European equities climbed, the dollar edged lower and oil prices eased after the White House dialed back speculation that the US was on the verge of joining Israel's strikes on Iran.

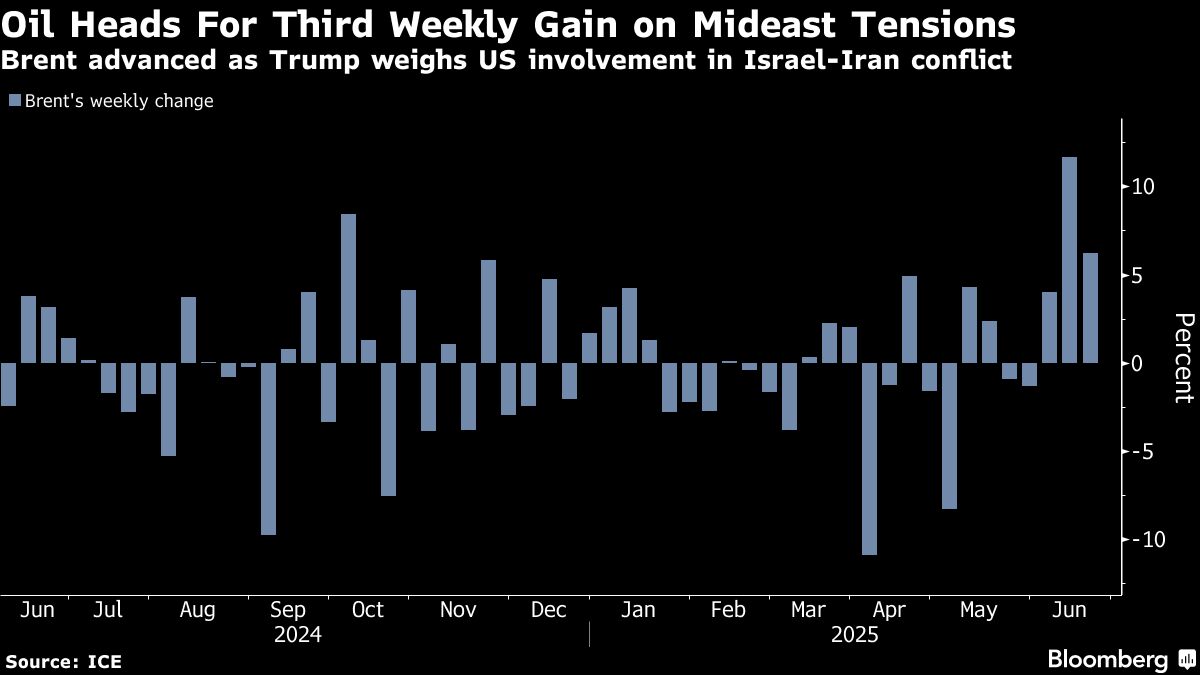

The Stoxx Europe 600 index snapped a three-day losing streak, though it remained on track for its first back-to-back weekly declines since the start of April. Futures on the S&P 500 dipped after dropping 0.9% on Thursday when US markets were closed for the Juneteenth holiday. Brent crude fell around 2% to temper gains from earlier in the week. Treasuries were steady, while a gauge of the dollar headed for a second day of declines.

Traders were on edge following a Bloomberg report earlier this week that senior US officials are preparing for a possible strike on Iran in the coming days. The White House, however, said President Donald Trump would decide within two weeks, and there was a “substantial chance” of a negotiated settlement. Israel, meanwhile, struck more of Iran's nuclear sites on Thursday and warned it could bring down Tehran's leadership as both sides awaited the US president's decision.

“One must of course be aware of the potential for significant gapping risk at the Sunday night open, depending on how geopolitical tensions evolve over the weekend,” said Michael Brown, senior research strategist at Pepperstone Group Ltd. “Some trimming of risk, and squaring of positions, seems likely as today goes on.”

Among individual movers in Europe, TUI AG gained the most in two months after Barclays Plc double-upgraded the stock, citing robust demand for packaged travel. Berkeley Group Holdings Plc slumped after the homebuilder announced management changes and cited persistent regulatory headwinds as it reported earnings.

Some extreme scenarios resulting from increased US involvement in the Israel-Iran war could push oil prices as high as $130 to $150 a barrel, particularly if Iran retaliates in a major way, said Jennifer McKeown, chief global economist at Capital Economics Ltd. Such a development would pause further policy easing by central banks, she said.

Markets were rattled earlier in the week after the Federal Reserve downgraded its estimates for growth this year and projected higher inflation.

“Even though central banks would like to think that would be a temporary impact, I think it would be a brave central bank that would cut interest rates,” McKeown said on Bloomberg TV.

Brent futures have been pricing in a geopolitical premium of about $8 a barrel since Israel and Iran began attacking each other last week, according to a survey of analysts and traders. US intervention in the conflict would bolster that further, but exactly how much would depend on the nature of the involvement, the nine respondents said.

“The recent air strikes pose risks to the new energy market landscape; however, further fallout for global energy prices seems, for now at least, limited,” said Kieran Calder, head of Asia equity research at Union Bancaire Privee in Singapore. “Markets tend not to price in geopolitical risks until there is a conflagration, and they are currently showing little sign of factoring in a worst-case outcome.”

In Japan, a key consumer inflation measure accelerated to a fresh two-year high as Prime Minister Shigeru Ishiba gears up for a summer election and the Bank of Japan mulls the country's price trajectory. Japan's Finance Ministry will seek feedback from market players later Friday over its planned reductions to super-long bond issuance as it takes steps to quell market turbulence.

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.5% as of 9:41 a.m. London time

S&P 500 futures fell 0.2%

Nasdaq 100 futures fell 0.2%

Futures on the Dow Jones Industrial Average fell 0.2%

The MSCI Asia Pacific Index rose 0.5%

The MSCI Emerging Markets Index rose 1%

Currencies

The Bloomberg Dollar Spot Index fell 0.1%

The euro rose 0.2% to $1.1518

The Japanese yen was little changed at 145.34 per dollar

The offshore yuan was little changed at 7.1842 per dollar

The British pound rose 0.1% to $1.3485

Cryptocurrencies

Bitcoin rose 2% to $106,397.09

Ether rose 2% to $2,557.84

Bonds

The yield on 10-year Treasuries was little changed at 4.40%

Germany's 10-year yield was little changed at 2.52%

Britain's 10-year yield was little changed at 4.53%

Commodities

Brent crude fell 1.9% to $77.33 a barrel

Spot gold fell 0.6% to $3,350.48 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.