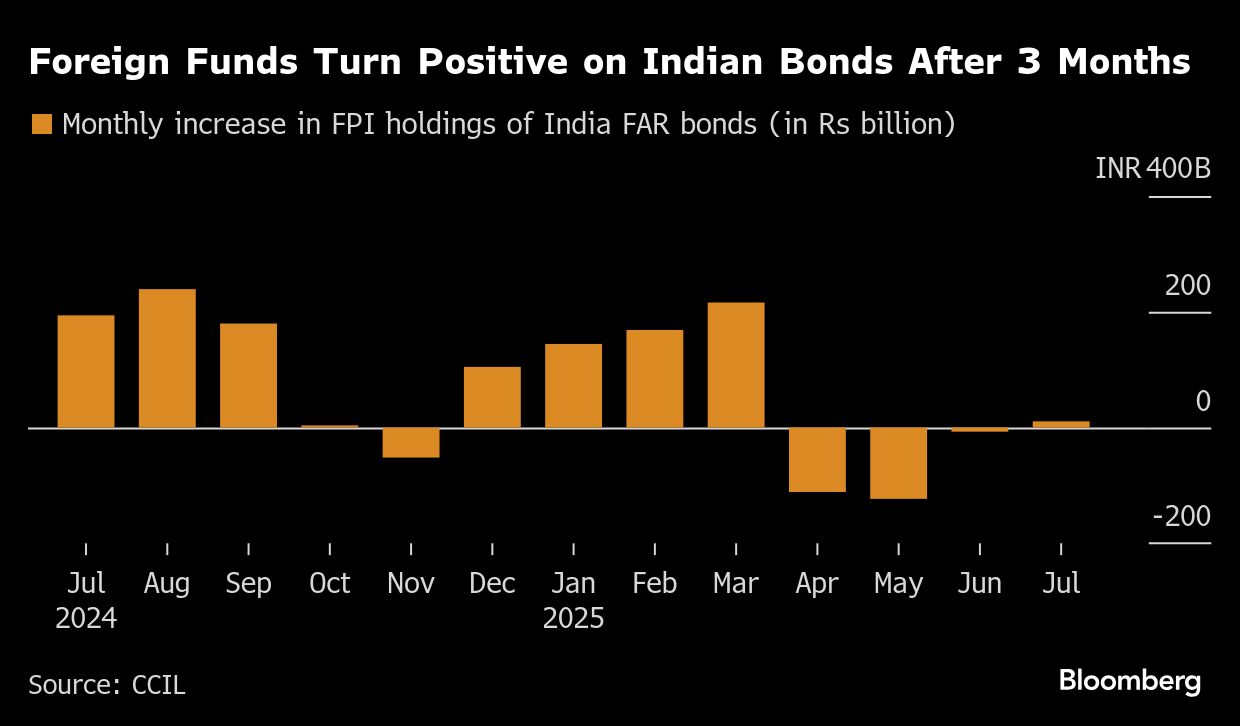

Foreign investors turned modest buyers of Indian sovereign bonds, ending a three-month selling streak, as relatively higher yields and a cheaper rupee improved the appeal of local debt.

Overseas holdings of bonds eligible for inclusion in global indices rose by 24.7 billion rupees ($283 million) to 2.8 trillion rupees in July, according to data from the Clearing Corp. of India.

The pickup signals renewed interest in Indian debt despite global uncertainty and tariff risks. A sustained rebound, however, may depend on the outcome of ongoing trade negotiations with the US, as President Donald Trump imposed higher tariffs on Indian exports than on those from many other regional peers.

India's 10-year bond yield climbed five basis points last month as the central bank switched to a neutral stance in June. With inflation dropping to the lowest in more than six years, the Reserve Bank of India may have room for further monetary easing, offering potential upside for bonds later in the year.

The rupee, meanwhile, has been the worst-performing Asian currency since April, with Barclays Plc analysts saying the drop in the currency looks overdone. Adjusted for inflation, the rupee is now at its cheapest level in more than two years, adding to the appeal of local assets for global investors.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.