US Stocks Approach Fresh Record With Fed In Focus: Markets Wrap

The S&P 500 was hovering around a closing high seen in late December, while the tech-heavy Nasdaq 100 Index also climbed.

US stocks rose to approach a new record on Tuesday, as investors awaited data that could help shape the Federal Reserve’s interest rate outlook.

The S&P 500 was hovering around a closing high seen in late December, while the tech-heavy Nasdaq 100 Index also climbed. European stocks rose 0.4%. Shares in Asia extended their best-ever start to a year and a gauge of emerging markets hit back-to-back records.

Stock investors have so far been largely unfazed by tensions in Venezuela, extending a three-year bull run that’s been fueled by demand for AI–linked shares. A weaker than expected US Services PMI reading reported on Tuesday bolstered rate cut hopes, with business activity and jobs market data due later this week.

“Despite the solid performance of the last three years, we think this bull market has more to go,” said David Lefkowitz, head of US equities at UBS Global Wealth Management, in a recent note. The firm’s year end price target on the S&P 500 is 7,700, some 11% from where the index trades today.

Richmond Fed president Tom Barkin said Tuesday the policy outlook remains in a delicate balance given the conflicting pressures from rising unemployment and still-high inflation.

“We are waiting for data,” said Emilie Tetard, a cross-asset strategist at Natixis. “Before this data, as macro uncertainty is probably stronger in the US vs. the rest of the world, it’s a good time to put in place the diversification.”

Gold climbed 1% as the rally in precious metals extended, while silver rose around 5%. Brent crude unwound earlier gains. US Treasury yields crept higher, while the dollar posted a small advance.

Sunny Outlook

Optimism for the S&P 500 remains strong, with the latest Markets Pulse survey predicting another rally following three years of double-digit gains. Such a feat was last accomplished at the end of the previous century.

The US benchmark will climb as much as 20% this year, according to 60% of the 590 respondents to a poll conducted in the last three weeks of December. Less than a third of participants expected losses for the index while only a 10th saw more than 20% in gains.

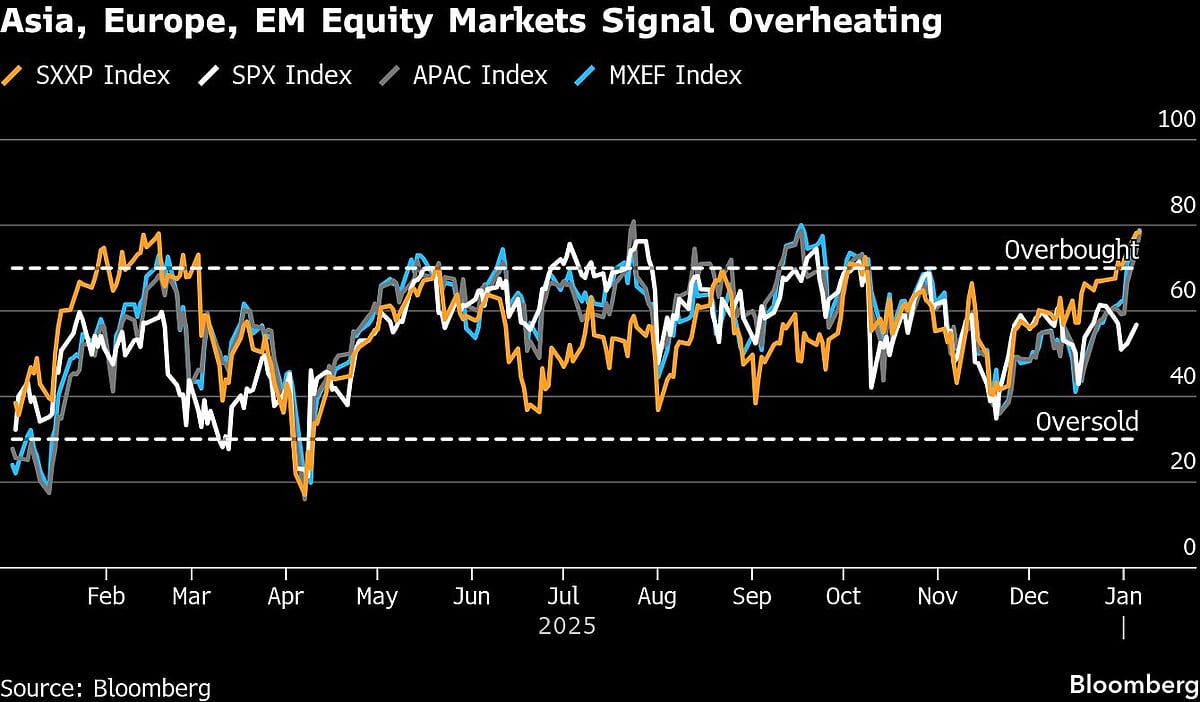

The S&P 500’s 14-day relative strength index also suggests that US stocks might have further room to run, in contrast with other regions that have surpassed levels typically seen as overbought.

For the time being, some investors are diversifying their exposure. Equity positioning drifted lower across US indexes last week as longs were unwound and new shorts put in place, according to Citigroup Inc. strategists.

“We expect U.S. interest rates to be higher than consensus and higher than the rate of inflation, for longer,” wrote Qian Wang, Vanguard global head of capital market research. “So fixed income will remain attractive even beyond the important portfolio diversification benefits that it offers.”

The AI theme will remain in focus after a flurry of late updates Monday from chip giants at the CES trade show in Las Vegas. Nvidia Corp. outperformed Magnificent Seven peers in premarket trading after an upbeat update on the rollout of its latest processor. Advanced Micro Devices Inc. rose on plans for a new corporate data center chip.

Some of the main moves in markets:

Stocks

The S&P 500 rose 0.2% as of 11:40 a.m. New York time

The Nasdaq 100 rose 0.4%

The Dow Jones Industrial Average rose 0.4%

The Stoxx Europe 600 rose 0.7%

The MSCI World Index rose 0.3%

Currencies

The Bloomberg Dollar Spot Index rose 0.2%

The euro fell 0.3% to $1.1690

The British pound fell 0.3% to $1.3500

The Japanese yen fell 0.2% to 156.66 per dollar

Cryptocurrencies

Bitcoin fell 1.6% to $92,590.35

Ether rose 0.2% to $3,243.36

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.18%

Germany’s 10-year yield declined three basis points to 2.84%

Britain’s 10-year yield declined two basis points to 4.48%

Commodities

West Texas Intermediate crude fell 0.5% to $58.01 a barrel

Spot gold rose 0.9% to $4,488.06 an ounce