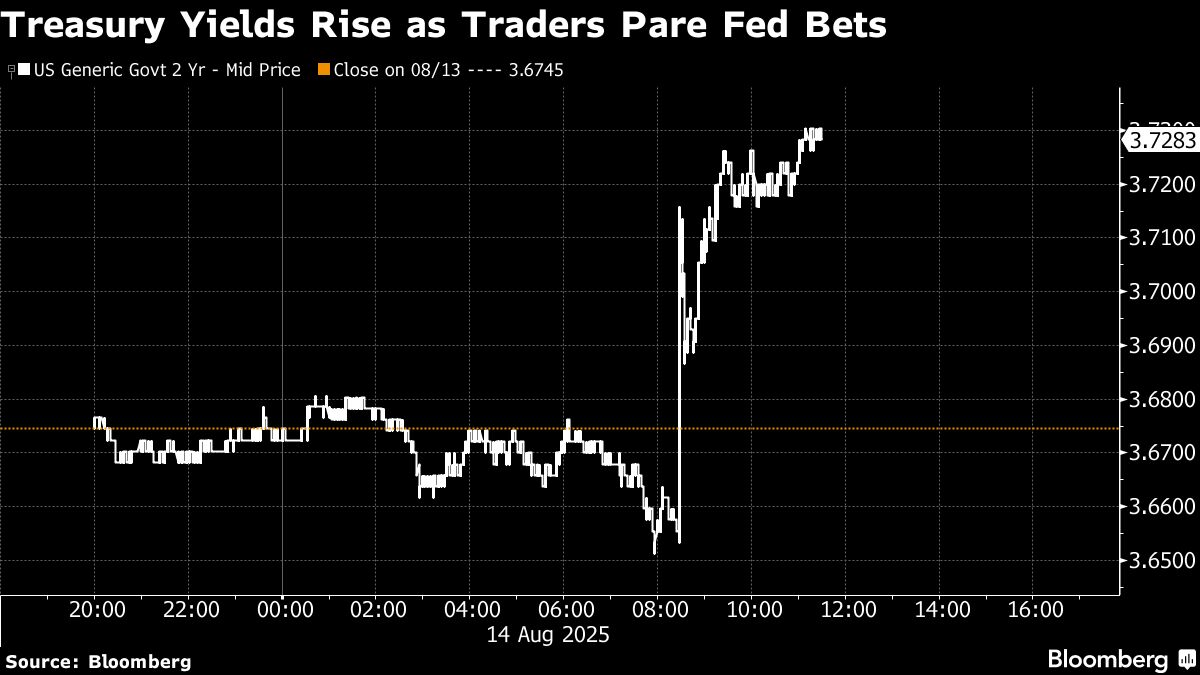

A record-breaking run in stocks took a breather after a pick-up in inflation lifted bond yields and the dollar, with traders paring bets the Federal Reserve will cut interest rates next month.

Following an about 30% surge from its April lows, the S&P 500 edged lower. While the index's move was mild thanks to gains in most big techs, about 400 shares fell. Two-year yields climbed six basis points to 3.74%. Money markets showed an about 85% chance the Fed will reduce rates in September after fully pricing in the move a day earlier.

Stocks fall after PPI.

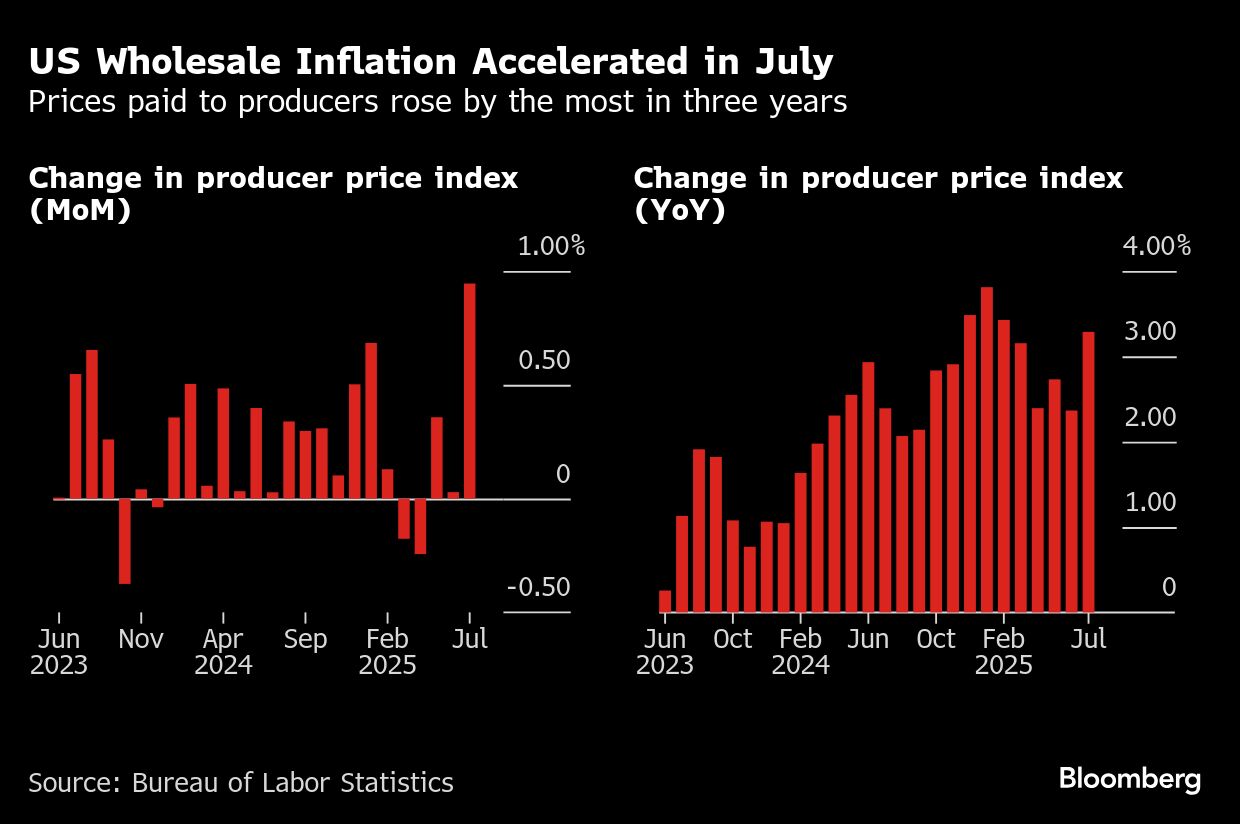

US wholesale inflation accelerated in July by the most in three years, suggesting companies are passing along higher import costs related to tariffs. The producer price index increased 0.9% from a month earlier and 3.3% from a year ago. Services costs jumped 1.1% last month.

The firm wholesale inflation may give some policymakers pause that price pressures are rearing back up again. Earlier this week, consumer price data pointed to a milder pass-through in July, and the labor market now shifting to a lower gear.

To Chris Zaccarelli at Northlight Asset Management, the spike in PPI shows inflation is coursing through the economy, even if it hasn't been felt by consumers yet.

“Given how benign the CPI numbers were on Tuesday, this is a most unwelcome surprise to the upside and is likely to unwind some of the optimism of a ‘guaranteed' rate cut next month,” he said.

“The fact that PPI was stronger-than-expected and CPI has been relatively soft suggests that businesses are eating much of the tariff costs instead of passing them onto the consumer,” said Clark Geranen at CalBay Investments.

With input costs rising, this could impact earnings for companies in the third and fourth quarters, according to Fawad Razaqzada at City Index and Forex.com. Yet, the downside was limited, suggesting that investors are not too concerned just yet.

“It is likely that the Fed will see through the rise as the one-time increase and their concerns about the jobs market may make them more open to the idea of resuming rate cuts from September,” he said.

The 0.9% jump in PPI reflects lingering cost pressures — some driven by tariffs — but core inflation trends remain contained, according to Gina Bolvin, president of Bolvin Wealth Management Group.

“It's a reminder that the path to lower rates may not be linear, but the broader disinflationary trend is still intact,” she said. “This is not a signal to panic. It's a time to focus on fundamentals, maintain diversification, and look for companies with strong pricing power and healthy margins.”

This doesn't slam the door on a September rate cut, but based on the market's initial reaction, the opening may be a little smaller than it was a couple of days ago,” said Chris Larkin at E*Trade from Morgan Stanley.

Thierry Wizman at Macquarie Group says traders are taking a more subdued view of what US monetary policy may deliver in the next few weeks.

“The Fed is more likely to give us a hawkish cut than a dovish cut,” in September, assuming no radical changes in the direction of data or markets until then, he noted.

At BMO Capital Markets, Ian Lyngen said there wasn't anything in the details that materially changed investors' understanding of the state of play in either the real economy or with the Fed.

Meantime, Treasury Secretary Scott Bessent said he isn't calling for a series of interest-rate cuts from the Fed, just pointing out that models suggest a “neutral” rate would be about 1.5 percentage points lower.

“I didn't tell the Fed what to do,” Bessent told Fox Business, referring to his comments a day before about how the central bank “could go into a series of rate cuts here.”

Fed Bank of St. Louis President Alberto Musalem told CNBC said it's too early for him to decide on whether to lower interest rates at next month's meeting.

Separate data on Thursday showed US jobless claims edged lower last week, suggesting employers remain reluctant to lay off workers.

From here, analysts and investors are getting ready to scour Friday's retail sales report for a readout on how US households are feeling about the economy.

Elsewhere, oil traded in a narrow range near a two-month low as traders look ahead to the meeting between Donald Trump and Vladimir Putin, following a slew of bearish market outlooks.

Corporate News:

Cisco Systems Inc. gave a cautious forecast for the current fiscal year, even as sales from artificial intelligence projects begin to pick up.

Apple Inc. is restoring the blood oxygen tracking feature on its smartwatch in the US following a years-long legal fight.

Peloton Interactive Inc. is planning its biggest product upgrades in years, a bid to rejuvenate sales with refreshed hardware, new accessories and artificial intelligence.

Deere & Co., the world's biggest farm machinery maker, pared its full-year earnings outlook with lower grain prices curbing farmers' spending.

Eli Lilly & Co. is raising the list price for its obesity shot in the UK by as much as 170%, as the pharma industry comes under pressure from US President Donald Trump to increase medicine prices in Europe and lower them for Americans.

JD.com Inc.'s revenue grew a faster-than-anticipated 22%, benefiting from government-directed consumer subsidies as well as an aggressive but costly drive into new arenas such as meal delivery.

Costco Wholesale Corp. has decided not to dispense the abortion pill mifepristone at its more than 500 pharmacy locations, a decision hailed by a group of faith-based activists who urged the retailer to avoid selling the drug.

Rogers Communications Inc. will sell a portfolio of nine data centers to infrastructure asset manager InfraRed Capital Partners to help pay down debt.

Tapestry Inc. has been one of the stars of the retail world, but a mix of tariff costs and weakness at its Kate Spade brand sent investors fleeing on Thursday.

Carlsberg A/S reported a drop in volumes and warned consumers were continuing to pull back on spending.

Klarna Group Plc had to set aside more money for potentially souring loans in the second quarter, a move that put pressure on results ahead of its expected public debut.

Hon Hai Precision Industry Co. expects sales of servers to more than double this quarter while its consumer electronics business dwindles, underscoring how it's relying on the AI boom to offset volatile iPhone sales.

Some of the main moves in markets:

Stocks

The S&P 500 fell 0.1% as of 12 p.m. New York time

The Nasdaq 100 was little changed

The Dow Jones Industrial Average fell 0.3%

The Stoxx Europe 600 rose 0.5%

The MSCI World Index fell 0.2%

Bloomberg Magnificent 7 Total Return Index rose 0.4%

The Russell 2000 Index fell 1.7%

Currencies

The Bloomberg Dollar Spot Index rose 0.4%

The euro fell 0.5% to $1.1643

The British pound fell 0.3% to $1.3530

The Japanese yen fell 0.2% to 147.69 per dollar

Cryptocurrencies

Bitcoin fell 3.8% to $118,310.37

Ether fell 2.1% to $4,621.21

Bonds

The yield on 10-year Treasuries advanced six basis points to 4.29%

Germany's 10-year yield advanced three basis points to 2.71%

Britain's 10-year yield advanced five basis points to 4.64%

The yield on 2-year Treasuries advanced six basis points to 3.74%

The yield on 30-year Treasuries advanced five basis points to 4.88%

Commodities

West Texas Intermediate crude rose 1.8% to $63.79 a barrel

Spot gold fell 0.4% to $3,342.06 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.