A strong week on Wall Street is ending on a quiet note, with stocks holding near all-time highs and bonds edging lower as consumer data did little to alter bets the Federal Reserve will cut rates in September.

Following a rally that drove equities to all-time highs, the S&P 500 was little changed. A gauge of megacaps jumped, led by a surge in Tesla Inc. Shares of vaccine makers slumped on a report that health officials plan to link Covid shots to the deaths of around two dozen children.

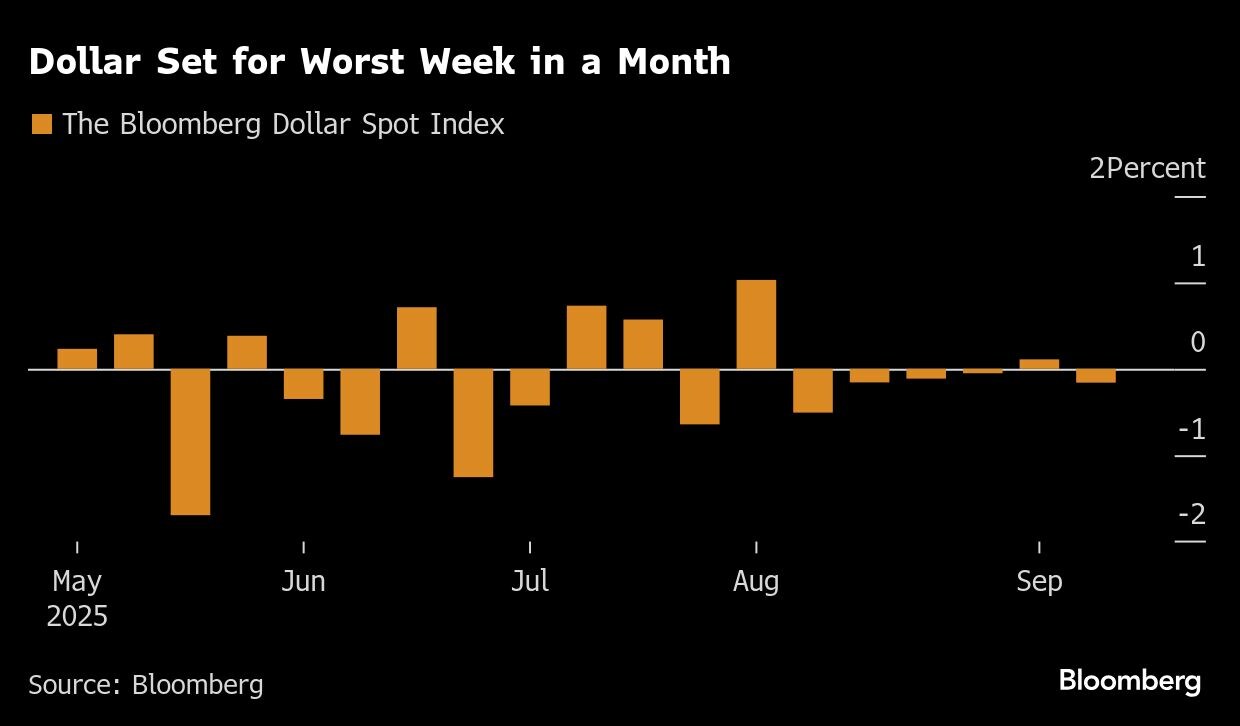

A modest slide in Treasuries trimmed an advance that put the market on pace for its fourth straight up week. The dollar was on track for its worst weekly slide in about a month.

US consumer sentiment hit the lowest since May and long-term inflation expectations rose. That follows recent data painting a picture of a materially slowing labor market, with investors leaning heavily in the direction of three rate cuts this year.

“The Fed is pulled in opposite directions by rising inflation on the one hand and a weak job market on the other,” said Bill Adams at Comerica Bank. “The Fed can be expected to cut rates further in coming months; the question is how much, not if.”

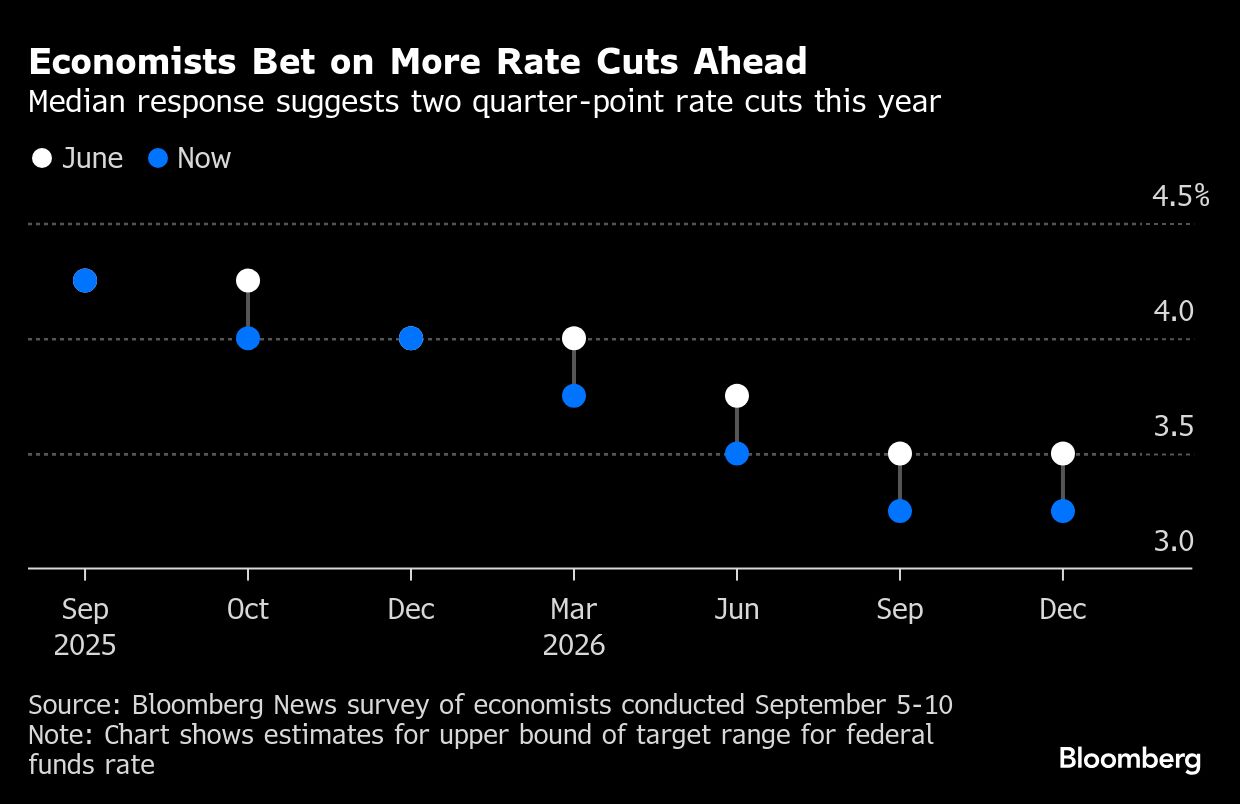

Cracks in the job market will likely prompt the Fed to execute a series of rate cuts in the coming months, beginning next week, according to economists surveyed by Bloomberg News. The median respondent sees two cuts by year-end, but a sizable minority — more than 40% — anticipates three reductions.

Deutsche Bank AG economists added a third cut to their forecast for the remainder of 2025. They previously expected officials led by Chair Jerome Powell would cut this month and then wait to ease again until December.

Jerome Powell

At Morgan Stanley, economists including Michael Gapen expect four straight rate cuts. Beyond January, they see officials pausing to assess inflationary impacts. Once that “noise” clears, they we anticipate further reductions in April and July.

And what about Fed guidance?

TD Securities strategists say that's likely to “lean dovish” next week as a result of labor-market conditions — but not overly so given an inflation overshoot remains an important risk.

They believe the September Summary of Economic Projections will reflect this, continuing to show two cuts in 2025, while shifting data projections in a “slightly hawkish direction.”

“The market is unlikely to be surprised by the cut,” said Oscar Munoz and Gennadiy Goldberg at TD Securities. “However, the likely reluctance of Chair Powell and the dots to commit to future cuts could be interpreted as less dovish.”

That could lead rates and the curve to reverse some recent momentum, they noted.

“We're anticipating a 25 basis-point rate cut and expect that the tone of the statement, press conference, and SEP will be interpreted as net dovish,” said Ian Lyngen at BMO Capital Markets.

As Powell restarts the “normalization process,” Lyngen anticipates that the 2025 dot plot will be lowered to reflect the potential for a 25 basis-point cut at both the October and December meetings.

Financial markets are betting the Fed will still be “ahead of the curve” when it starts lowering borrowing costs, according to Bank of America Corp.'s Michael Hartnett.

The strategist pointed to a rally in banks and rate-sensitive stocks as well as a drop in investment-grade credit spreads, which suggests investors are “saying the Fed can cut with credibility and is cutting into US growth re-acceleration,” he said.

Still, cash drew the bulk of inflows in the past week, bringing the four-week total to $266 billion, according to BofA citing EPFR Global data. US stocks saw outflows of $19 billion.

“With cash returns set to fall further as the Fed resumes rate cuts, we see a growing need to deploy excess cash into higher-yielding assets,” said Mark Haefele at UBS Global Wealth Management.

With the Fed poised to cut rates next week and market sentiment still far from complacent, the path of least resistance remains higher for equities in the near term, according to Mark Hackett at Nationwide.

“Rate cuts would add to a growing list of tailwinds, from the stimulative budget deal and trade agreements to the earnings boost from a weaker dollar,” he said.

While bears highlight labor market softness, positioning and sentiment remain cautious, suggesting markets still have room to run, Hackett concluded.

Corporate News:

Adobe Inc. gave a strong quarterly revenue outlook, suggesting that the software maker is seeing a payoff from its investment in AI features.

The leader of Tesla Inc.'s board said no one other than Elon Musk is capable of running the company as it expands beyond electric vehicles into artificial intelligence and robotics.

Apple Inc. delayed the launch of its new iPhone Air in mainland China, citing regulatory approval issues.

Microsoft Corp. avoided a hefty antitrust penalty after the European Union accepted its commitments to settle a probe into the alleged illegal bundling of its Teams video-conferencing app.

The US Federal Trade Commission is investigating whether Amazon.com Inc. and Alphabet Inc.'s Google misled advertisers that place ads on their websites, according to people familiar with the matter.

OpenAI said it's closer to converting into a more traditional for-profit company — nearing the resolution of painful negotiations with top shareholder Microsoft and outlining terms of at least $100 billion in equity for its nonprofit arm.

The leaders of OpenAI and Nvidia Corp. plan to pledge support for billions of dollars in UK data center investments when they head to the country next week at the same time as President Donald Trump, according to people with knowledge of the matter.

The Federal Aviation Administration said it would fine Boeing Co. $3.1 million for a series of safety violations that it uncovered over a space of several months between late 2023 and early last year.

Workers at Boeing's St. Louis-area defense factories will remain on strike after union members rejected a third contract offer from management.

Tylenol-maker Kenvue Inc. spoke with Health Secretary Robert F. Kennedy Jr. in a bid to keep the over-the-counter painkiller off a list of autism-causing treatments.

Union Pacific Corp.'s chief executive officer discussed the railroad's proposed $72 billion acquisition of rival Norfolk Southern Corp. with President Donald Trump as the company seeks regulatory approval for the deal.

Exxon Mobil Corp. said it has invented a new form of graphite that can increase the life of electric-vehicle batteries by as much as 30%.

Luxury furniture company RH cut its sales outlook for the full year, citing mounting impacts from new US tariffs that resulted in delays to a seasonal catalog.

Its CEO told analysts the industry needs to offer discounts to stay afloat amid a weak housing market.

Gemini Space Station Inc. raised $425 million in an initial public offering, pricing its stock above a marketed range and shrinking the number of shares.

WisdomTree Inc. launched its first tokenized fund that gives investors exposure to private credit, marking the latest attempt by Wall Street to connect fast-growing markets with blockchain technology.

Paramount Skydance Corp., the Hollywood studio taken over in August by independent filmmaker David Ellison, is preparing a bid for rival Warner Bros. Discovery Inc., according to people with knowledge of the matter.

Super Micro Computer Inc. announced the availability of its Nvidia Blackwell Ultra solutions.

Giorgio Armani's will outlines plans to sell a stake in his closely held fashion house to a major luxury firm, setting in motion a process to eventually fold the Italian brand into a larger group.

One of Banco Sabadell SA's largest shareholders said he won't accept BBVA SA's $18 billion takeover bid at the current price, putting more pressure on the prospective buyer to improve it.

Ocado Group Plc tumbled after Kroger Co. questioned the future of their partnership, raising concerns that the major US grocer could close some existing automated warehouses to cut costs.

SK Hynix Inc. jumped after the company announced it had completed development of HBM4, the next generation of high-bandwidth memory crucial for artificial-intelligence work.

The S&P 500 was little changed as of 1:09 p.m. New York time

The Nasdaq 100 rose 0.4%

The Dow Jones Industrial Average fell 0.4%

The MSCI World Index was little changed

Bloomberg Magnificent 7 Total Return Index rose 1.5%

The Russell 2000 Index fell 0.8%

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1733

The British pound was little changed at $1.3566

The Japanese yen fell 0.3% to 147.65 per dollar

Bitcoin rose 1% to $115,610.01

Ether rose 3.6% to $4,575.45

The yield on 10-year Treasuries advanced five basis points to 4.07%

Germany's 10-year yield advanced six basis points to 2.72%

Britain's 10-year yield advanced six basis points to 4.67%

The yield on 2-year Treasuries advanced two basis points to 3.56%

The yield on 30-year Treasuries advanced four basis points to 4.69%

West Texas Intermediate crude rose 0.4% to $62.60 a barrel

Spot gold rose 0.4% to $3,649.51 an ounce

What Bloomberg Strategists say...

“The S&P 500 is still trading in a ‘good news' regime, rallying on weak lagging/coincident data that accelerates Fed cuts, or on forward-looking signals pointing to brighter prospects. Such regimes often support equities for extended periods, but they have also preceded prior market peaks.”

—Tatiana Darie, Macro Strategist, Markets Live.

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Bonds

Commodities

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.