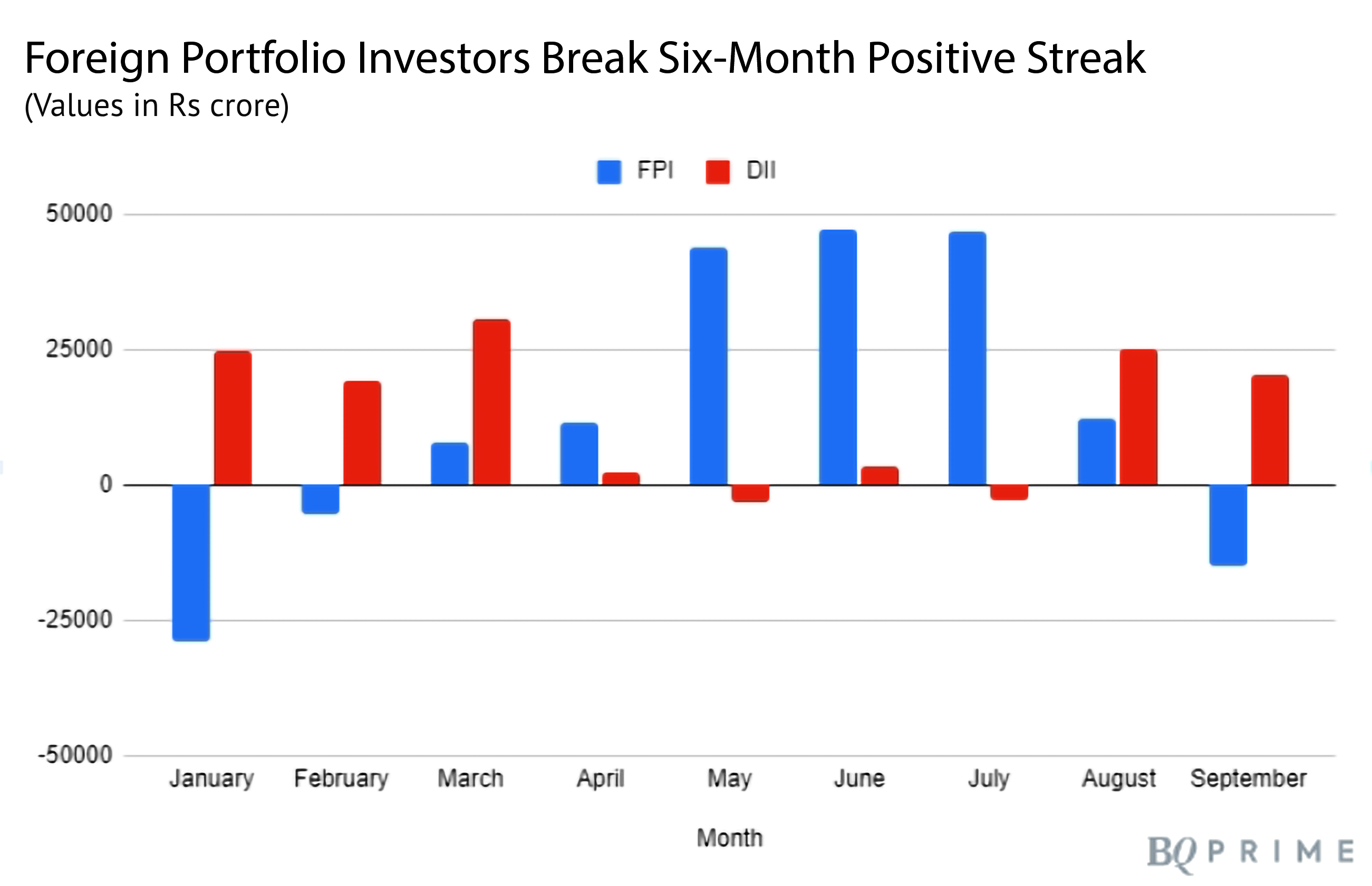

Foreign portfolio investors, for the first time in seven months, turned net sellers of Indian equities in September as benchmark stock indices cooled off from their record highs.

The FPIs recorded outflows of Rs 14,768 crore in September, while domestic institutional investors net bought Rs 20,312.2 crore of Indian stocks.

The outflows were recorded in conjunction with a consolidation in the markets as the NSE Nifty 50 fell over 3% since hitting a record high of 20,222.45 as of Sept. 15.

While the Indian markets have experienced a bull run, rising over 16% since the beginning of the financial year, speculation has begun about whether the peak has already been achieved.

Oil prices rose to their highest since November last year, hitting highs of 96.55 on Sept. 27, rising 33% over a three-month period.

Despite the rising concerns over the end of this bull run, international brokerages continued to remain positive on Indian markets, with several turning "overweight" over the past few months.

Below are the views of few brokerages:

CLSA

The brokerage increased its regional allocation for India to a 20% 'overweight' stance above the MSCI benchmark, citing rebounding credit impulses, improving external dynamics, and robust growth in the gross domestic product as key factors for the upgrade.

The brokerage expects a positive trajectory for India's credit impulse to be supportive of equity and consistent with a 20–35% year-on-year growth in the Nifty 50.

Nomura

The brokerage maintained an overall cautious outlook for the fourth quarter of the year. It upgraded India to an 'overweight' rating, increasing its exposure to the south Asian country.

Recent softness due to high oil prices is an opportunity to raise exposure, with India as a beneficiary of the China+1 theme and possessing a large, liquid equity market.

Morgan Stanley

The brokerage upgraded India to an 'overweight' rating, supported by FDI and portfolio flows, and a "secular trend towards sustained superior USD EPS growth", compared with other emerging markets, with a young demographic profile supporting equity inflows.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.