- Japanese stocks rose as PM Shigeru Ishiba announced his resignation, weakening the yen

- Europe's Stoxx 600 gained 0.2%, led by energy stocks amid rising crude oil prices

- US futures advanced modestly after Fed concerns eased; dollar fell 0.1%

Wall Street piled into bets the Federal Reserve will cut rates next week, with stocks rising on speculation that policy easing at a time when the economy is not in a recession will keep powering Corporate America.

Following a drop in the aftermath of weak jobs figures, the S&P 500 bounced amid gains in most big techs. While upcoming data is projected to show progress on reducing inflation has stalled, traders braced for almost three Fed cuts this year starting in September. Treasuries saw mild gains, with the two-year yield remaining at the lowest since 2022. The dollar edged down.

Stocks bounce on Fed Bets.

“After last week's tepid jobs numbers, it will likely take a major upside surprise from this week's inflation data to derail a Fed rate cut next week,” said Chris Larkin at E*Trade from Morgan Stanley. “With rate cuts increasingly baked into forecasts, the market may be less inclined in the near term to shrug off additional signs of a slowing economy.”

Fed officials say concerns are shifting from the inflation risks posed by tariffs to weakness in the job market. Steady inflation expectations are an indication that tariffs could prove a one-time price shock. That's even if they take several months to work their way through the economy.

Ahead of next week's Fed meeting, Thursday's core consumer price index is projected to show a 0.3% increase in August for a second month. Before that, figures from the Bureau of Labor Statistics on Tuesday will likely unveil another US jobs markdown that will set the stage for a rate cut.

“While the Sept. 5 report showed job growth had slowed, it doesn't appear to be signaling a recession,” according to Invesco Global Market Strategy Office. “Slower growth, anchored inflation expectations, falling yields, and anticipated rate cuts point to an optimistic outlook for stocks.”

“Near-term payroll data may look soft, but with the Fed set to begin cutting rates — and markets historically performing best in rate-cutting cycles, typically with a 20% run rate — the broader backdrop tilts positive,” said Mark Hackett at Nationwide. “All in all, as long as consumers feel secure in their jobs and their wealth, the bull case will remain stronger than the bear.”

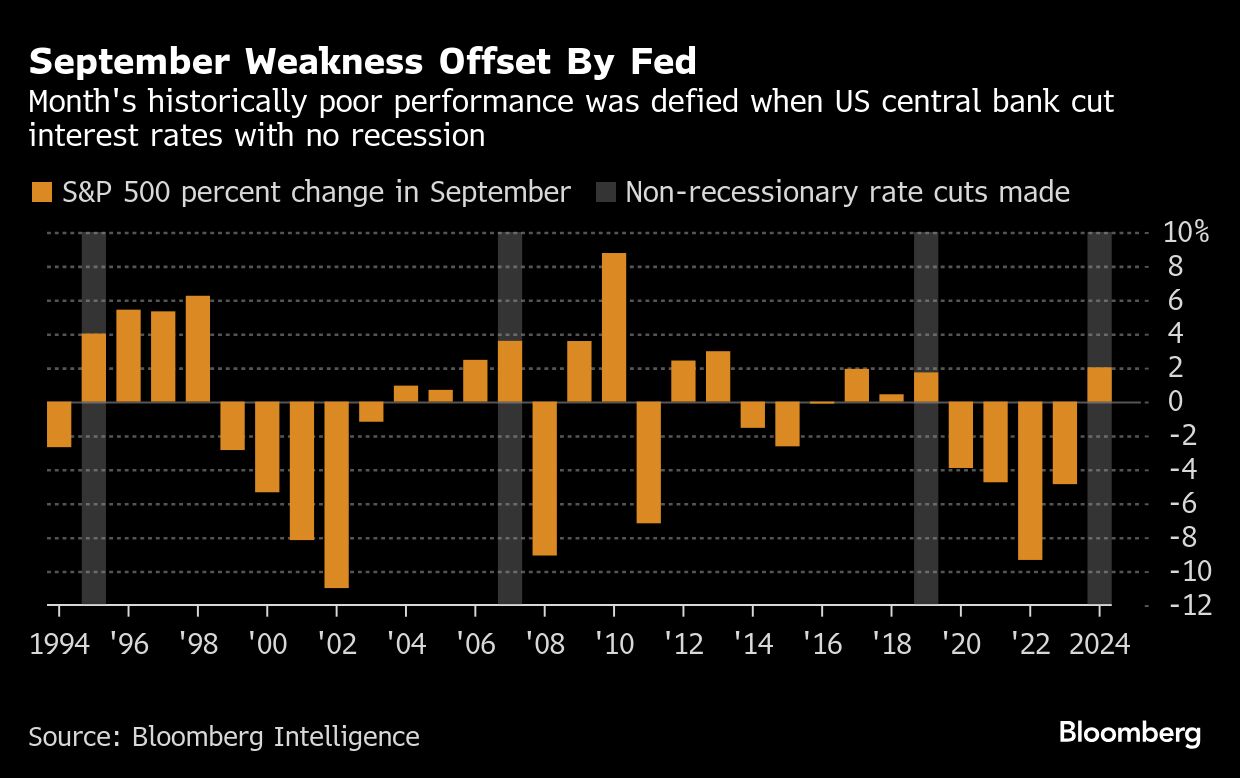

This month could defy the usual seasonal weakness in equities. While the S&P 500 has fallen 1% on average during Septembers going back to 1971, it has gained 1.2% in the month when the US central bank was reducing borrowing costs and the economy was not contracting, according to Bloomberg Intelligence.

Historically, in the two years following the start of a non-recessionary rate-cutting cycle, the median S&P 500 has climbed as much as 50%, according to Jim Reid at Deutsche Bank AG. By contrast, returns are far more muted when cuts coincide with recessions.

“That helps explain why equities are generally welcoming the prospect of Fed easing after a nine-month pause,” he said. “Recession probabilities are still relatively low, but the latest labor market data injects a dose of caution given payroll growth has slowed to a crawl.”

The hope, Reid notes, is that these rate cuts will help pre-empt any downturn, keeping us on the soft-landing path.

Morgan Stanley's Michael Wilson expects further gains in US equities even if moves turn more choppy in the near term. He reiterated that the US economy is transitioning to a so-called “early cycle” stage, which would support a “durable and broad” earnings recovery.

At Goldman Sachs Group Inc., strategists led by David Kostin said the rally in US stocks is set to extend as laggards including small caps play catch-up amid a resilient economic outlook.

A weaker-than-expected jobs report last week stirred worries among investors that the central bank has waited too long to reduce borrowing costs. RBC Capital Markets strategist Lori Calvasina said the soft data was raising uncertainty in a stock market that's “priced for perfection.”

“This current bull market feels unstoppable with new support forming as former tent poles weaken,” according to Morgan Chase & Co.'s trading desk led by Andrew Tyler. If the Fed follows through on a widely expected interest-rate cut at its Sept. 17 meeting, that “could turn into a ‘Sell the News' event as investors pullback.”

“Aggressive rate cuts are coming,” said Dennis DeBusschere at 22V Research. “That might change if labor-market data firms over the coming quarters. A series of rate cuts to end 2025 and persistently easy financial conditions should be expected. The bar to change to rate cut expectations through year-end 2025 seems high. “

Assuming economic activity holds up, easy financial conditions are a support for markets, he said, adding that his S&P 500 fair value framework points to 7,000. The index is currently hovering near 6,500.

To Mark Haefele at UBS Global Wealth Management, there's little to prevent the Fed from cutting rates at this month's meeting. And that would likely kick-start a run of 100 basis points in reductions over the next four meetings, from September to January, he said.

“Against this backdrop, we continue to recommend high-quality fixed income, where investors can lock in yields above those available on cash and benefit from potential capital gains if policy becomes more accommodative,” he said.

Secondary indicators of inflation have shown some upward pressure, so the market is clearly more concerned with these indicators coming in hot. How hot is the question? according to Bespoke Investment Group strategists.

“While a September cut next week is likely a done deal, the pace of cuts moving forward from there will hinge in large part on how ‘bad' the inflation data is,” they said. “Come Thursday morning, the market will either be only thinking about stagflation or three cuts between now and year-end.”

The US yield curve has further to steepen should the Fed unleash aggressive rate cuts, DoubleLine Capital's Bill Campbell said. The firm's global sovereign debt portfolio manager expects easier monetary policy to encourage risk-taking in credit markets, at least in the short term, while doing little to shore up rising long-term yields.

“It potentially extends this runway for risk assets, credit assets to continue to trade at very rich valuations,” Campbell said. “The clearest expression of these issues are likely a lower dollar and a steepening curve.”

Corporate News:

SpaceX, the Elon Musk-backed company that owns the Starlink satellite internet network, agreed to acquire wireless spectrum from EchoStar Corp. for about $17 billion, allowing Charlie Ergen's beleaguered telecommunications company to resolve an overhanging regulatory probe and pay down debt.

Nasdaq Inc. is asking regulators to let investors trade tokenized versions of stocks on its exchange, a move that could mark the first big test of blockchain technology inside the core of America's equity markets.

PNC Financial Services Group Inc. will fulfill its goals for expanding across Colorado with the planned takeover of FirstBank Holding Co., and the regional-banking giant will focus its branch-opening effort on other states instead, PNC Chief Executive Officer Bill Demchak said.

Robinhood Markets Inc. has been added to the S&P 500, marking a new phase for the retail trading platform that helped define the pandemic-era boom in individual investing. The company will join the benchmark in the latest quarterly rebalance, S&P Dow Jones Indices said Friday.

AppLovin Corp. and Emcor Group Inc. will also be added to the index. The three companies will replace MarketAxess Holdings Inc., Caesars Entertainment Inc. and Enphase Energy Inc. prior to the start of trading on Sept. 22.

CVS Health Corp. shares dipped after executives didn't provide details about its upcoming quality ratings from the US government and didn't comment on guidance during a private investor meeting.

Alphabet Inc.'s Google was sued by advertising exchange PubMatic Inc., which is seeking billions of dollars over its claim that the search giant has illegally monopolized the ad technology market.

Investors expecting Apple Inc.'s biggest product event of the year to serve as the next catalyst for its recently-revived stock might come away disappointed.

Barring a surprise at Tuesday's unveiling, Apple shares are seen to have little room for further gains after adding more than $450 billion in market value since the end of July

BYD Co. is reinforcing its European expansion with new models and showrooms amid a bruising price war at home in China.

The S&P 500 rose 0.2% as of 12:16 p.m. New York time

The Nasdaq 100 rose 0.6%

The Dow Jones Industrial Average was little changed

The MSCI World Index rose 0.3%

Bloomberg Magnificent 7 Total Return Index rose 0.6%

The Russell 2000 Index was little changed

The Bloomberg Dollar Spot Index fell 0.2%

The euro rose 0.3% to $1.1748

The British pound rose 0.3% to $1.3544

The Japanese yen fell 0.1% to 147.62 per dollar

Bitcoin rose 0.9% to $112,386.17

Ether rose 1.2% to $4,353.05

The yield on 10-year Treasuries declined two basis points to 4.05%

Germany's 10-year yield declined two basis points to 2.64%

Britain's 10-year yield declined four basis points to 4.61%

The yield on 2-year Treasuries declined two basis points to 3.49%

The yield on 30-year Treasuries declined five basis points to 4.71%

West Texas Intermediate crude rose 0.8% to $62.34 a barrel

Spot gold rose 1.5% to $3,639.52 an ounce

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Bonds

Commodities

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.