(Bloomberg) -- As India's $1 trillion bond market gets ready for the global index inclusion, state-run lenders are trimming their holdings while foreign banks are piling in.

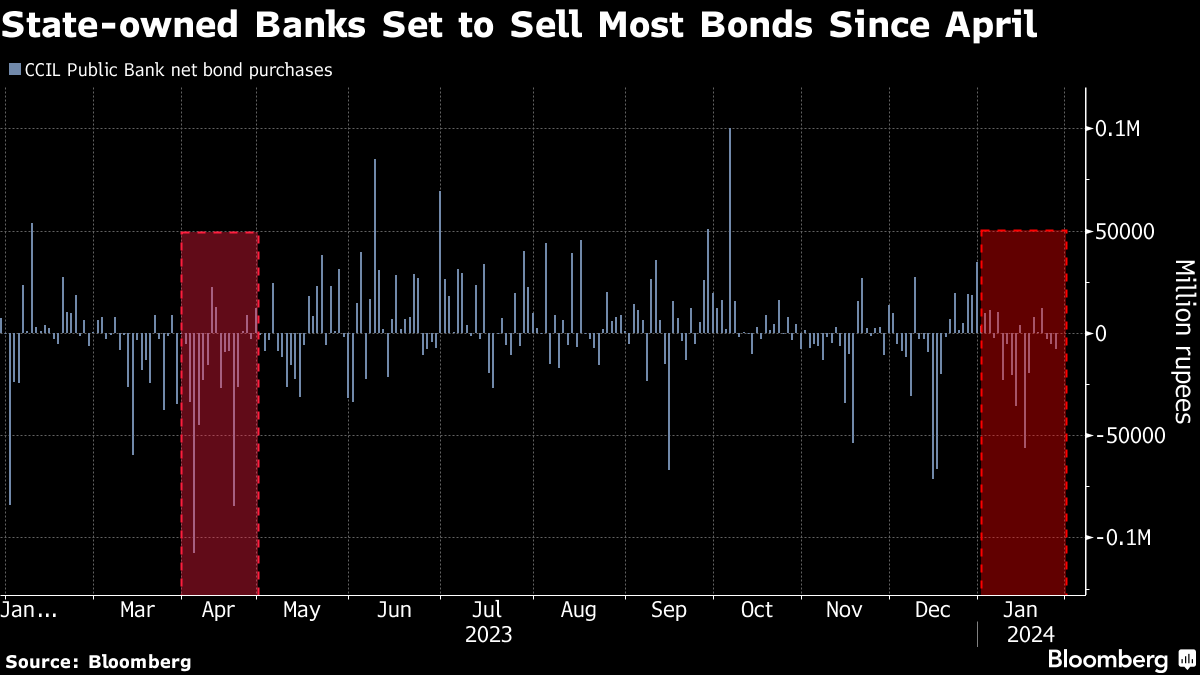

Government-owned banks, the biggest holders of debt, have sold about 129 billion rupees of bonds ($1.5 billion) this month so far, the most since April, according to data compiled by Bloomberg. Banks investing on behalf of mostly overseas clients have poured a net $5 billion in the period.

Lenders are likely locking gains after a rally in December caused the yields on the benchmark sovereign debt to fall by the most in seven months. Besides, this week's interim budget is unlikely to throw up any surprises, with economists expecting the government to stay fiscally conservative. And the central bank is unlikely to slash interest rates anytime soon.

Foreign banks, on the other hand, are getting global flows in the run-up to the global bond index inclusion due in June.

“For domestic banks seeing the rally from December to now it makes sense to sell into that,” said Rajeev Pawar, head of treasury at Ujjivan Small Finance Bank. “I don't expect a very dovish RBI policy, and rate cuts only in three-to-six months from now.”

The yields on benchmark 10-year government bond fell 11 basis points in December, the biggest drop since May.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.