq 100 slid 0.5%. The Dow Jones Industrial Average lost 1%. The Russell 2000 dropped 0.9%. The KBW Bank Index slumped 2.4%. A gauge of the Magnificent Seven megacaps fell 0.6%.

The yield on 10-year Treasuries slid three basis points to 4.50%. The Bloomberg Dollar Spot Index fell 0.7%. The yen led gains in major currencies on bets the Bank of Japan will hike rates sooner rather than later.

“Walmart, a bellwether for consumer spending, raised another red flag, just as mounting trade tensions threaten to drive up the costs of goods,” said Jose Torres at Interactive Brokers.

Before Thursday's decline, Walmart's shares had doubled since December 2023. That left no room for disappointment.

Despite the market reaction, its outlook is more nuanced than it first appears. In reality, it reflects a few key factors that don't necessarily spell doom and gloom for the company's business. In addition, CFO John David Rainey also said consumer behavior remained “consistent” and “resilient.” He noted that January had actually been the strongest month in the quarter.

Aside from the selloff in consumer companies, banks were among the groups hit the hardest.

Among the reasons, Jason Goldberg at Barclays Plc cited Walmart's outlook and a contraction in the Conference Board leading economic index as factors fueling macroeconomic concerns.

But there's also the fact that banks have also “had a decent move” resulting in “some profit taking,” the analyst wrote.

“US equities are seeing some broader de-risking today,” said Dan Wantrobski at Janney Montgomery Scott.

While the overall consolidation pattern remains intact/healthy at this time, Wantrobski says he's watching for key support within the 5,950-6,000 range for the S&P 500.

“A closing break below this threshold still opens the door to a bigger drawdown towards the 200-day moving average — which resides within our 5,600-5,800 support target,” he added. The gauge is currently above 6,100.

The US stock market can flip into a correction territory as retail and institutional buyers are running out of steam, according to Goldman Sachs Group Inc.'s Scott Rubner, the bank's managing director for global markets and tactical specialist.

Demand from retail traders, which have been piling into US stocks at a record pace this year, is expected to slow down ahead of the tax paying season in March. Flows from pension funds can also “run out of juice,” according to Rubner attributing it to seasonal trends. January and February are typically the strongest months of the year for yearly asset allocations, followed by weaker inflows in March.

Meantime, a measure of the S&P 500's ability to brush off fear-inducing headlines and surprise policy announcements is the strongest since before the Covid-19 pandemic.

Investors are now less fixated on one particular variable — like a key inflation report — than in recent years, making the market more resilient to macro shocks, according to analysts at 22V Research.

“More variables, like earnings, industry group, and factor exposures, matter,” said Kevin Brocks, director at 22V Research. “The macro picture has improved and the economy is further from recession.”

Key events this week:

Eurozone consumer confidence, Thursday

US initial jobless claims, Philadelphia Fed manufacturing index, Thursday

Fed's Austan Goolsbee and Alberto Musalem speak, Thursday

Eurozone HCOB manufacturing & services PMI, Friday

US S&P Global manufacturing & services PMI, existing home sales, consumer sentiment, Friday

Some of the main moves in markets:

Stocks

The S&P 500 fell 0.8% as of 12:21 p.m. New York time

The Nasdaq 100 fell 1.1%

The Dow Jones Industrial Average fell 1%

The MSCI World Index fell 0.6%

The Russell 2000 Index fell 1.5%

Bloomberg Magnificent 7 Total Return Index fell 1.5%

Currencies

The Bloomberg Dollar Spot Index rose 0.2%

The euro fell 0.5% to $1.0453

The British pound fell 0.2% to $1.2641

The Japanese yen rose 0.2% to 149.41 per dollar

Cryptocurrencies

Bitcoin fell 0.3% to $97,857.73

Ether fell 0.9% to $2,703.77

Bonds

The yield on 10-year Treasuries declined five basis points to 4.46%

Germany's 10-year yield declined six basis points to 2.47%

Britain's 10-year yield declined four basis points to 4.57%

Commodities

West Texas Intermediate crude fell 2.2% to $70.89 a barrel

Spot gold was little changed

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.