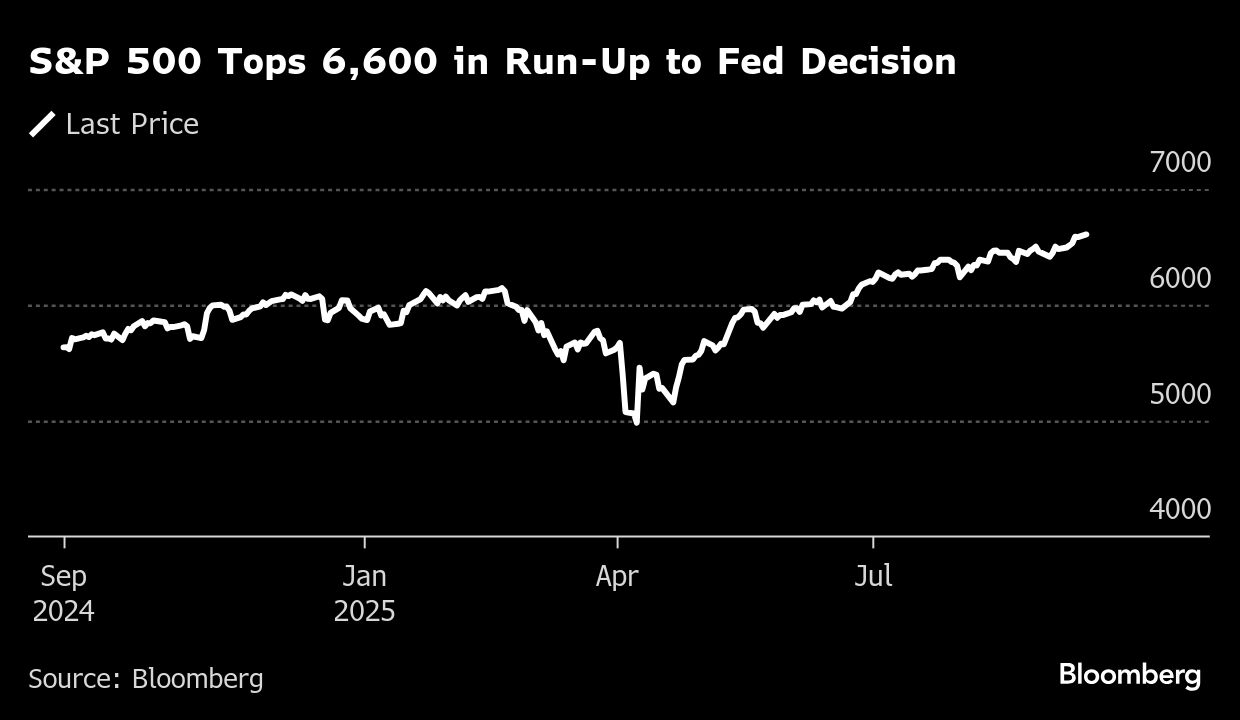

- Stocks remained near record highs as markets awaited the Federal Reserve’s policy decision on Wednesday

- The Federal Reserve is expected to cut interest rates by 25 basis points amid slowing US job growth

- France was downgraded to A+ from AA- by Fitch, reflecting concerns over political instability and debt

Wall Street kicked off the week with gains as traders see a Federal Reserve cut on Wednesday as a sure thing, while awaiting validation from officials on bets for a series of reductions extending into next year.

Equities resumed their record-breaking run, with the S&P 500 topping 6,600. Megacaps led the charge, with Tesla Inc. soaring 6% as Elon Musk bought $1 billion worth of shares and Alphabet Inc. hitting $3 trillion. Nvidia Corp. underperformed as China ruled that violated anti-monopoly laws with a high-profile 2020 deal.

Treasuries rose, with two-year yields hovering near the lowest since last September. The dollar fell. Money markets are pricing in a quarter-point Fed cut this month, and nearly two more by year-end.

The first US rate reduction since Donald Trump became president again is likely to seize the spotlight in a week that will determine policy settings for half of the world's 10 most-traded currencies.

Recent signs of weakening in the labor market, paired with no surprises in the latest inflation data, sealed the deal for what most economists expect will be a quarter-point Fed cut. The pace of easing after that is now the big question, with prices stubbornly above the central bank's target.

“Now the discussion will turn to how aggressively the Fed will act, and the market may take its near-term cues from Chairman Jerome Powell's press conference,” said Chris Larkin at E*Trade from Morgan Stanley. “The Fed may remind everyone that it may be focused on jobs now, but it hasn't forgotten about the other half of its mandate.”

Officials on Wednesday will also release their quarterly update of economic and rate forecasts — known as the dot plot — and Powell will hold his regular post-decision press conference. In June, Fed officials were narrowly in favor of two quarter-point cuts in 2025.

What traders will really hang on is the tone of Powell's press conference and the “dot plot” projections, according to Fawad Razaqzada at City Index and Forex.com.

“Personally, I'll be watching how the market reacts to any mention of inflation being ‘well anchored' or the labor market ‘cooling more than expected,” he said. “That sort of language would be music to the ears of dollar bears. On the flip side, a cautious Fed that hints at a ‘wait and see' approach might stall the rally, at least temporarily.”

Before that, Razaqzada noted that there's also a bit of data to keep things lively before and after the decision. Tuesday's retail sales could either reinforce the soft-landing narrative or raise fresh concerns about consumer demand, he said. And Thursday's jobless claims will add another piece to the puzzle.

In a nod to data that suggests that US-based firms are growing reluctant to hire, the Fed will cut by 25 basis points this week, according to Thierry Wizman at Macquarie Group. But to the central bank's hawks, monetary policy doesn't present as being tight, he noted

“And so Jay Powell will offer balance. He'll highlight again the downside risk to employment growth, but refrain from signaling a (long) string of cuts after September,” Wizman said.

Lon Erickson at Thornburg Investment Management says he doesn't think we're ready for another 50 basis-point cut this year like the Fed did when the cutting process first began.

“Considering what we've seen with inflation, which came in a bit higher than expected, they'll continue to be cautious,” he said. “The wild card remains inflation. We've seen signs of relief in goods prices and stickiness in services as well. The key question is how that plays out over the rest of the year and whether we end up in the dreaded stagflation-type environment, which would put the Fed in a tough spot.”

Erickson says he's leaning more towards expecting a rate cut at each of the remaining meetings this year amid a softening labor market.

“With the weakening labor market and inflation seemingly under control, we expect a rate cut starting this week and totaling 100 basis points over the next four meetings through January 2026,” said Brian Buetel at UBS Wealth Management. “The stock market's recent gains are being driven by strong earnings momentum and declining rates.”

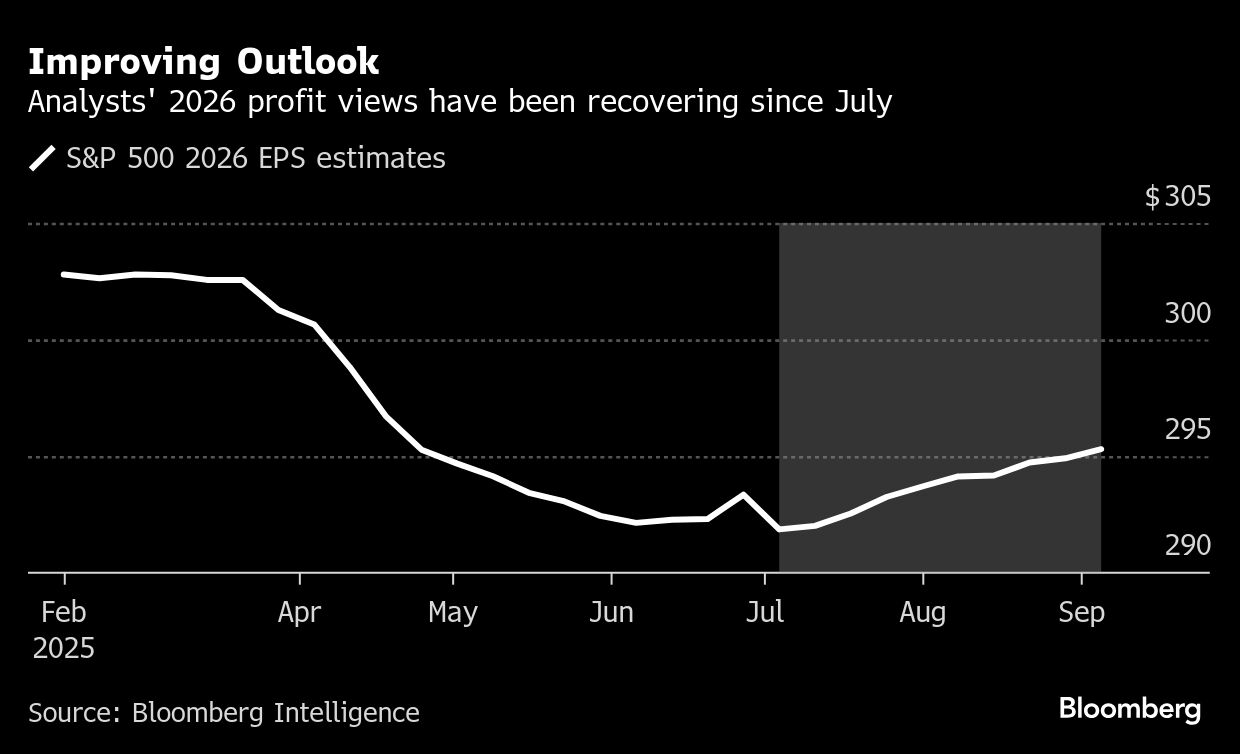

Buetel says he expects modest upside between now and the end of the year, and the bull market continuing to gain steam into 2026, as investors have plenty of earnings momentum runway to work with.

Measures of projected volatility look dormant, and analysts' profit views for the first half of 2026 are climbing back toward where they stood at the beginning of the year. Since bottoming in July, 2026 earnings estimates for the S&P 500 have climbed in each of the past nine weeks. At $295 per share, they're in line with where they stood in late April, according to Bloomberg Intelligence.

Meantime, President Trump said companies should not be forced to deliver earnings reports on a quarterly basis, saying he preferred a six-month schedule he cast as saving businesses time and money.

On the trade front, Trump said he would speak with Chinese leader Xi Jinping on Friday, following talks between the countries to keep ByteDance Ltd.'s TikTok app running in the US.

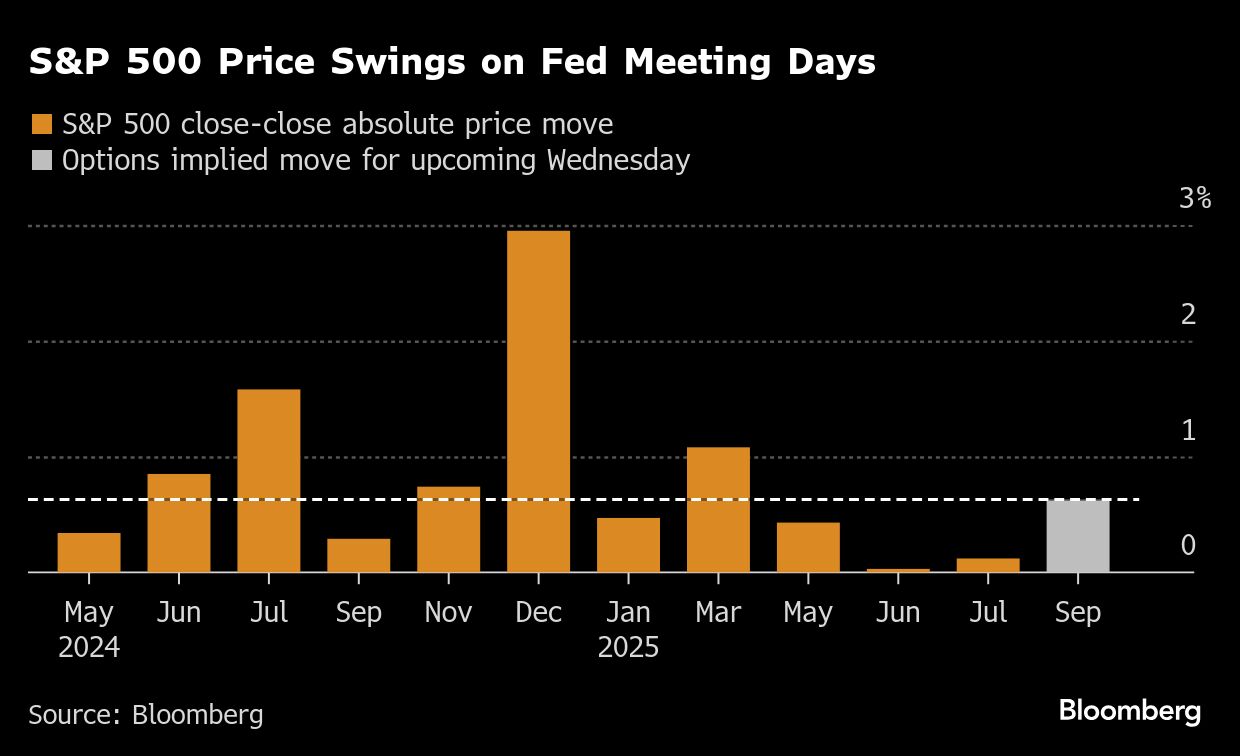

Even as the Fed meeting and $5 trillion quarterly triple-witching options expiry loom over the equity market, volatility traders are also circling the upcoming jobs data on their calendars.

Options markets are pricing in a 0.78% move for the US nonfarm payrolls report Oct. 3 and 0.72% for Wednesday's Fed rate decision, according to Citigroup Inc.

“If you threw up a minus 50k payrolls next month you're gonna get vol higher,” said Stuart Kaiser, head of US equity-trading strategy at Citigroup, adding that negative payrolls are likely needed to get swings higher. “I don't think there's any way.”

Corporate Highlights:

CoreWeave Inc. said its shareholder Nvidia Corp. will buy cloud services with an initial value of $6.3 billion.

Alaska Air Group Inc.'s adjusted third-quarter profit will be at the low end of the carrier's previous estimate of $1 to $1.40 a share, driven down by a July technology outage and rising fuel prices.

Exxon Mobil Corp. is introducing a program to encourage more retail investors to support the company in proxy votes with an automatic system that threatens to limit the influence of activists.

Snap Inc. is rolling out an updated version of its operating system for augmented-reality glasses, a move that signals it's getting closer to launching its first consumer smart glasses next year.

WaterBridge Infrastructure LLC's initial public offering of as much as $540 million has attracted investor demand for multiple times the available shares, according to people familiar with the matter.

Robinhood Markets Inc. is launching a closed-end fund to give US retail investors exposure to private companies.

Orsted A/S will offer new shares at a heavy discount as the offshore wind developer pushes ahead with a $9.4 billion rights offering to shore up its finances after a bet on the US market went wrong.

Stocks

The S&P 500 rose 0.5% as of 11:55 a.m. New York time

The Nasdaq 100 rose 0.7%

The Dow Jones Industrial Average was little changed

The Stoxx Europe 600 rose 0.4%

The MSCI World Index rose 0.5%

Bloomberg Magnificent 7 Total Return Index rose 2.3%

The Russell 2000 Index rose 0.4%

Tesla rose 6.2%

Alphabet rose 3.5%

Nvidia was little changed

Currencies

The Bloomberg Dollar Spot Index fell 0.3%

The euro rose 0.3% to $1.1771

The British pound rose 0.4% to $1.3607

The Japanese yen rose 0.3% to 147.28 per dollar

Cryptocurrencies

Bitcoin fell 0.9% to $114,813.78

Ether fell 2.6% to $4,497.8

Bonds

The yield on 10-year Treasuries declined three basis points to 4.03%

Germany's 10-year yield declined two basis points to 2.69%

Britain's 10-year yield declined four basis points to 4.63%

The yield on 2-year Treasuries declined two basis points to 3.53%

The yield on 30-year Treasuries declined three basis points to 4.65%

Commodities

West Texas Intermediate crude rose 0.7% to $63.10 a barrel

Spot gold rose 1% to $3,679.19 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.