Weak economic data and concerns about an escalation of risks in the Middle East drove stocks down as bonds rose, with traders gearing up for Wednesday's Federal Reserve decision. Oil climbed.

Risk-off sentiment prevailed, with the S&P 500 trimming this month's gains. Treasuries halted two days of declines as tepid reports on retail sales and industrial output bolstered the case for interest-rate cuts this year if the rally in crude proves temporary - and not a major threat to the disinflationary path. The dollar was little changed. Gold edged up.

Stocks fall as Mideast risks build.

As the conflict between Israel and Iran extended into a fifth consecutive day, President Donald Trump played down the odds of a ceasefire in favor of a “real end” to the conflict. Earlier Monday, he warned Tehran residents to evacuate the city, while also telling Iran to abandon its nuclear ambitions and seek a deal with the US.

“For now, markets will remain mostly on edge until they lower the temperature in the region,” said Kenny Polcari at SlateStone Wealth.

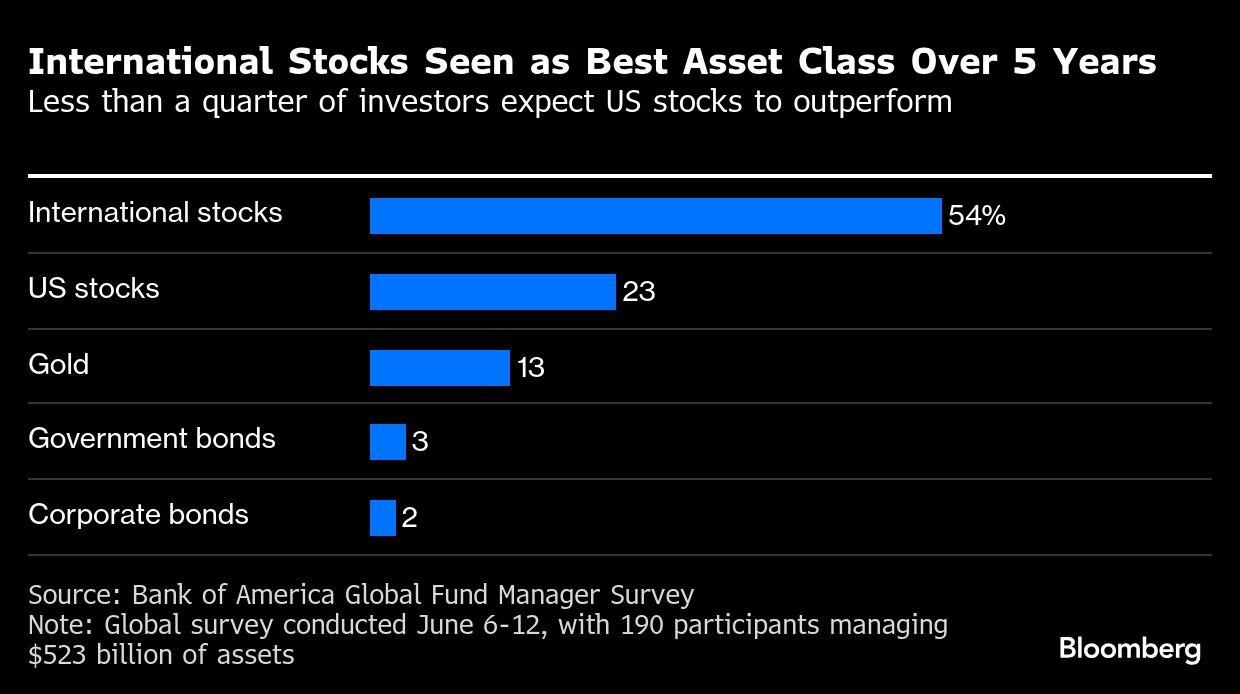

Global stocks will beat US equities over the next five years, according to Bank of America Corp.'s latest fund manager survey, adding evidence that investors increasingly see America's market dominance as coming to an end.

Some 54% of asset managers expect international stocks to be the top asset class, while 23% picked US stocks, according to the survey. Only 13% said gold will deliver top returns, and 5% are betting on bonds. It's the first time that Bank of America's survey asked investors to predict which asset class will perform best over a five-year horizon.

Corporate Highlights:

Senate Republicans released a bill that would end tax credits for wind and solar earlier than for other sources, and make only modest changes to most other incentives, dashing hopes of those seeking relief from major cuts passed by the House.

Eli Lilly & Co. agreed to buy gene-editing biotech company Verve Therapeutics Inc. for $1.3 billion, the obesity drugmaker's latest investment in an experimental medicine that could fuel long-term growth.

Kraft Heinz Co. said it will remove synthetic food dyes from all of its US products by the end of 2027, eliminating ingredients such as Red 40 and Yellow 5 from Jell-O, Kool-Aid and some Lunchables products.

SoftBank Group Corp. raised around $4.8 billion through a sale of T-Mobile US Inc. shares, a move that helps fund the Japanese company's grandiose plans for artificial intelligence.

Airbus SE maintained its momentum on the second day of the Paris Air Show, locking in an order from Vietjet for 100 A321 narrowbody jets.

Some of the main moves in markets:

Stocks

The S&P 500 fell 0.4% as of 9:30 a.m. New York time

The Nasdaq 100 rose 1.4%

The Dow Jones Industrial Average fell 0.4%

The Stoxx Europe 600 fell 0.8%

The MSCI World Index fell 0.2%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was unchanged at $1.1561

The British pound fell 0.1% to $1.3558

The Japanese yen was little changed at 144.79 per dollar

Cryptocurrencies

Bitcoin fell 2.9% to $105,637.25

Ether fell 4.3% to $2,557.4

Bonds

The yield on 10-year Treasuries declined three basis points to 4.42%

Germany's 10-year yield was little changed at 2.52%

Britain's 10-year yield was little changed at 4.53%

Commodities

West Texas Intermediate crude rose 1.7% to $73.01 a barrel

Spot gold rose 0.2% to $3,393.47 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.