US stocks are set to extend a retreat with traders nervous about rising bond yields as House lawmakers debated tax cuts at the center of the Trump administration's policy agenda. The dollar also fell.

S&P 500 futures slid 0.5% alongside a retreat in European shares. Oil climbed about 0.7% on a report that Israel could be gearing up for a possible strike on Iran's nuclear facilities. Yields on 30-year Treasuries rose further above the 5% mark. The greenback lost ground against all major currencies.

Republicans reached an agreement on state and local tax deductions for President Donald Trump's economic bill after negotiating through the night. While investors have rushed back into stocks on hopes that the US is easing off its tariff threats, there are questions about whether gains can be sustained as concerns about fiscal deficits and mounting debt drive bond yields higher.

“There's a lot of optimism that has been discounted in markets and it seems that many investors believe that the trade war is over,” said Frederique Carrier, head of investment strategy for RBC Wealth Management in the British Isles and Asia. “However, the underlying issues which have been at the root of tensions for decades have not been tackled.”

Equity trading volumes were light across the board. The UK and European Union extended the bidding window for debt auctions on Wednesday in response to Bloomberg LP technical issues.

Globally, the yield-curve for government debt steepened across most markets as worries mount around swelling debt and deficits. The rate for 10-year US Treasuries advanced four basis points to 4.53%, while the yield for gilts with a similar tenure rose six basis points to 4.76%.

“The direction of travel is obviously higher,” Lindsay Rosner, head of multi-sector fixed income investing at Goldman Sachs Asset Management, told Bloomberg TV. “At the core of it, fiscal is in question, and it's not just a US problem, it's a global problem.”

In oil markets, traders were responding to a report by CNN that said it wasn't clear that Israeli leaders have made a final decision on whether to carry out the strikes on Iran. Crude prices have been volatile since last week on mixed headlines about the fate of Iran-US nuclear talks, which could pave the way for more barrels to return to a market.

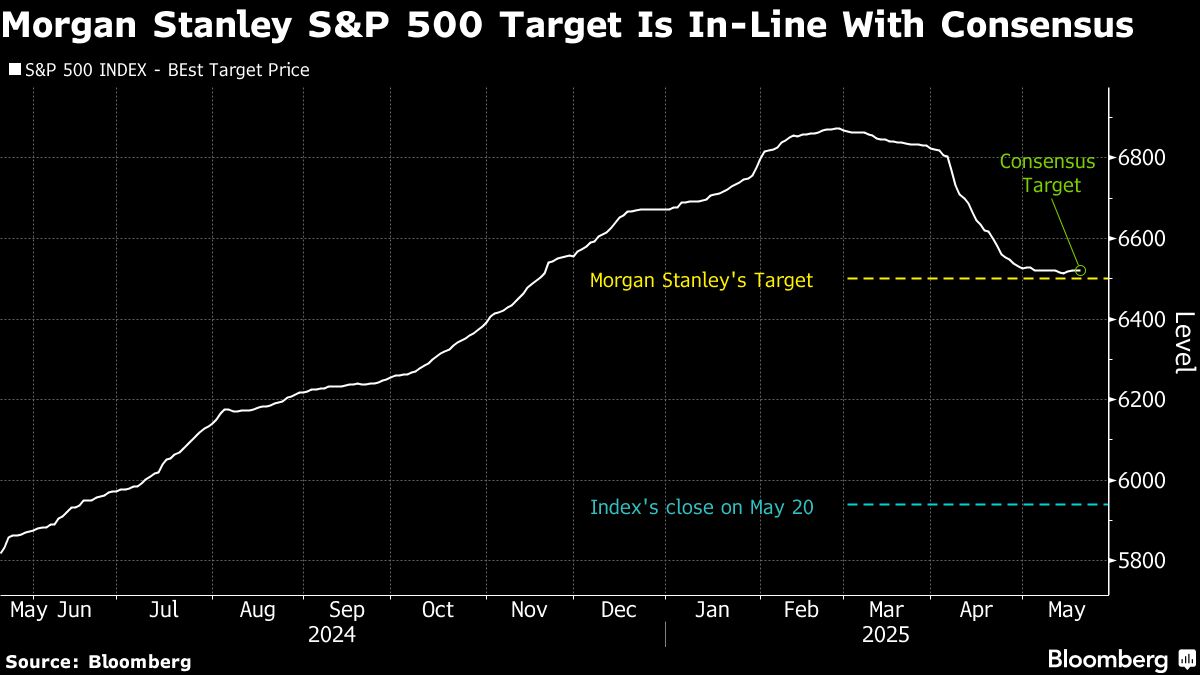

Meanwhile, Morgan Stanley raised its call on US stocks and Treasuries on expectations that interest-rate cuts will support bonds and boost company earnings. The S&P 500 Index will reach 6,500 by the second quarter of 2026, they wrote. They also see the dollar continuing to weaken as the US's economic growth premium relative to peers fades.

“The US dollar has of course lost its luster as the undisputed safe reserve asset,” said Richard Franulovich, head of FX strategy at Westpac Banking Corp.

Corporate Highlights

Target Corp. cut its sales forecast following a weaker-than-expected quarter — the latest sign the big-box retailer's plans to recapture growth are faltering.

Boeing Co. has told customers that it's approaching a key production target that would signal manufacturing of its all-important 737 jet is back on track.

Nvidia Corp. chief Jensen Huang blasted the “failure” of US restrictions intended to help contain China's technological ascent, calling on the White House to lower barriers to AI chip sales before American firms cede that market to up-and-coming rivals.

Baidu Inc.'s revenue beat estimates, after China's internet search leader fended off intensifying competition in AI and a persistent economic downturn.

Medical-device maker Medtronic plans to separate its diabetes business into a stand-alone company, Wall Street Journal has reported.

UnitedHealth Group Inc.'s shares tumble after the Guardian reported that the health insurer secretly paid nursing homes to reduce hospital transfers for ailing residents.

Key Events This Week:

Stocks

S&P 500 futures fell 0.5% as of 7:49 a.m. New York time

Nasdaq 100 futures fell 0.5%

Futures on the Dow Jones Industrial Average fell 0.8%

The Stoxx Europe 600 fell 0.4%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index fell 0.3%

The euro rose 0.4% to $1.1327

The British pound was little changed at $1.3398

The Japanese yen rose 0.5% to 143.84 per dollar

Cryptocurrencies

Bitcoin fell 0.4% to $106,505.95

Ether rose 1.1% to $2,540.96

Bonds

The yield on 10-year Treasuries advanced four basis points to 4.53%

Germany's 10-year yield advanced four basis points to 2.65%

Britain's 10-year yield advanced six basis points to 4.76%

Commodities

West Texas Intermediate crude rose 0.7% to $62.48 a barrel

Spot gold rose 0.6% to $3,308.46 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.