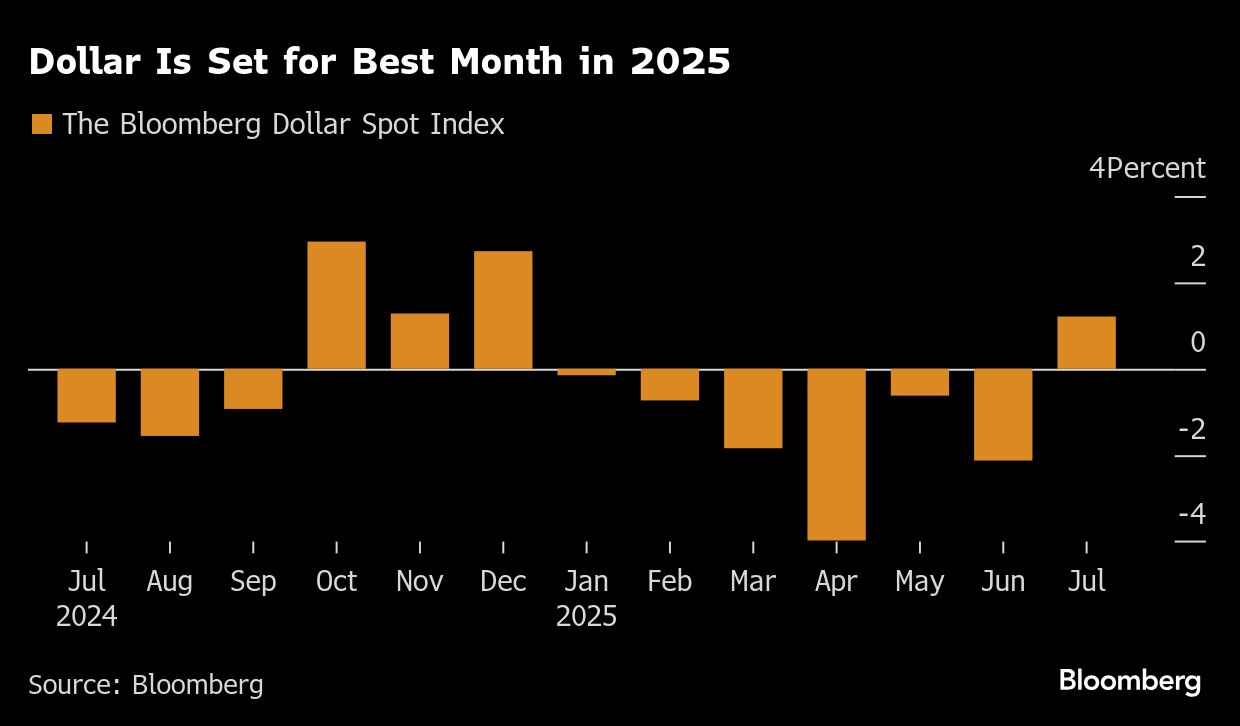

Wall Street kicked off a pivotal week with the dollar climbing after President Donald Trump reached a tariff deal with the European Union and signs mounted that the US and China will extend their trade truce. Stocks held near a record and bonds edged lower.

The start of a week that will set the tone for the rest of the year in markets saw the greenback extending its July rally. The euro dropped the most in over two months. The S&P 500 hovered around 6,400. Treasuries saw small losses before a pair of US debt sales. Oil rose as Trump said he would reduce the deadline for Russia to agree to a truce in Ukraine.

In the run-up to the Aug. 1 US tariff deadline, traders will go through a raft of key data from jobs to inflation and economic activity. The big event comes Wednesday, when the Federal Reserve is expected to keep rates unchanged. Then there's a string of big-tech earnings, with four megacaps worth a combined $11.3 trillion reporting results.

“This is about as busy as a week can get in the markets,” said Chris Larkin at E*Trade from Morgan Stanley. “This week could make or break that momentum in the near term.”

US and Chinese officials kicked off two days of talks aimed at extending their tariff truce beyond a mid-August deadline and hashing out ways to maintain trade ties while safeguarding economic security.

President Trump said he would impose a new deadline of 10-12 days for Russian leader Vladimir Putin to reach a truce with Ukraine, ramping up pressures on Moscow to bring the fighting to a halt.

“Whether we agree or not with the use of tariffs and the deals announced, we are getting the big ones out of the way which will allow American businesses to adjust and plan, for better or worse,” said Peter Boockvar at the Boock Report. “And we can now focus on how this all plays out.”

While the dollar's strength today may reflect the perception that the new EU deal is lopsided in favor of the US, it may also reflect a feeling that America is reengaging with its major allies, according to Thierry Wizman at Macquarie Group.

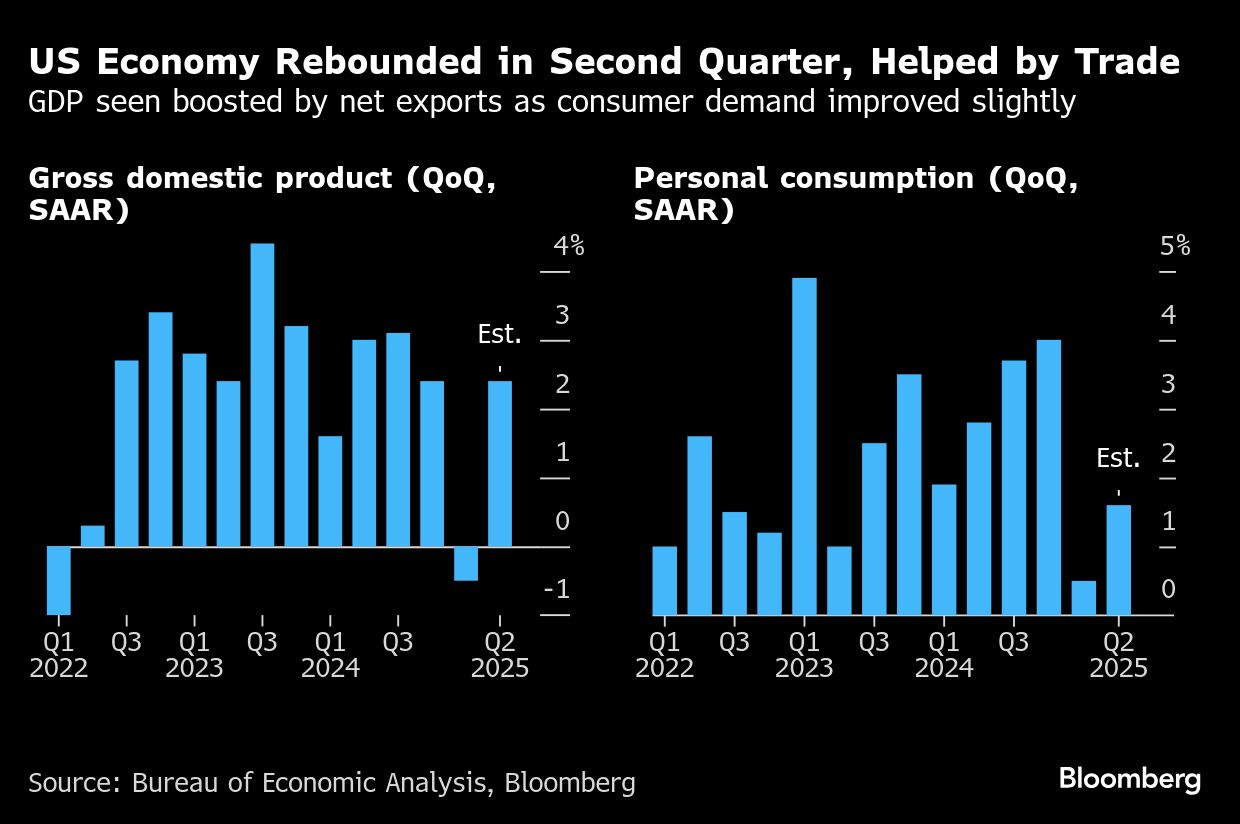

“The impact this new reality has on the real economy remains to be seen, although we're certainly cognizant that the recent data has reinforced the US exceptionalism narrative,” said Ian Lyngen and Vail Hartman at BMO Capital Markets. “At the end of the day, it is simply too soon for the full extent of the new tariff structure to be evident in the data or real economy.”

Federal Reserve Chair Jerome Powell and his colleagues will step into the central bank's board room on Tuesday to deliberate on rates at a time of immense political pressure, evolving trade policy, and economic cross-currents.

In a rare occurrence, policymakers will convene in the same week that the government issues reports on gross domestic product, employment and the Fed's preferred price metrics. Forecasters anticipate the heavy dose of data will show economic activity rebounded in the second quarter.

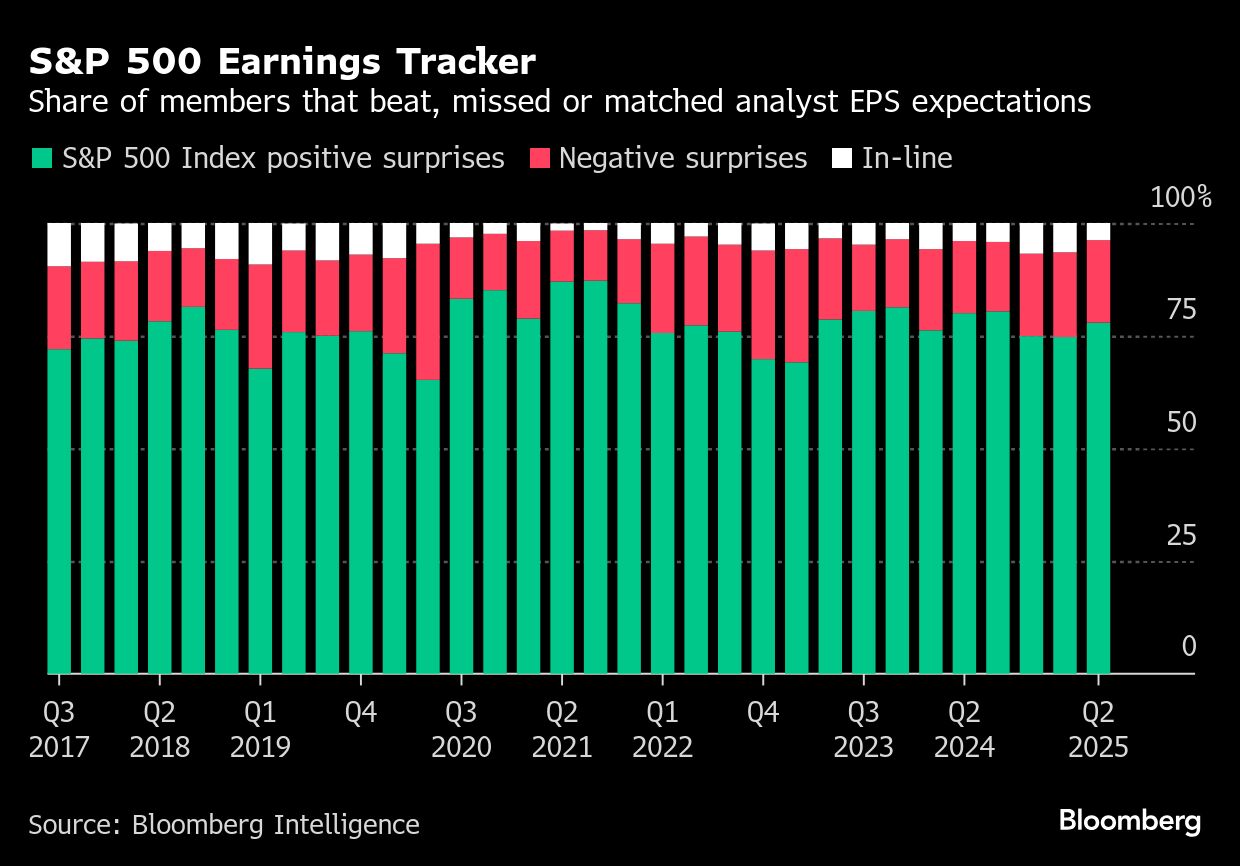

While this earnings season is off to a solid start, all eyes will be on results from Microsoft Corp. and Meta Platforms Inc. on Wednesday, and Apple Inc. and Amazon.com Inc. on Thursday.

So far, Corporate America appears to be taking tariffs in stride. With about a third of S&P 500 firms having reported, roughly 82% have beaten profit forecasts, on track for the best quarter in about four years, data compiled by Bloomberg Intelligence show.

At RBC Capital Markets, Lori Calvasina says it would be premature to write off the impact of tariffs on inflation and corporate earnings.

“It also poses a risk to the path of stock prices if company outlooks for 2026 don't end up being as rosy as investors have been anticipating,” she noted.

Progress in trade negotiations will take the S&P 500 to a third consecutive year of 20% gains, according to Oppenheimer Asset Management, a feat unseen since the late 1990s. Chief investment strategist John Stoltzfus raised his year-end target for the US benchmark to 7,100.

Some market forecasters including Morgan Stanley's Michael Wilson have turned more optimistic about the S&P 500 as they expect earnings to remain upbeat.

The technical evidence suggests a broadening of participation in equities off the April low, according to Craig Johnson at Piper Sandler.

“Despite a slight easing in momentum as investors await earnings, the combination of several major indices at all-time highs and improving market breadth continues to draw investors off the sidelines, offering opportunities to buy the dip,” he said.

The stock market's stunning rebound and resilience have again emboldened equity investors, who have developed muscle memory around “buying the dip',” according to Lisa Shalett at Morgan Stanley Wealth Management.

“With volatility having decoupled from stress indicators, passive indexes have ground to new highs, while the most speculative corners of the market have begun to lead,” she said. “Complacency is elevated, and valuations are rich. In this environment, we want to be stock-pickers.”

Some of the main moves in markets:

Stocks

The S&P 500 was little changed as of 11 a.m. New York time

The Nasdaq 100 rose 0.3%

The Dow Jones Industrial Average was little changed

The Stoxx Europe 600 fell 0.3%

The MSCI World Index fell 0.2%

Bloomberg Magnificent 7 Total Return Index rose 0.7%

The Russell 2000 Index was little changed

Currencies

The Bloomberg Dollar Spot Index rose 0.5%

The euro fell 0.9% to $1.1638

The British pound fell 0.2% to $1.3413

The Japanese yen fell 0.4% to 148.27 per dollar

Cryptocurrencies

Bitcoin fell 0.7% to $117,990.17

Ether fell 1.1% to $3,783.26

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.41%

Germany's 10-year yield declined four basis points to 2.68%

Britain's 10-year yield advanced one basis point to 4.65%

Commodities

West Texas Intermediate crude rose 2% to $66.48 a barrel

Spot gold fell 0.9% to $3,306.10 an ounce.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.