A selloff in technology stocks came to a halt on Monday, setting a steadier tone at the start of a month that could bring plenty of tests to markets trading near record highs.

Europe's Stoxx 600 edged 0.1% higher. BAE Systems Plc and Rheinmetall AG led advances in defense shares after the Financial Times reported that Europe is working on detailed plans for potential post-conflict deployments in Ukraine. A regional gauge for tech stocks eked out a small gain.

S&P 500 and Nasdaq 100 futures were little changed after Friday's tech rout, with cash trading in US stocks and Treasuries closed for the Labor Day holiday. Asian equities were mixed, with a 19% surge in Alibaba Group Holding Ltd. contrasting with a slump in chipmaking shares. The dollar traded flat.

In commodity markets, silver rose above $40 an ounce for the first time since 2011. Gold inched closer to an all-time high as optimism grew for an interest rate cut by the Federal Reserve this month.

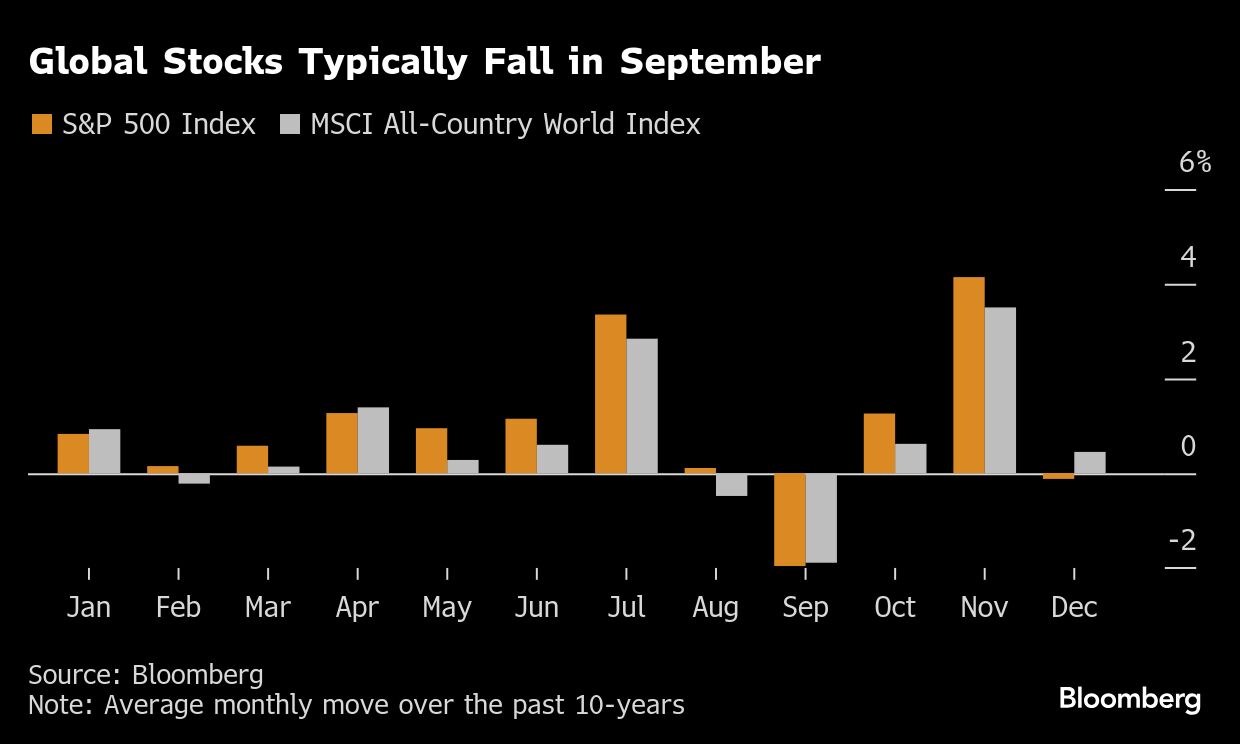

Wall Street's rally to all-time highs faces a crucial stretch, with jobs numbers, inflation data and the Fed's rate call all landing within the next three weeks. The flurry of events will help determine whether stocks can extend gains or lose momentum as traders navigate what is historically the weakest month of the year for US markets.

Tariff tensions and questions over the Fed's independence are compounding the risks.

“The bar to derail a Fed Rate cut on Sept. 17 appears high,” Deutsche Bank AG economist Peter Sidorov wrote. “But with Fed funds futures now pricing over 140 basis points of easing by the end of 2026, markets are expecting an amount of easing that since the 1980s has only occurred around recessions.”

European bonds weakened broadly, with a week to go before a confidence vote that could topple France's government. The French-German 10-year spread, a key measure of risk, was little changed at 78 basis points. The gauge closed at 82 on Aug. 27, the highest since January.

“I wouldn't be surprised to see the spread between Germany and France test 100 basis points,” said Alexandre Baradez, chief market analyst at IG in Paris. “This could encourage further profit selling in European banking stocks, moreover since the European Central Bank seems to be on pause when it comes to rate cuts.”

What Bloomberg Strategists Say...

“A holistic indicator of market-based risks in France is wider than it's been since June last year when President Macron called a snap election. That's in contrast to the go-to measure for risk in France, government bond yield spreads with Germany, which are only as wide as they were in November when Michel Barnier's resigned as Prime Minister. Spreads only capture one aspect of market-based risk, however.”—Simon White, Macro Strategist. Click here to read the full analysis

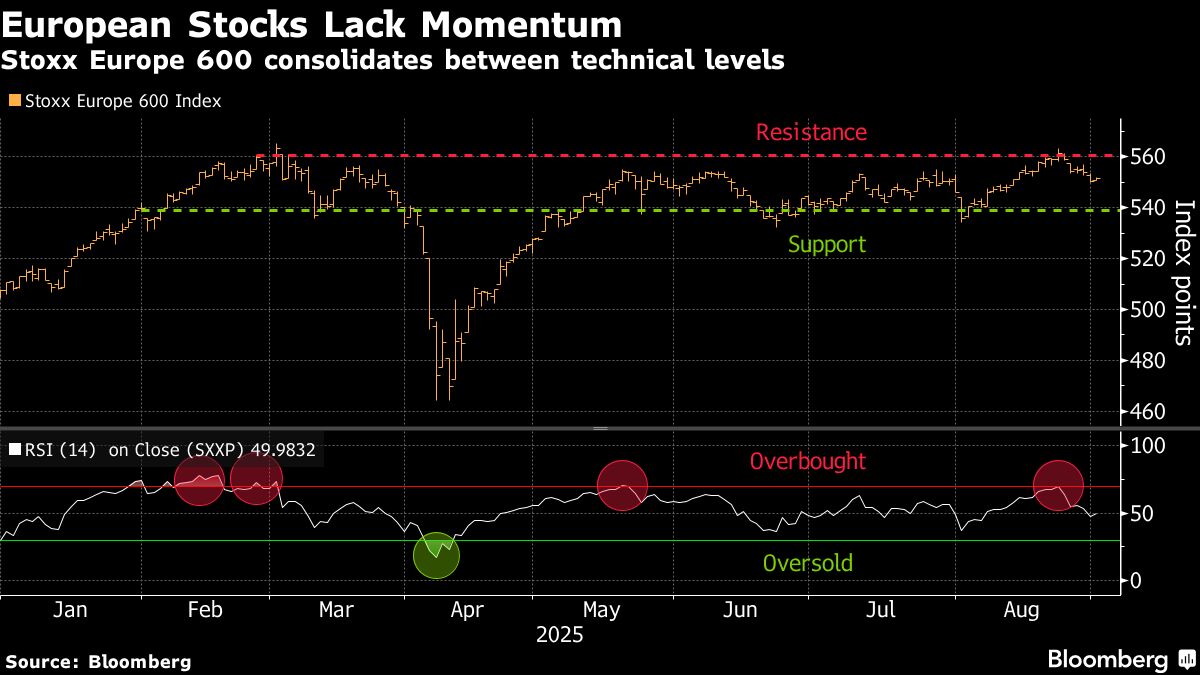

A stronger economic outlook is set to help European equities escape their narrow trading range, according to top Wall Street strategists.

Goldman Sachs Group Inc. expects the Stoxx 600 to climb about 2% to 560 by year-end, supported by improving growth prospects, light positioning, and relatively attractive valuations. JPMorgan Chase & Co. strategist Mislav Matejka sees the recent loss of momentum as a “healthy” development.

Elsewhere, Indonesian stocks tumbled the most in nearly five months as political risks flared, with President Prabowo Subianto canceling a China trip after deadly unrest over living costs and inequality. Stress also was evident in the bond market, with yields on the nation's 10-year government note rising to the highest in almost three weeks.

Corporate News:

New World Development Co.'s controlling shareholder, the billionaire Cheng family, is considering injecting capital into the debt-laden builder as early as the end of the year, Bloomberg News has reported.

Equinor ASA said it intends to subscribe for new shares in wind developer Orsted A/S, the first major investor after the Danish government to back the sale.

OpenAI is seeking to build a massive new data center in India that could mark a major step forward in Asia for its Stargate-branded artificial intelligence infrastructure push.

CapVest Partners is nearing a deal to acquire Stada Arzneimittel AG for around €10 billion ($11.7 billion) including debt, potentially ending the long-running saga to sell the German drugmaker, according to people familiar with the matter.

Alibaba Group Holding Ltd.'s stock leapt more than 18% after reporting a surge in revenue from AI, underscoring the steady progress it's making against rivals in a post-DeepSeek Chinese development frenzy.

BYD Co. shares fell after reporting a staggering 30% plunge in quarterly profit last Friday, its first decline in over three years, it's become clear that not even dominant players are safe in the cutthroat battle for market share.

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.1% as of 1:32 p.m. London time

S&P 500 futures were little changed

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index rose 0.1%

The MSCI Emerging Markets Index rose 0.7%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro rose 0.2% to $1.1712

The Japanese yen was little changed at 147.18 per dollar

The offshore yuan fell 0.2% to 7.1332 per dollar

The British pound rose 0.2% to $1.3527

Cryptocurrencies

Bitcoin fell 0.2% to $108,920.98

Ether fell 1.2% to $4,402.55

Bonds

The yield on 10-year Treasuries was little changed at 4.23%

Germany's 10-year yield advanced three basis points to 2.75%

Britain's 10-year yield advanced two basis points to 4.74%

Commodities

Brent crude rose 1.2% to $68.29 a barrel

Spot gold rose 0.6% to $3,469.65 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.