Asian shares slipped after risk sentiment dimmed on Wall Street as bad loans at two US banks heightened concerns about the credit market.

MSCI's regional stock gauge dropped 0.2% with financials the biggest drag. US equity-index futures indicated further weakness after the S&P 500 fell 0.6%, weighed down by a drop for its financial stocks. Gold and silver touched all-time highs as fears about credit quality in the US economy and heightened US-China frictions strengthened demand.

Treasury yields extended their losses with the two-year yield falling to the lowest level since 2022 and the 10-year yield below 4%. An index of the dollar declined, with the gauge set for its worst week since late July.

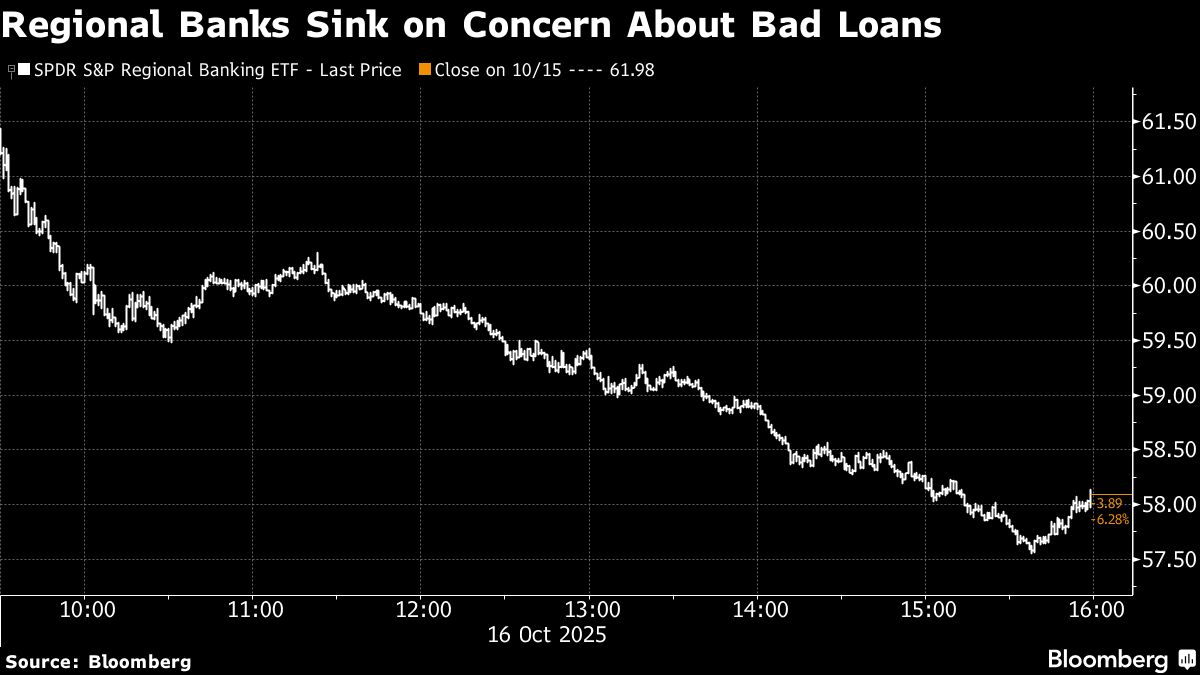

Shares of US regional lenders tumbled after fallout from the collapse of subprime auto lender Tricolor Holdings spread beyond Wall Street. Zions Bancorp fell 13% after a $50 million charge-off tied to a California Bank & Trust loan, while Western Alliance Bancorp dropped 11% after revealing exposure to the same borrowers.

The moves highlighted growing concerns about the US credit market, serving as the clearest evidence of the nervous undercurrents recently plaguing Wall Street, after stocks rallied to record high levels. That's adding to a list of worries facing investors, including the US government shutdown, fears of an AI bubble and renewed trade tensions between the US and China.

“It will be creating some cautious pullback, taking risk off the table,” said Vishnu Varathan, head of macro research for Asia ex-Japan at Mizuho Bank. “Investors in Asia may be cautious of exposures or liabilities on the books in Asia that may get hurt.”

Meanwhile, Bank of Japan Governor Kazuo Ueda indicated that the bank will continue tightening if confidence in achieving its economic outlook strengthens — keeping the door open for a near-term interest-rate hike.

The yen was stronger against the dollar in early Friday trading, extending its run of three consecutive sessions of gains.

In trade news, the White House is poised to ease tariffs on the US auto industry, a move that would deliver a major win for carmakers that have aggressively lobbied to stem the fallout from record-level import duties.

Elsewhere, Federal Reserve Governor Christopher Waller said officials can keep lowering rates in quarter-percentage-point increments to support a faltering labor market, while Stephen Miran continued to advocate a larger reduction.

September inflation data that was slated to have been released this week was postponed because of the US government shutdown.

That has complicated assessing the urgency of additional rate cuts, however Fed officials broadly have continued to back their September assessment that two more quarter-point cuts were likely this year.

“With the government shutdown limiting the amount of economic data available to investors, they'll have to rely on earnings to drive the near-term narrative,” said Bret Kenwell at eToro. “At this point, earnings have the potential to steady the ship or rock the boat when it comes to recent volatility — and bulls are hoping for the former rather than the latter.”

Traders also kept a close eye on geopolitics. President Donald Trump and his Russian counterpart Vladimir Putin agreed to meet in Budapest during a two-hour phone call. The conversation took place a day before Trump's White House meeting with Ukrainian President Volodymyr Zelenskiy.

Oil headed for a third weekly decline as investors focused on oversupply and the fallout from renewed US-China trade tensions. Brent was near $61 a barrel as Trump said he would hold a second meeting with Putin, raising the prospect that an increase of barrels from the OPEC+ member will exacerbate a global glut.

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.2% as of 9:45 a.m. Tokyo time

Hang Seng futures fell 0.2%

Japan's Topix fell 0.8%

Australia's S&P/ASX 200 fell 0.6%

Euro Stoxx 50 futures fell 0.6%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro rose 0.1% to $1.1704

The Japanese yen rose 0.2% to 150.19 per dollar

The offshore yuan was little changed at 7.1189 per dollar

Cryptocurrencies

Bitcoin rose 0.7% to $108,624.48

Ether rose 1.7% to $3,916.68

Bonds

The yield on 10-year Treasuries declined two basis points to 3.96%

Japan's 10-year yield declined three basis points to 1.625%

Australia's 10-year yield declined four basis points to 4.11%

Commodities

West Texas Intermediate crude was little changed

Spot gold rose 1% to $4,368.23 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.