(Bloomberg) -- Asian shares climbed after President Donald Trump delayed tariffs on Mexico and Canada for a month, and said he'd hold further talks with China.

Stocks in Australia and Japan gained, while contracts for Hong Kong stocks also looked up. US futures rose after the S&P 500 on Monday trimmed most of its slide that earlier approached 2%.

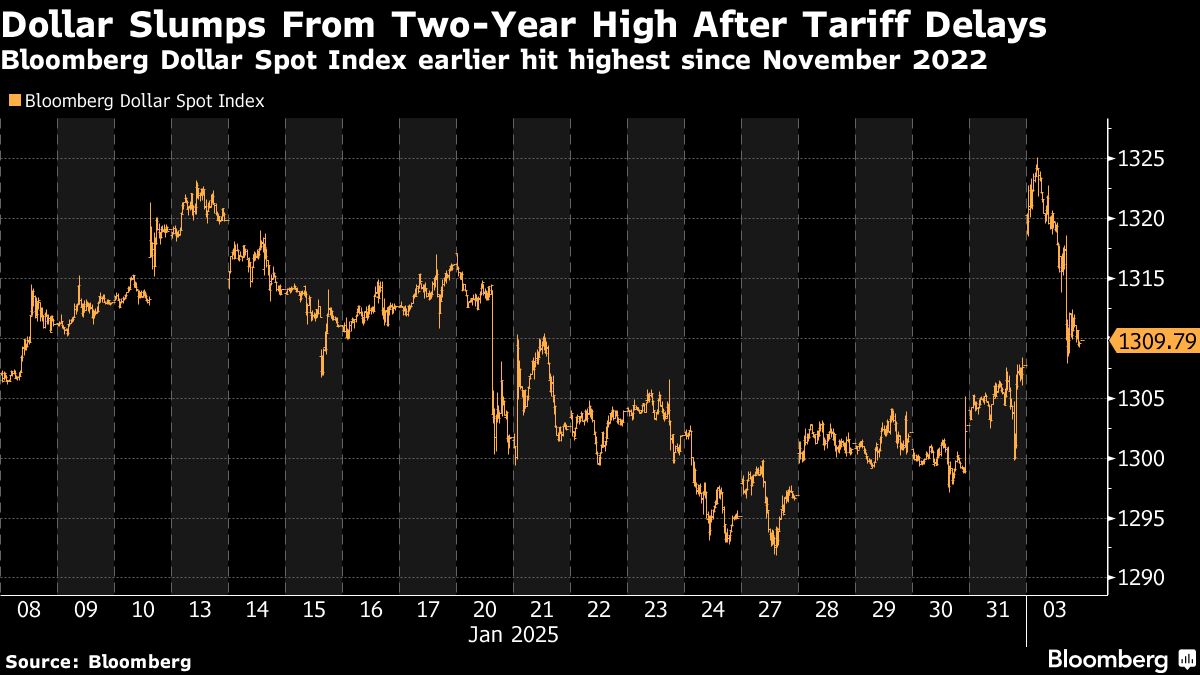

The reversal in sentiment came after Trump agreed to delay tariffs against Mexico following a conversation with his counterpart Claudia Sheinbaum. That spurred a quick turnaround in currencies with a gauge of the dollar falling from its strongest in more than two years and the yen paring its rally in a bid for safety. Canada's loonie gained after Justin Trudeau said US tariffs would also be paused for now. The US may speak with China over the next 24 hours.

“The overnight pushing back of tariffs on Mexico serves as a reminder of the cycle we have entered: tariff announcements are followed by calls and negotiations, declarations of victory, and then the cycle begins anew,” wrote Tony Sycamore a market analyst at IG Australia Pty Ltd. in a note. “Ultimately the path leads to higher tariffs, slower growth, higher inflation and less certainty for risk takers and equities.”

The delay with Mexico and Canada bolsters the view that Trump sees tariffs as a negotiating ploy — but is still reluctant to inflict economic pain on Americans. His move to invoke an emergency and impose tariffs on the two nations and China is the most extensive act of protectionism taken by a US president in almost a century.

Among the biggest uncertainties is how a resilient US economy would handle the impact of a trade war, in case it materializes. That concern was evident in the bond market, where short-dated Treasury yields climbed as longer ones moved in the opposite direction.

“While we believe that tariffs are primarily a negotiating tool for President Trump, it's very difficult to say whether these tariffs will be short-lived or if there is a scenario where a deal is struck that reduces the tariffs,” said Yung-Yu Ma at BMO Wealth Management.

The S&P 500 fell 0.8%. The Nasdaq 100 slid 0.8%. A gauge of the “Magnificent Seven” megacaps sank 1.7%. A gauge of US-listed Chinese shares pared earlier losses to fall 0.5%. The Bloomberg Dollar Spot Index rose 0.2% Monday after earlier gaining as much as 1.3% in its largest intraday advance since the US election. The yield on 10-year Treasuries was little changed at 4.56%.

West Texas Intermediate oil fell early in Tuesday's session after its biggest advance in more than two weeks, while gold was little changed after reaching an intraday record on Monday.

Key events this week:

US factory orders, US durable goods, Tuesday

Alphabet earnings, Tuesday

Fed's Raphael Bostic, Mary Daly, Philip Jefferson speak, Tuesday

China Caixin services PMI, Wednesday

Eurozone HCOB Services PMI, PPI, Wednesday

US trade, Wednesday

Fed's Austan Goolsbee, Tom Barkin, Michelle Bowman, Philip Jefferson speak, Wednesday

Eurozone retail sales, Thursday

UK rate decision, Thursday

US initial jobless claims, Thursday

Fed's Christopher Waller, Lorie Logan speak, Thursday

Amazon earnings, Thursday

US nonfarm payrolls, unemployment, University of Michigan consumer sentiment, Friday

Fed's Michelle Bowman, Adriana Kugler speak, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.6% as of 8:47 a.m. Tokyo time

Hang Seng futures rose 0.9%

Australia's S&P/ASX 200 rose 0.7%

Currencies

The Bloomberg Dollar Spot Index fell 0.3%

The euro fell 0.1% to $1.0329

The Japanese yen fell 0.3% to 155.23 per dollar

The offshore yuan was little changed at 7.3058 per dollar

Cryptocurrencies

Bitcoin fell 0.3% to $101,646.36

Ether rose 2.1% to $2,878.4

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.55%

Japan's 10-year yield was unchanged at 1.245%

Australia's 10-year yield advanced six basis points to 4.44%

Commodities

West Texas Intermediate crude fell 1% to $72.44 a barrel

Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.