Garden Reach Shipbuilders and Engineers Ltd.'s share price rose over 5% in trade on Thursday, recovering from a 2% slip at market open, after the company reported that the Bangladesh government cancelled an order for the construction of an advanced ocean-going tug.

The company's stock was up as much as 5.21%, to Rs 2,630.80 apiece, as of 09:55 a.m.

The order—worth $21 million (Rs 180 crore)—was from the Directorate General Defence Purchase, Ministry of Defence, Bangladesh. The construction and delivery of one advanced ocean-going tug was to be designed, built and delivered in 24 months, according to an exchange filing.

The company had clocked an order book of Rs 22,680 crore as on March 31, Garden Reach Shipbuilders' Chairman and Managing Director PR Hari said in an analysts call.

Ties between India and Bangladesh have been strained since the ouster of former Prime Minister Sheikh Hasina in August last year. The interim government under Muhammad Yunus has also moved closer to China, securing $2.1 billion in new deals.

Last week, India implemented curbs on imports from Bangladesh on goods worth $770 million (Rs 6,600 crore), covering nearly 42% of bilateral imports. The move was seen as a response to Dhaka's recent restrictions on Indian yarn, rice, and other goods, as well as the imposition of a transit fee on Indian cargo, which has marked a departure from past cooperation.

With this, key goods like garments, processed foods, and plastic items are now limited to select sea ports or barred from land routes entirely.

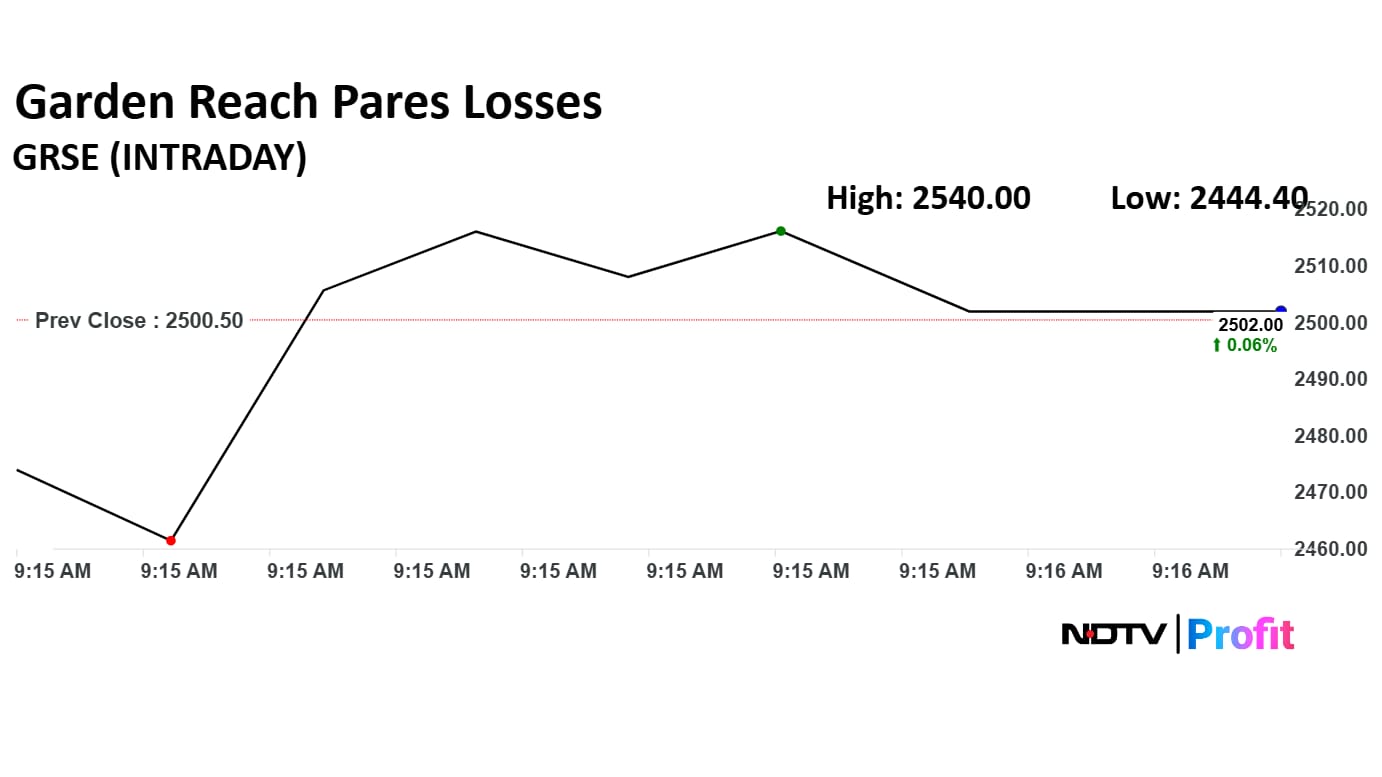

Garden Reach Share Price Today

The scrip roseas much as 5.21% to 2,630.80 apiece. It pared gains to trade 4.46% higher at Rs 2,611.90 apiece as of 09:56 a.m. This compares to a 0.93% decline in the NSE Nifty 50 Index.

It has risen 51.58% on a year-to-date basis, and 109% in the last 12 months. The relative strength index was at 63.38.

Out of four analysts tracking the company, three maintain a 'buy' rating, and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 25.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.