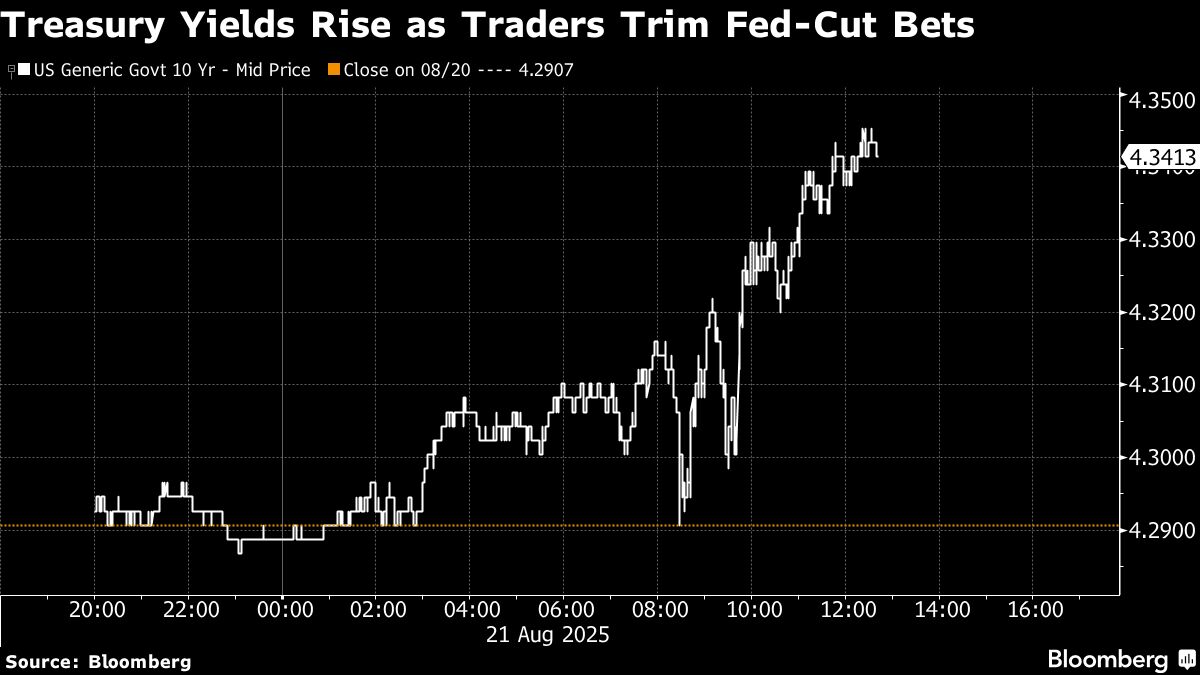

Caution prevailed on Wall Street ahead of Jerome Powell's speech, with stocks falling and bond yields rising as a key factory report raised concern that inflation pressures could dim the outlook for rate cuts.

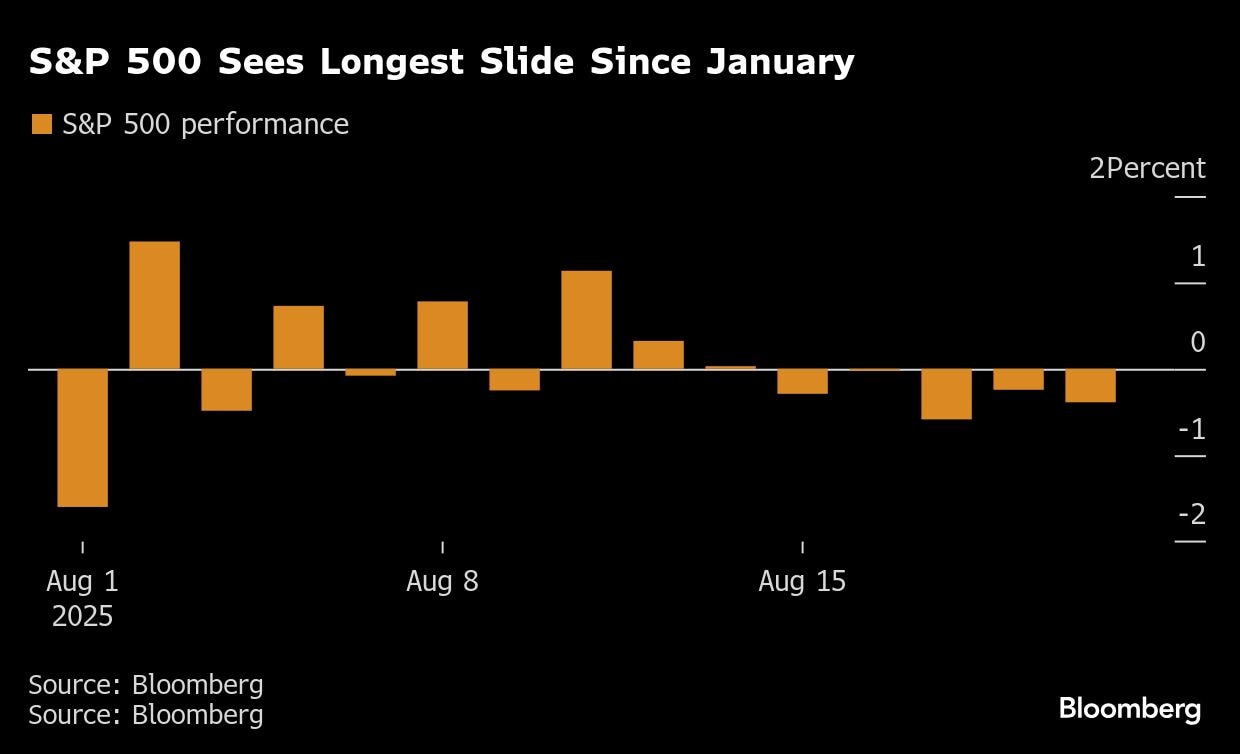

The fastest growth in manufacturing since 2022 drove Treasuries lower, with 10-year yields up five basis points to 4.34%. Federal Reserve Bank of Cleveland chief Beth Hammack said she wouldn't support easing if officials had to decide tomorrow. The S&P 500 slipped for a fifth straight day, its longest slide since January. Most big techs dropped. Walmart Inc. sank on a profit miss.

Jerome Powell.

While data showed an increase in jobless claims — adding to signs of a slowing labor market — the solid factory purchasing managers index saw traders reducing their bets on rate cuts. Money markets showed about a 65% chance of a reduction in September. A week ago the odds were above 90%.

The Fed is getting ready to kick off its economic symposium in Jackson Hole. Central bankers and economists from around the world are on their way to the gathering, which will focus on structural changes in the labor market. Chair Powell will speak Friday.

“The great PMI numbers have made it more difficult for Powell to pivot to employment weakness for tomorrow, said Andrew Brenner at NatAlliance Securities. “No fun in the equity space either.”

Meantime, the Justice Department signaled possible plans to investigate Fed Governor Lisa Cook, with a top official encouraging Powell to remove her from the board. President Donald Trump's housing-finance chief, Bill Pulte, has called for a probe over mortgage agreements she allegedly made in 2021.

“Investors are looking for assurance that a rate cut is likely at the September meeting, in order to help prevent any further weakening of the labor market,” said Rick Gardner at RGA Investments.

Other Fed officials speaking Wednesday and Thursday struck a similarly hawkish tone as Hammack.

Atlanta Fed President Raphael Bostic said he still sees just one rate cut this year as appropriate. Jeffrey Schmid, president of the Kansas City Fed, said inflation risk still outweighs risks to the labor market.

Those comments echoed minutes of the central bank's latest policy meeting in July, published on Wednesday, which showed most officials held the same view.

Corporate Highlights:

Walmart Inc. shares fell after profit missed expectations for the first time in three years, overshadowing higher sales.

The world's largest retailer cited a rise in insurance claims, legal charges and restructuring costs as factors weighing down its profit.

Despite the rare profit miss, Walmart raised its full-year sales guidance, an optimistic signal that consumers' purchasing power is holding up despite rising concerns over inflation and weakening economic data.

Boeing Co. is heading closer toward finalizing a deal with China to sell as many as 500 aircraft, according to people familiar with the matter, a transaction that would end a sales drought that stretches back to US President Donald Trump's last visit in 2017.

Coty Inc. forecast steep sales declines will continue as retailers clear out existing inventory and consumer demand remains tepid in the face of an uncertain economic outlook.

Gilead Sciences Inc. slipped after CVS Health Corp said it hasn't yet added its new HIV prevention shot to its commercial drug plans.

Thoma Bravo has agreed to buy human resources software provider Dayforce Inc. in what is set to become one of the investment firm's largest-ever deals.

The S&P 500 fell 0.5% as of 1:01 p.m. New York time

The Nasdaq 100 fell 0.7%

The Dow Jones Industrial Average fell 0.5%

The MSCI World Index fell 0.5%

Bloomberg Magnificent 7 Total Return Index fell 0.7%

The Russell 2000 Index fell 0.1%

The Bloomberg Dollar Spot Index rose 0.3%

The euro fell 0.3% to $1.1612

The British pound fell 0.3% to $1.3419

The Japanese yen fell 0.7% to 148.29 per dollar

Bitcoin fell 1.7% to $112,407.15

Ether fell 3.2% to $4,219.01

The yield on 10-year Treasuries advanced five basis points to 4.34%

Germany's 10-year yield advanced four basis points to 2.76%

Britain's 10-year yield advanced six basis points to 4.73%

West Texas Intermediate crude rose 1.2% to $63.46 a barrel

Spot gold fell 0.3% to $3,339.81 an ounce

What Bloomberg Strategists say...

“The mix of more jobless claims and flat hiring points to a softening jobs backdrop, which will require a big tradeoff from the Fed in light of rising inflationary pressures.”

—Tatiana Darie, Macro Strategist, Markets Live

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Bonds

Commodities

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.