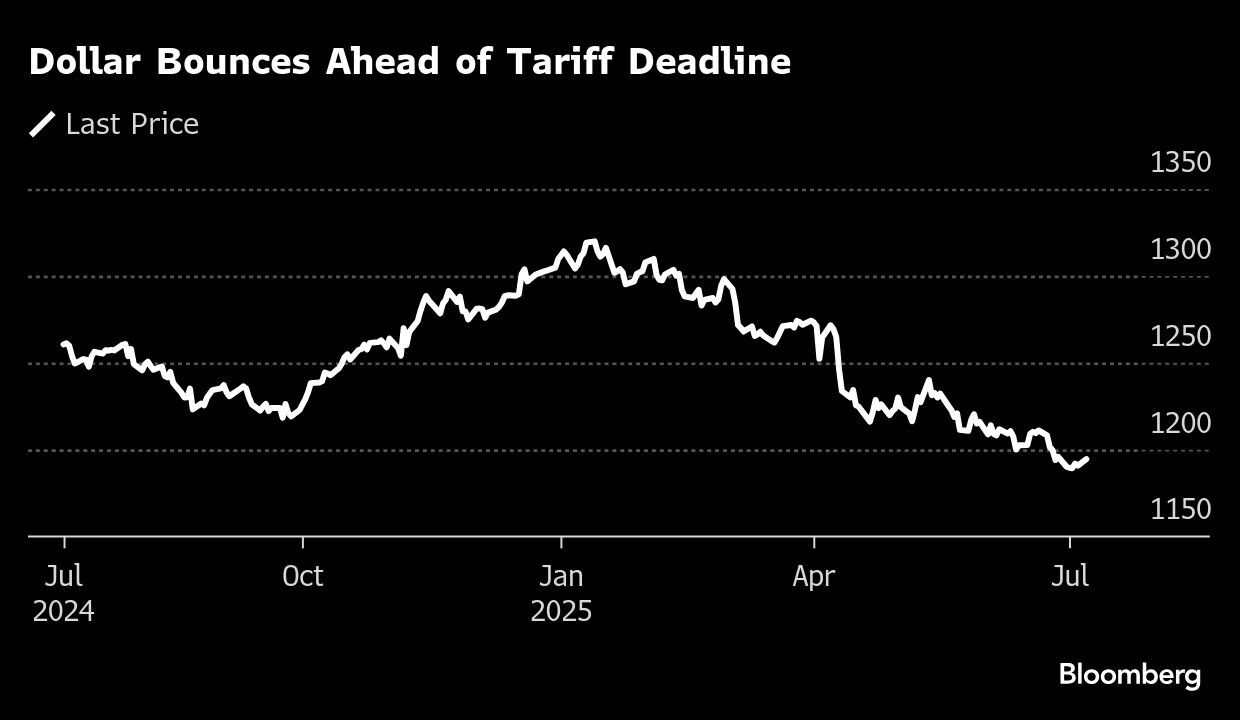

US stocks fell and the dollar rose as President Donald Trump said the US will impose a 25% tariff on imports from Japan and South Korea, sinking currencies of both nations. Longer-dated Treasuries underperformed on Monday.

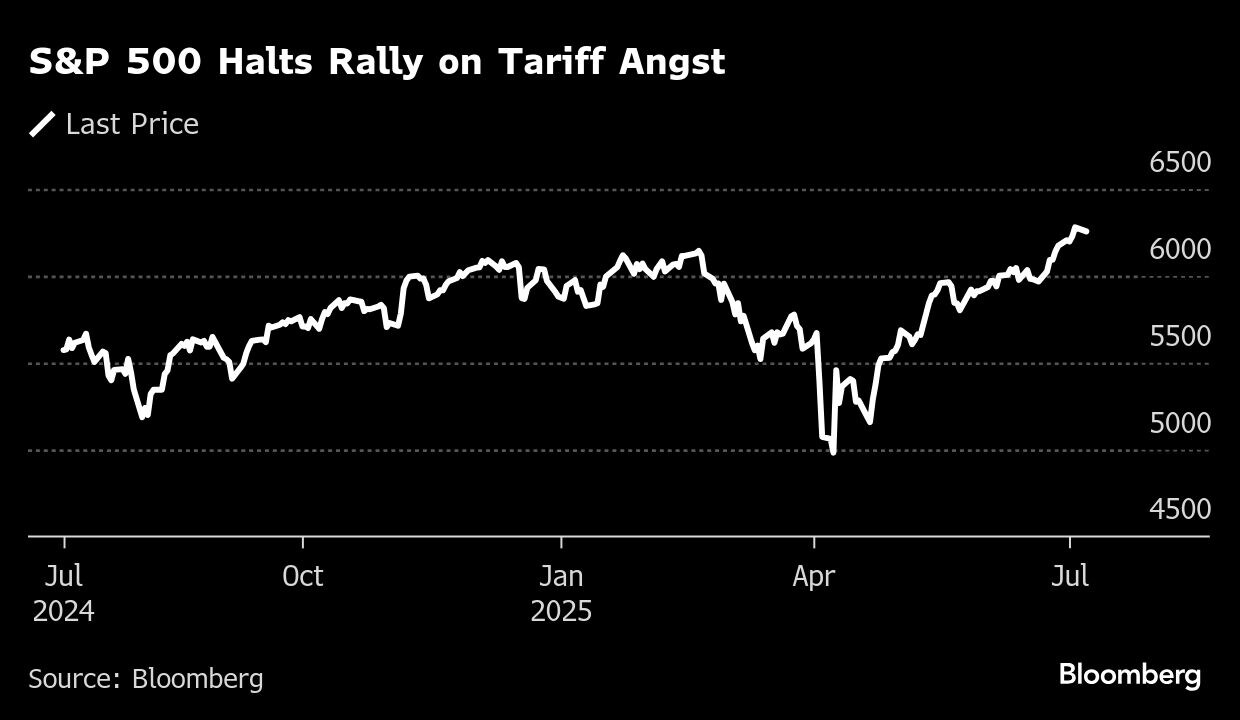

Following a rally to all-time highs, the S&P 500 lost about 1%, with megacaps leading losses. Tesla Inc. tumbled 7% as Elon Musk announced he's formed a new political party, digging deeper into a pursuit that's been a drag on his most valuable business

Stocks fall as tariffs in focus.

Aside from trade angst, US 30-year yields topped 4.9% on lingering concerns about the nation's deficit. Emerging-market currencies slid as Trump warned he'd add extra tariffs on any country that aligns with “the Anti-American policies of BRICS.”

Trump plans to announce trade deals and deliver tariff warnings on Monday, as countries negotiated to avoid punitive measures before a Wednesday deadline. US officials signaled that trading partners will have until Aug. 1 before the levies kick in.

Heading into the final days before the July 9 end of Trump's 90-day reprieve of reciprocal tariffs, Treasury Secretary Scott Bessent said 18 top partners are the priority, telling CNBC he expected “several” announcements in the next 48 hours.

“Investors should be alert to headline risk over the next 48 hours,” said Fawad Razaqzada at City Index and Forex.com. “The scope for last-minute deals is high, but so too is the possibility of renewed trade tensions.”

To Ian Lyngen and Vail Hartman at BMO Capital Markets, the actions of the administration during the last few months have left the impression this is just “another tactic” in the negotiation process.

The European Union said it's closing in on a framework trade agreement with the US after the head of the bloc's executive arm, Ursula von der Leyen, held a call with Trump Sunday. Officials from Japan were in talks with Washington through the weekend. Bessent told CNBC said he expected to meet with his Chinese counterpart in the coming weeks.

“Short-term ‘deals' are limited in scope and leave several questions unanswered,” said Seth Carpenter at Morgan Stanley. “Comprehensive trade deals that reduce trade uncertainty will take much longer to finalize, and will require clarity on ongoing investigations and legal challenges.”

So far, the US economy is holding up, hiring is healthy, and inflation has remained tame. But the Federal Reserve is wary about tariffs despite pressure from Trump to lower rates, and wants to see how they feed through to output in the next few months.

Investors on Wednesday will parse minutes of the Fed's June policy meeting.

Elsewhere, copper and other industrial metals slid after Trump injected fresh uncertainty into his trade agenda with a pledge to impose a 10% tariff on countries aligned with the BRICS bloc of nations.

Oil crept higher even after OPEC+ decided on a bigger-than-expected production increase next month, with the group's leadership showing confidence the market can absorb the extra barrels.

Corporate Highlights:

CoreWeave Inc. said it has agreed to buy Core Scientific Inc. in an all-stock deal worth about $9 billion that will allow it to expand its AI data center capacity.

Apple Inc. appealed a €500 million ($580 million) fine from the European Union, calling the penalty “unprecedented” and the regulator's required changes to its App Store as “unlawful.”

Netflix Inc. was downgraded to neutral from buy at Seaport Global Securities, which cites valuation in the wake of strong gains at the streaming-video company.

Applied Materials Inc. was downgraded at Rothschild & Co. Redburn to neutral from buy.

CrowdStrike Holdings Inc. was downgraded at Piper Sandler to neutral from overweight after it surpassed the investment bank's price target.

Goldman Sachs Group Inc. initiated coverage of MGM Resorts International with a sell recommendation due to the volatile Las Vegas market.

Wells Fargo & Co. was downgraded to market perform from strong buy at Raymond James, which said the stock's “favorable fundamentals” are already reflected in its valuation.

Some of the main moves in markets:

Stocks

The S&P 500 fell 0.9% as of 12:26 p.m. New York time

The Nasdaq 100 fell 0.8%

The Dow Jones Industrial Average fell 1%

The MSCI World Index fell 0.8%

Bloomberg Magnificent 7 Total Return Index fell 1.5%

The Russell 2000 Index fell 1.5%

Tesla fell 7.3%

Currencies

The Bloomberg Dollar Spot Index rose 0.5%

The euro fell 0.5% to $1.1723

The British pound fell 0.2% to $1.3618

The Japanese yen fell 0.9% to 145.84 per dollar

Cryptocurrencies

Bitcoin fell 0.5% to $108,165.84

Ether fell 0.5% to $2,533.75

Bonds

The yield on 10-year Treasuries advanced three basis points to 4.38%

Germany's 10-year yield advanced four basis points to 2.64%

Britain's 10-year yield advanced three basis points to 4.59%

The yield on 30-year Treasuries advanced five basis points to 4.91%

Commodities

West Texas Intermediate crude rose 0.6% to $67.37 a barrel

Spot gold fell 0.3% to $3,325.69 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.