Treasuries lost steam as traders looked past a US jobs markdown ahead of inflation data that will test the market's conviction on Federal Reserve interest-rate cuts.

The slide in bonds sent yields higher across the curve, following a four-day rally. The S&P 500 wavered near its all-time highs, with economically sensitive corners of the market underperforming. Apple Inc. dropped before its product event. Oil jumped after an Israeli attack in Qatar revived fears of an escalation of the conflict in the Middle East. Gold rose to a record.

S&P 500 hits all-time high.

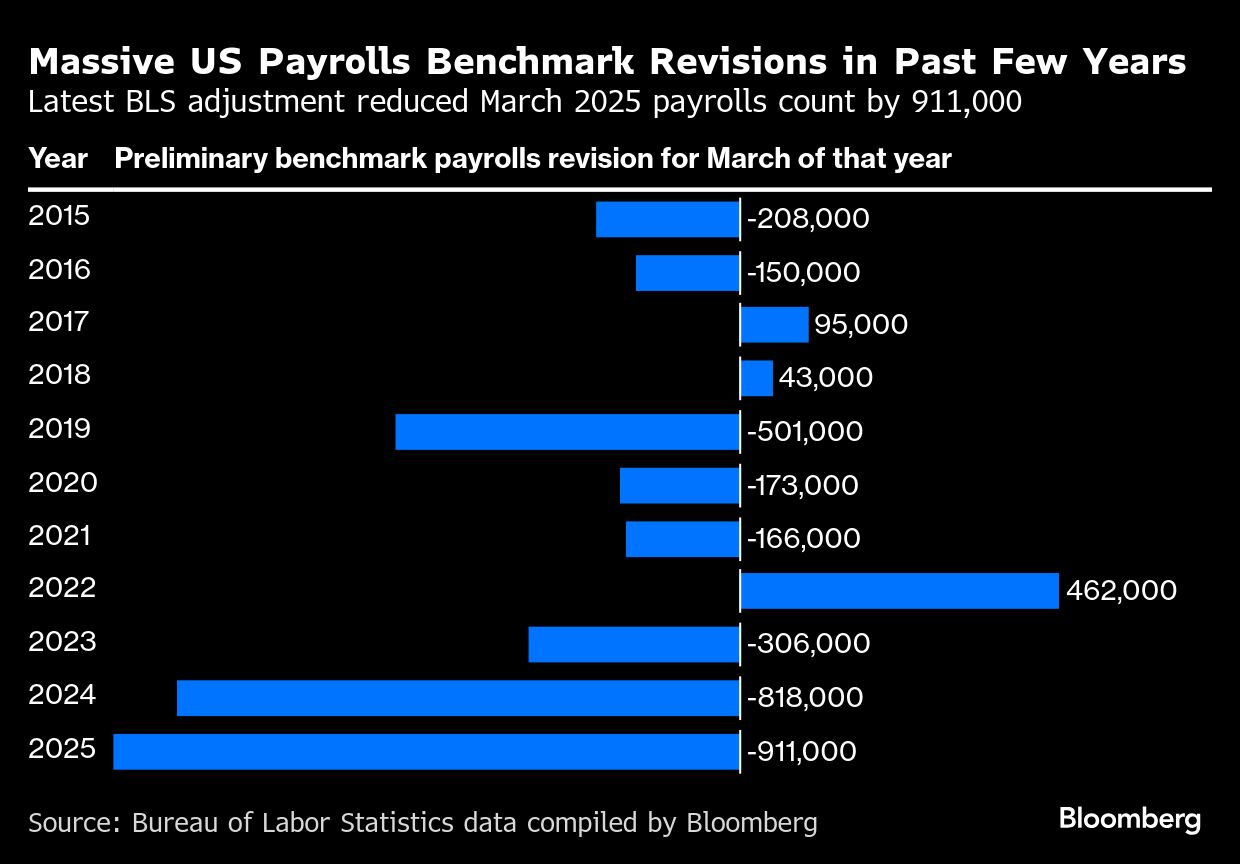

US job growth was far less robust in the year through March than previously reported. The number of workers on payrolls will likely be revised down by a record 911,000, or 0.6%, according to the government's preliminary benchmark revision out Tuesday. The final figures are due early next year.

Next up will be readings on both producer and consumer prices, due Wednesday and Thursday, respectively. While traders have fully priced in a quarter-point rate cut by the Fed this month, sticky inflation could dim the outlook for cuts in October and December.

“The jobs picture keeps deteriorating and while that should make it easier for the Fed to cut rates this fall, it could also throw some cold water on the recent rally,” said Chris Zaccarelli at Northlight Asset Management. “Worse still, if the CPI shows a worsening trend of higher inflation on Thursday then the market will begin worrying about ‘stagflation'.”

A worse-than-expected increase in consumer prices would complicate policy decisions at a time when pressure is mounting to provide economic relief through lower rates, according to Stephen Kates at Bankrate.

“Combined with Friday's dismal payroll report and this morning's preliminary payroll benchmark revision of -911,000, it is clear the economy is caught between a rock and a hard place — or more accurately, between a labor shock and a hot pace,” he said.

Data last week showed US job growth cooled notably last month while the unemployment rate rose to the highest since 2021, fanning concerns the labor market may be on the cusp of a more significant deterioration. Fed Chair Jerome Powell recently acknowledged risks to the job market have increased, and two of his colleagues preferred to lower borrowing costs in July.

Traders are assigning more than 90% probability that the Fed will cut rates by a total of 75 basis points by the end of December, having ramped up bets for cuts over the past week.

“The labor market appears weaker than originally reported,” said Jeff Roach at LPL Financial. “A deteriorating labor market will allow the Fed to highlight the need to ease rates. Investors should expect the Fed to officially start the rate-cutting campaign at the next meeting.”

To Gary Schlossberg at Wells Fargo Investment Institute, weakening job growth, underscored by Tuesday's report, should be viewed against support from ample market liquidity, the rally in stocks and the Fed's prospective interest-rate cuts in pointing toward an economic “soft patch” rather than a sustained economic slowdown.

“The shallow growth slowdown that we are anticipating is fully consistent with our recommended tilt toward more liquid, large-cap stocks and other higher-quality sectors of the financial market, as the economy navigates a period of slowing growth ahead of a forecasted recovery in 2026,” he said.

The government will release its latest consumer price index ahead of the Fed's Sept. 16-17 policy meeting. Core CPI, a measure of underlying inflation excluding food and fuel, probably rose 0.3% in August for a second month, according to the Bloomberg survey median estimate.

Economists will parse the extent to which higher US import duties are filtering through to consumers. So far, many companies have made an effort to refrain from hiking prices in order to maintain sales.

Options traders are betting the S&P 500 will post a modest swing on Thursday following the CPI report, with a projected move of nearly 0.6% in either direction, according to data compiled by Bloomberg. That's well below an average realized move of 1% over the past year.

“Given the recent softness in the labor market data, even if we were to see elevated inflation data this week, we still think the Fed would cut rates next week,” said Chris Kampitsis at Barnum Financial Group. The Fed is likely more focused on the employment market rather than inflation at this time.”

Corporate Highlights:

Apple Inc. will hold its biggest product launch event of the year Tuesday, when the company is set to unveil the new iPhone 17 lineup, smartwatches and AirPods ahead of the holiday season.

The video presentation — carrying the tagline “awe dropping” — will kick off from the company's headquarters in Cupertino, California, at 10 a.m. local time.

Nvidia Corp., whose chips and systems are at the heart of the artificial intelligence computing boom, said it plans to offer a new product designed to handle demanding tasks such as video generation and software creation.

The pressure is on for Oracle Corp. to deliver another quarter of accelerating revenue growth driven by spending on artificial intelligence after a run-up in its shares this year.

JPMorgan Chase & Co.'s third-quarter trading revenue could climb by a percentage in the “high teens” from a year earlier, well ahead of the 8.2% jump analysts currently expect.

Boeing Co. delivered 57 commercial aircraft in August, its best performance for the month since 2018, in the latest sign of steadying factory operations as the US planemaker targets faster production rates.

UnitedHealth Group Inc. said it expects most of its Medicare Advantage members to be in highly rated plans that earn bonus payments next year, a boon for its health insurance business.

Cracker Barrel Old Country Store Inc. said it's suspending store remodels as the restaurant chain continues to walk back planned changes such as a new logo that sent its shares crashing.

Goldman Sachs Group Inc. won a $40 billion mandate from Shell Plc to oversee pension assets for the energy company, in one of the biggest outsourced deals of its kind.

Nebius Group NV shares soared on Tuesday after signing an artificial intelligence infrastructure deal worth as much as $19.4 billion with Microsoft Corp.

Anglo American Plc has agreed to acquire Canada's Teck Resources Ltd., creating a more than $50 billion company in one of the biggest mining deals in over a decade.

American Express Co. grew its global merchant acceptance rate by more than 16% in the 12 months through June as it continues to invest in the domestic and international network of places that accept its credit cards.

Exxon Mobil Corp. and Chevron Corp. are bullish on China's future appetite for liquefied natural gas even if Russia succeeds in adding another pipeline to the Asian nation.

Lazard Inc. is aiming to station half a dozen bankers in its newly-opened office in Abu Dhabi as part of Chief Executive Officer Peter Orszag's yearslong plan to double the firm's revenue.

Airbus SE can achieve its aircraft delivery target for the year, though handing over 820 planes depends on receiving engines that remain difficult to source, Chief Executive Officer Guillaume Faury said.

Novartis AG agreed to buy Tourmaline Bio Inc. in a deal valued at about $1.4 billion as the Swiss drugmaker continues to pursue bolt-on deals to boost its drug pipeline.

The S&P 500 was little changed as of 12:21 p.m. New York time

The Nasdaq 100 was little changed

The Dow Jones Industrial Average rose 0.1%

The MSCI World Index was little changed

Bloomberg Magnificent 7 Total Return Index rose 0.4%

The Russell 2000 Index fell 0.8%

The Bloomberg Dollar Spot Index rose 0.2%

The euro fell 0.4% to $1.1720

The British pound fell 0.1% to $1.3527

The Japanese yen rose 0.1% to 147.32 per dollar

Bitcoin fell 1% to $110,860.11

Ether fell 0.3% to $4,284.15

The yield on 10-year Treasuries advanced four basis points to 4.08%

Germany's 10-year yield advanced two basis points to 2.66%

Britain's 10-year yield advanced two basis points to 4.62%

The yield on 2-year Treasuries advanced six basis points to 3.54%

The yield on 30-year Treasuries advanced three basis points to 4.73%

West Texas Intermediate crude rose 0.9% to $62.82 a barrel

Spot gold rose 0.3% to $3,645.14 an ounce

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Bonds

Commodities

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.