Foreign investors are pulling back from Indian equities, with October and November witnessing meaningful selling, according to Aditya Suresh, managing director and head of equity research, India, at Macquarie Capital.

The sell-off comes as expectations from Indian markets remain high, while valuations hover near a two-year forward P/E multiple of 20 times.

Suresh attributed the outflows to three key factors: high expectations, stretched valuations, and slowing momentum in corporate earnings. "On return and equity, the premium India is seeing in aggregate isn't dissimilar from history," he noted in conversation with NDTV Profit.

Aditya Suresh, managing director and head of equity research, India, at Macquarie Capital. (Photo source: Company website)

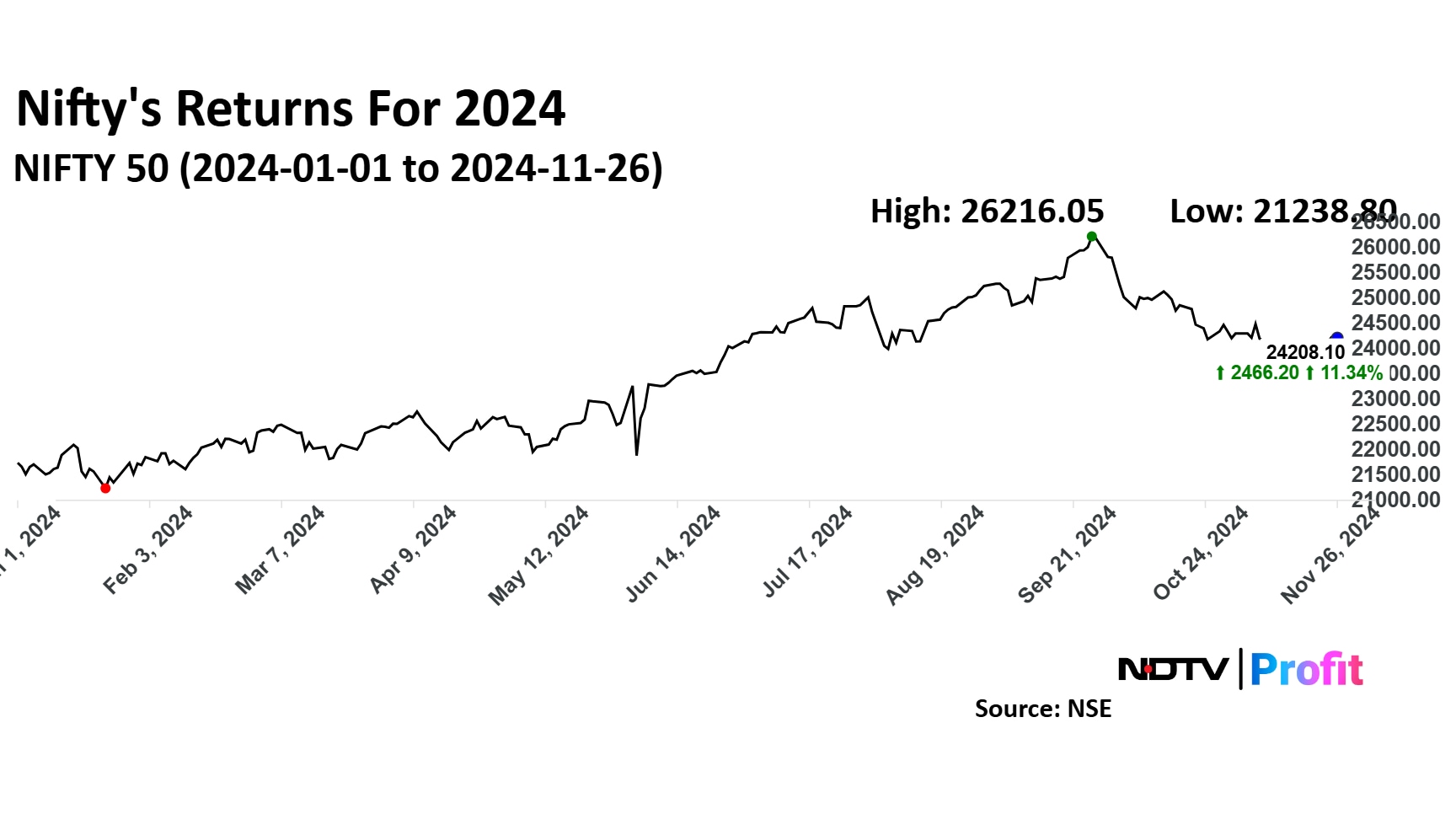

"Nifty's returns for the full year of 2024 is going to depend on domestic liquidity, rather than foreign flows," he stated. He expects further sell-off in the quarters to come.

We want to be selectively specific, and bottoms up— Not just chasing a theme or a headline. We're well past that phase right now.Aditya Suresh

While Indian markets have traditionally commanded a premium due to their growth potential, the broader macro environment—marked by geopolitical uncertainties and controlled commodity prices—appears to be weighing on sentiment. Brent crude's surprising stability at around $75 per barrel, despite global unrest, is a case in point, said Suresh.

He emphasised on the importance of adopting a selective, bottom-up approach in the current environment. "We're well past the phase of chasing a theme or headline. For the next couple of quarters, moderation in broader market performance seems likely," he said.

Watch The Conversation Here

Here Are The Excerpts

Let me start by asking about the kind of fund flows that we saw coming in yesterday, an ongoing debate since this morning on whether this was just a technical correction, the MSCI rebalancing, or are foreign investors now tired of selling India? What's your view?

Aditya Suresh: So far, in October, November, we've seen meaningful foreign selling. It's about $12-13 billion. If I think about this perspective, what is the maximum selling we have seen as in 2022 in the first half, we saw close to $30 billion worth of foreign selling.

Now why is this happening? I think it's happening because one is expectations are high. Two, valuations are full, and three is, I think there is this general theme of momentum slowing. If so, I think India is set for a period of relative underperformance given where expectations are at.

So yes, there will be daily volatility in these foreign flow numbers, but when we take a step back, we do worry that in the next couple of quarters, we will see further foreign selling.

Okay, who's selling? I guess it is good to understand. But how do you feel about Indian valuations? Until a few weeks ago, before the short spurt has returned to the markets, the big concern for local and global investors was the fact that India is an expensive market. But again, we are a growth market. Historically being an expensive market, the risk reward was far more favourable, maybe for investors who are looking at the U.S and India to keep the money in the western market on back of the developments that have happened there.

Second half is expected to be promising, but the earnings were rather disappointing. Keeping those as your backdrop, do you feel that after a 7-8% correction that the Indian markets have seen, and some of those counters around 40-50% India is looking attractive, or would you still anticipate and hope for a better entry price?

Aditya Suresh: So we've done a lot of work on this topic, just to kind of try to empirically think about, why does India trade where it trades at. Yes, we have pulled back as a market. But even on expectations, which are full two years forward, going to P/E multiples for India as a market in aggregate is almost 20 times like 2.4 times P/ multiple. Now when you think about defending that 20 times 2.4 P/E multiple in a broader sense, the reality is that we still think that fundamentally, you're going to still struggle defending that 20 times two year forward, just in EPS growth, return equity and these types of metrics, when you actually plot India versus Emerging markets, I think, by the forward growth premium, typically as a market.

One reason why we've been expensive is the fact that growth expectations in India have been, let's say, 500 basis points above where the consensus expectations were for Emerging markets. Today, that growth premium is basically zero. So you really can't quantify it on the growth dimension. Similarly on return and equity as well as proxy for quality, the premium which India is seeing in aggregate is not too dissimilar from history. So purely on growth and return on equity, if those are the only two dimensions as a market, we should not be trading at 20 times. We should be at a level which is below this.

What is clearly a support factor is what you should keep pointing out, which is on domestic liquidity. So we are where we are as a market purely on domestic liquidity dynamics. As long as that holds, perhaps we stay at these elevated levels, but to the extent we start seeing that as a support factor also receding, then I think there is a period of pain that can work through expectations that are slowing, foreigners are selling, and we really need the domestic piece to hold tight.

Aditya, just what will change the mood in foreigners selling and I did I get it right, that your answer to my first question on how you see the fund flows from yesterday, aberration or pivot? Are we clear in your view on what that is and what are the catalysts or reasons where you see the foreigners now seizing selling?

Aditya Suresh: We are not yet in a camp to suggest that the foreign selling is done, but I think there is more that kind of to come since the case in point, when you think back at 2022, in the first half, we saw about $30 billion worth outflow. We've seen about $13 billion over November so far. Yes, we did see some inflows, etc, but I think it's more an aberration.

The broader dynamic is one where expectations are full and just to extend that discussion, one of the themes, I guess, is just on expectations. So look at earnings expectations and forward expectations. We're not seeing clearly across any of the sectors where expectations are going to be revised upward. Since the bar is high and at best we are meeting estimates.

In contrast, in some of the other markets, in a regional perspective, the bar is really low, and so for us to meet those estimates or exceed is easier, so that's not a support factor as well. So expectations, I think, is a key problem for India to attract foreign flows.

Yesterday or Friday was all about the anticipation, and then the landslide victory by Mahayuti in Maharashtra. Suddenly, everyone is now talking about how Modi Trade is back and some of those ideas may be compelling, because if you look at Defence, if you look at PSU Banks, you look at Fertilizers, Railways, some of these counters are down around 40-50% from their recent highs. Do you feel like it's an opportune investment? Do you feel like the trade that was the biggest talking point for the last few years is back in style and may not be such a bad idea to start accumulating this theme as we go along in the next couple of weeks?

Aditya Suresh: I'll probably extend the duration, not a couple of weeks, but maybe, let's say the next, say 12 months. Some of these themes are clearly going to be in vogue and at play now, the way we think about it is, that is actually priced into earnings estimates is that priced into valuations. Now, given the fact that valuations are immediately pulled back in several sectors, perhaps selectively on the bottom up, we can then start to kind of express a more positive view on specific names.

But I think the real point I want to make is that we want to be selective, specific and bottom up, not just chasing a theme on a headline. I think we are well past that phase right now.

That's a good point. Let's also quickly get some perspective on this and I'm going to ask a very pointed question, actually. There is excitement you know, we are all slightly confused between this being a mini rescorn versus a structural change, even though I'm from the camp that believes this is a mini Rescon at best, and a technical recovery that the markets are seeing. But just so that we hear it from an expert, do you feel like calendar year end could see the Nifty at new record highs, or that looks far more unlikely, and a slow grinding next few months is more likely?

Aditya Suresh: So the calendar year ‘24 where we end up, is going to be purely a function of domestic equity. It's not going to be about foreign flows, in our view, at least, it's not going to be about earnings estimates being revised upward, therefore drawing in much of the investors. It's going to be our domestic liquidity.

So to that extent, we're not seeing enough evidence to suggest that we trace back to where we were a couple of months back. So we are more in the camp that this recent Rescon is probably more of a short-term event. Expectations need to kind of come off, and some of the valuation exercises which are still there in the market need to cool and so we are more in the camp. In the next couple of quarters, we are more set for a moderation in broader market performance.

Very quickly. Aditya, how concerned are you of what's happening in terms of Crude, Commodities, all this anticipation of China coming to the rescue of Metals hasn't really played out as most of us would have liked. What is the outlook on Commodities as a whole and also Crude, because Crude has been so volatile, you know, you have weeks when it rises significantly, and then there are weeks that it corrects significantly. This, for whatever it's worth, has a very big impact on India's macros, as much as we don't talk about it enough?

Aditya Suresh: The impact of Crude on India's macros was more meaningful. Let's say a couple of years back. Today, the impact is less meaningful, but still a negative impact, and we import about 90% of our crude needs, that crude import dependence being structuring, kind of rising over time. So to the extent that Brent would go from, say, 75 towards 100, that is problematic. In a world where there's so much stuff geopolitically happening, you would have thought that Brent is closer to 75 but clearly that does not seem to be the case. That remains a surprising factor.

Brent at 75 is not really a problem necessarily for India, but if I then zoom out, the broader question which you were asking about Commodity price and the impact on sectors and margin and all these things. The problem statement is that, when you kind of drill down and look at earnings estimates, what's in earnings expectations is margin expansion. So part of this is operating leverage, part of it is gross margin, but the broader dynamic is one where margins are set to expand is at least what is in estimates over the next two years, that is problematic.

So inflation, I think it will be problematic from the top line, and the kind of volume assumptions, margin estimates, whether it be operating leverage, whether it be kind of commodity prices, that, again, is not a headwind kind of work through and we see this across sectors. There is no specific sector, where we actually see it like a tailwind.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.