Asian Stocks Edge Up Before US Jobs, Tariff Ruling: Markets Wrap

Shares opened higher in Japan and Australia, while South Korea lagged.

Asian equities gained modestly at the open after their first two-day slide of the year, with investors bracing for Friday’s US payrolls report and a possible Supreme Court ruling on President Donald Trump’s tariffs.

Shares opened higher in Japan and Australia, while South Korea lagged. A flat day for the S&P 500 on Thursday masked selling in tech behemoths such as Nvidia Corp. Treasury futures inched up and mortgage backed securities rallied after Trump said he was directing the purchase of $200 billion of mortgage bonds.

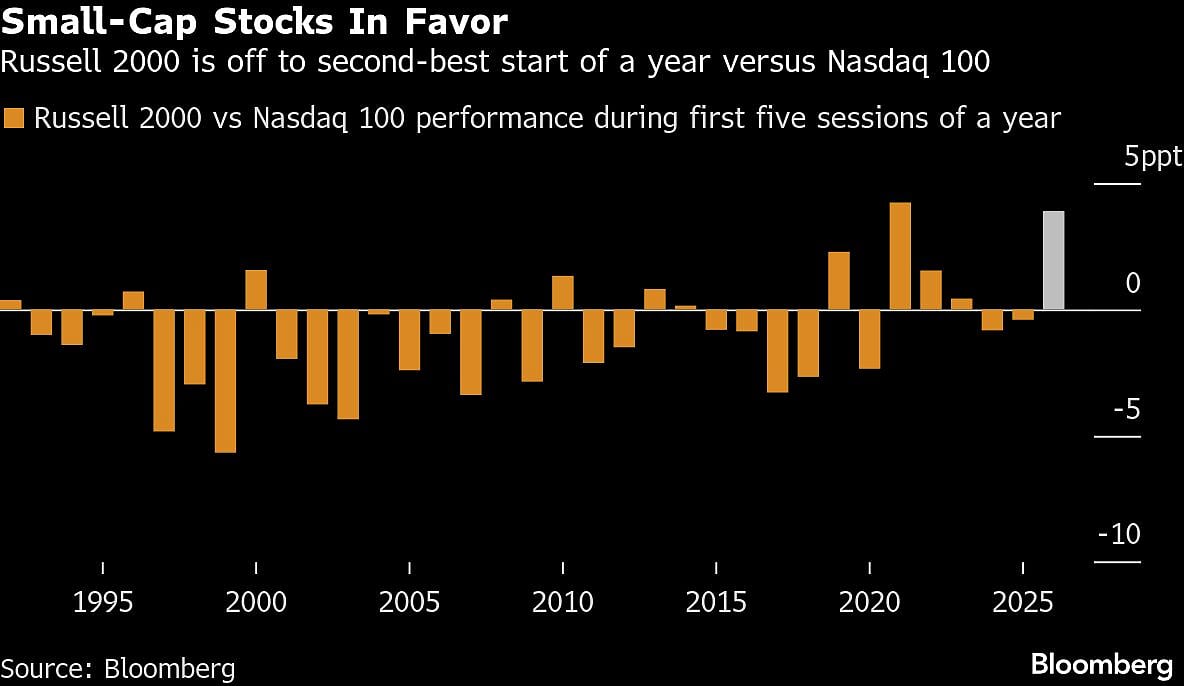

The rebound in equities after April’s tariff-driven slump faces a key test from the court ruling, just as investors brace for US jobs data that will offer clues on the Federal Reserve’s path for interest rates. In a defensive shift, money has rotated out of richly valued tech giants into smaller companies, tempering the AI-led gains of recent years.

“It’s unclear at this point whether this is just a breather or a full rotation,” said Paul Ticu at Calamos Investments. “Markets are still trying to figure out a direction.”

The Russell 2000 index of smaller US companies has beaten the Nasdaq 100 by around 4 percentage points in the first five sessions of 2026, the second-best outperformance to start a year on record.

Investors will be on guard for US jobs data set to land later Friday. Economists surveyed by Bloomberg anticipate 70,000 new positions were added to the US economy in December, slightly higher than the prior month, while the unemployment rate is expected to fall to 4.5%.

Jobs data will help illuminate the path ahead for US interest rates. Money markets are pricing in at least two quarter-point cuts from the Fed in 2026.

The Supreme Court is also poised to decide the fate of most of Trump’s tariffs as soon as Friday. Hundreds of companies have already lined up hoping to recoup their share of the billions of dollars in duties paid so far.

In other corners of the market, the dollar held on to its gains from the prior session, while oil extended its gain as investors monitored developments in Venezuela and Iran. Silver retreated further from its record struck earlier in the week, while gold was steady.

Mortgage bonds rose and home-lender stocks rallied after Trump’s move to bring down the cost of housing. There are roughly $9 trillion worth of agency mortgage bonds outstanding.

What Bloomberg strategists say...

Trump’s willingness to directly intervene in business is increasing by the day and it threatens to erode momentum for stocks and bonds. That represents a potential headwind for global markets, with US assets unlikely to move decisively higher unless the pace of presidential distractions ebbs.

— Garfield Reynolds, Asia MLIV Team Leader. For full analysis, click here.

In Asia, data set for release includes inflation and producer prices for China, consumer confidence in Indonesia, and industrial production in Malaysia.

Investors are still focused on the dispute between China and Japan. On Thursday, China said export control on dual-use items to Japan won’t impact civilian use, and that parties engaged in normal civilian trade “have absolutely no need to worry.”

Corporate News:

Rio Tinto Group is in talks to buy Glencore Plc to create the world’s biggest mining company with a combined market value of more than $200 billion, a little over a year after earlier talks between the two collapsed. Rio Tinto shares fell 5%.

General Motors Co. will take another $6 billion in charges tied to production cutbacks in its electric vehicle and battery operations as the financial fallout spreads from the weakening US market for EVs.

Paramount Skydance Corp. reaffirmed its offer to buy Warner Bros. Discovery Inc. for $30 a share, insisting its hostile bid is superior to one from Netflix Inc. despite multiple rejections by Warner Bros.’ board.

Shell Plc said its oil trading performance significantly worsened in the fourth quarter as crude prices slumped.

Stocks

S&P 500 futures were little changed as of 9:25 a.m. Tokyo time

Japan’s Topix rose 0.4%

Australia’s S&P/ASX 200 rose 0.3%

Euro Stoxx 50 futures fell 0.4%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1656

The Japanese yen was little changed at 156.94 per dollar

The offshore yuan was little changed at 6.9826 per dollar

Cryptocurrencies

Bitcoin fell 0.2% to $91,051.96

Ether fell 0.3% to $3,106.36

Bonds

The yield on 10-year Treasuries was unchanged at 4.17%

Japan’s 10-year yield was unchanged at 2.080%

Australia’s 10-year yield was little changed at 4.67%

Commodities

West Texas Intermediate crude rose 0.8% to $58.24 a barrel

Spot gold fell 0.2% to $4,468.13 an ounce