(Bloomberg) -- China's monthly streak of gold buying for central bank stockpiling has come to an end. Natural gas traders are skittish over any potential disruptions that could throw markets into disarray. And the US Department of Agriculture releases its latest supply-and-demand estimates Wednesday, with insights on how strong crop conditions are being incorporated into the closely watched forecast.

Here are five notable charts to consider in global commodity markets as the week gets underway.

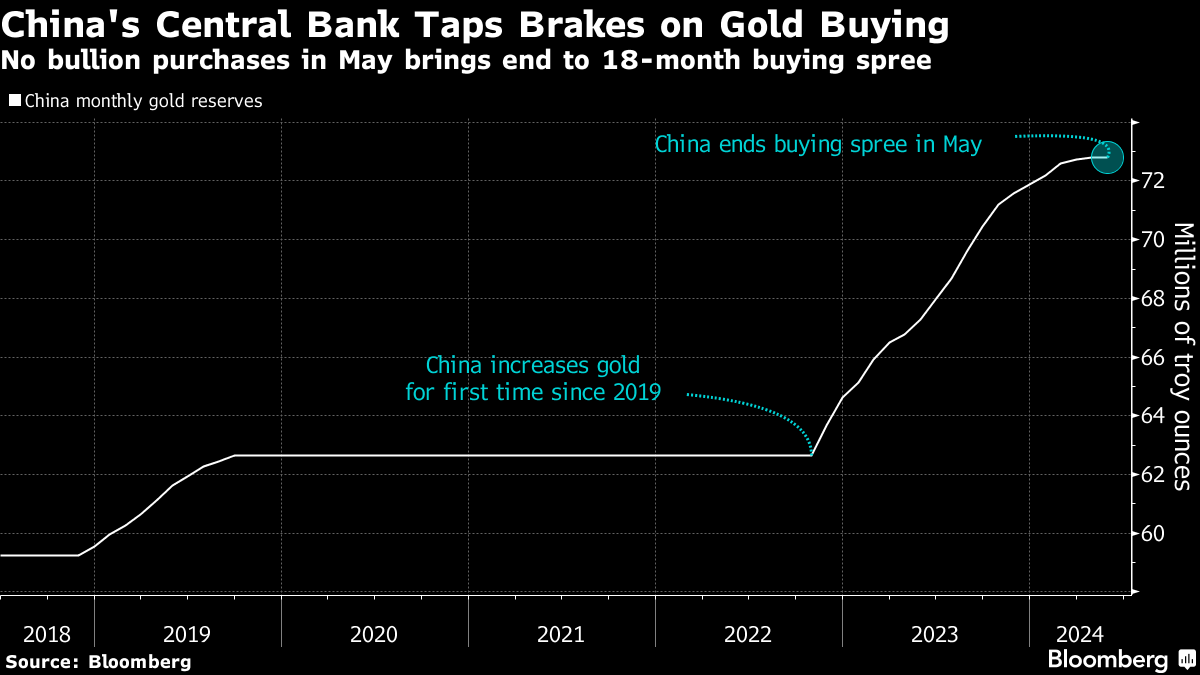

Gold

China's central bank didn't buy any gold last month, ending a massive buying spree that helped push the precious metal to a record high in May. The bank has been stocking up its reserves since November 2022, leading a flurry of purchases by the world's central banks amid rising geopolitical tensions. There were signs that China's demand was cooling as higher prices took their toll. The risk for gold bulls is that China's voracious appetite for bullion has left the precious metal vulnerable to any potential shift in demand.

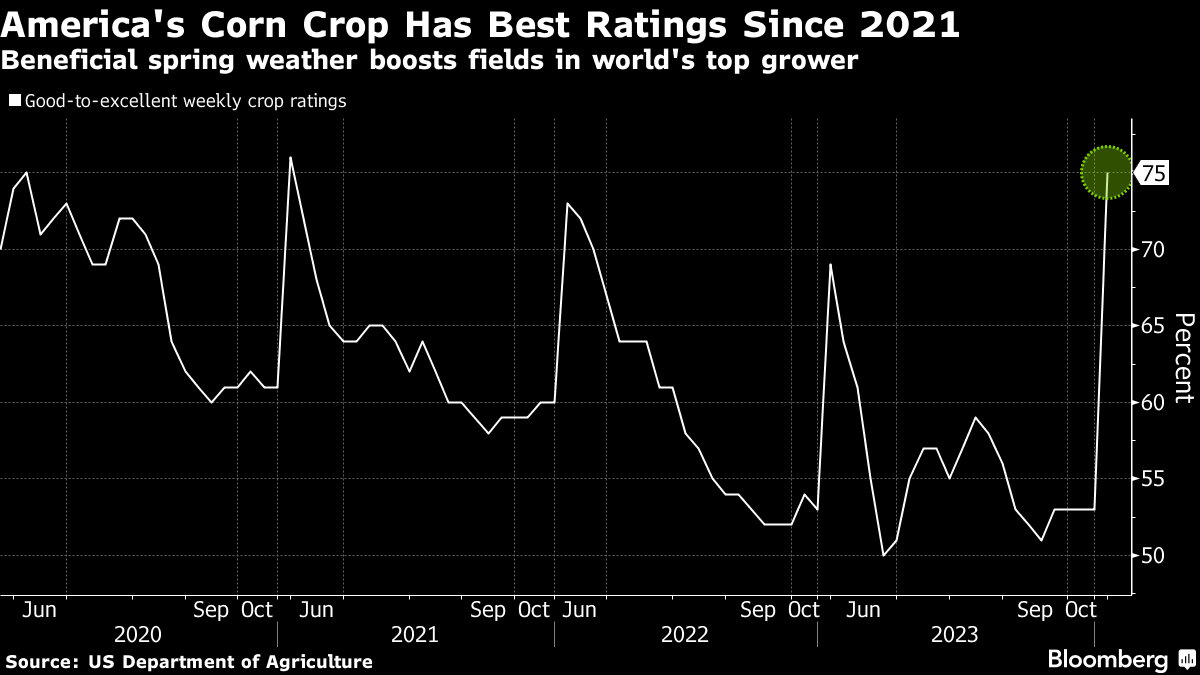

Corn

The US corn crop, the world's biggest, is off to its best start in three years, with 75% of fields in either good or excellent condition. Ample rainfall and not-too-hot temperatures were boosting emerging plants, even if some farmers were complaining about waterlogged fields. America's grain supplies are needed as adverse weather in Russia, the top wheat shipper, was taking a toll on the harvest. Traders on average expect the USDA to make few changes on its US corn output forecast in Wednesday's World Agriculture Supply and Demand report since it's still early in the growing season.

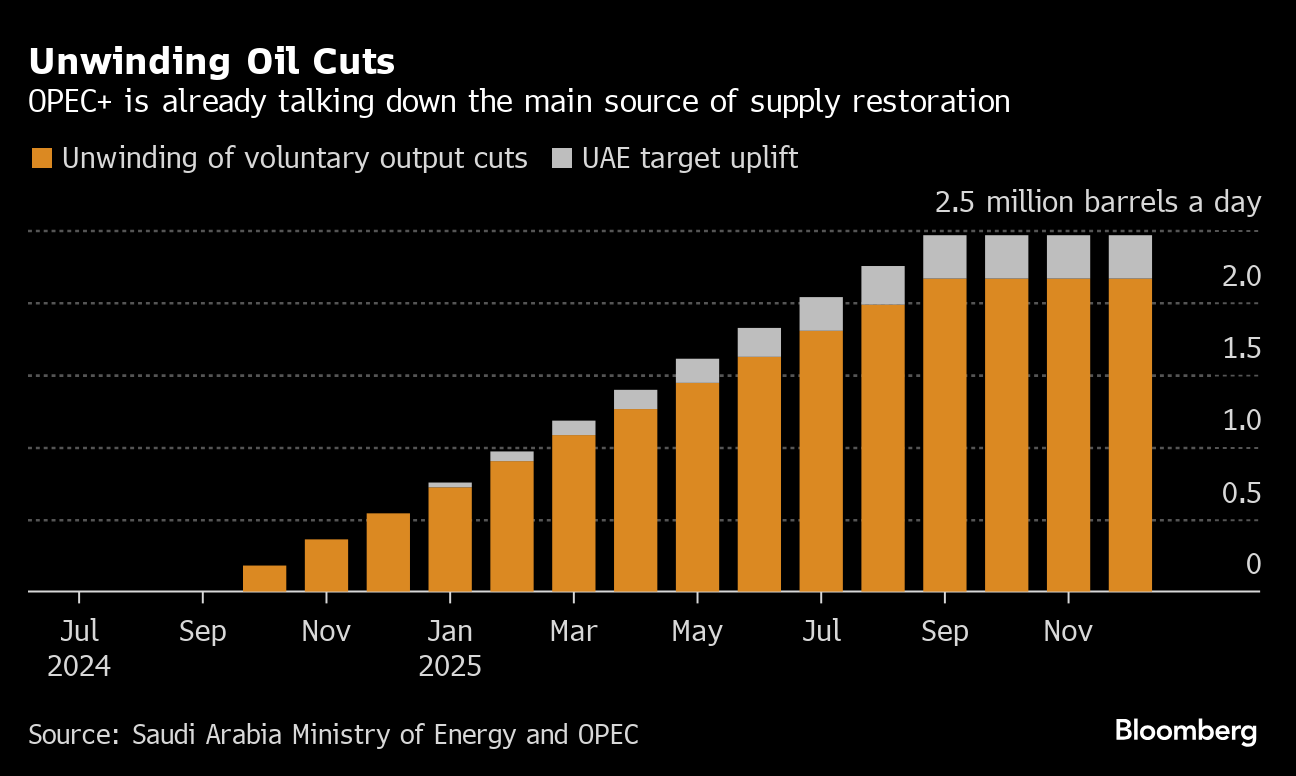

Oil

Ministers from the OPEC+ group of oil producers unveiled plans to add almost 2.5 million barrels a day to the group's supply by October 2025 when they met on June 2. The increase is to come from unwinding the most recent round of output cuts and allowing the United Arab Emirates a modest additional uplift in its target to reflect rising production capacity there. Oil prices slumped by 5% in the wake of the announcement, prompting a rapid U-turn, with ministers insisting that the biggest part of the increase could be postponed or even reversed.

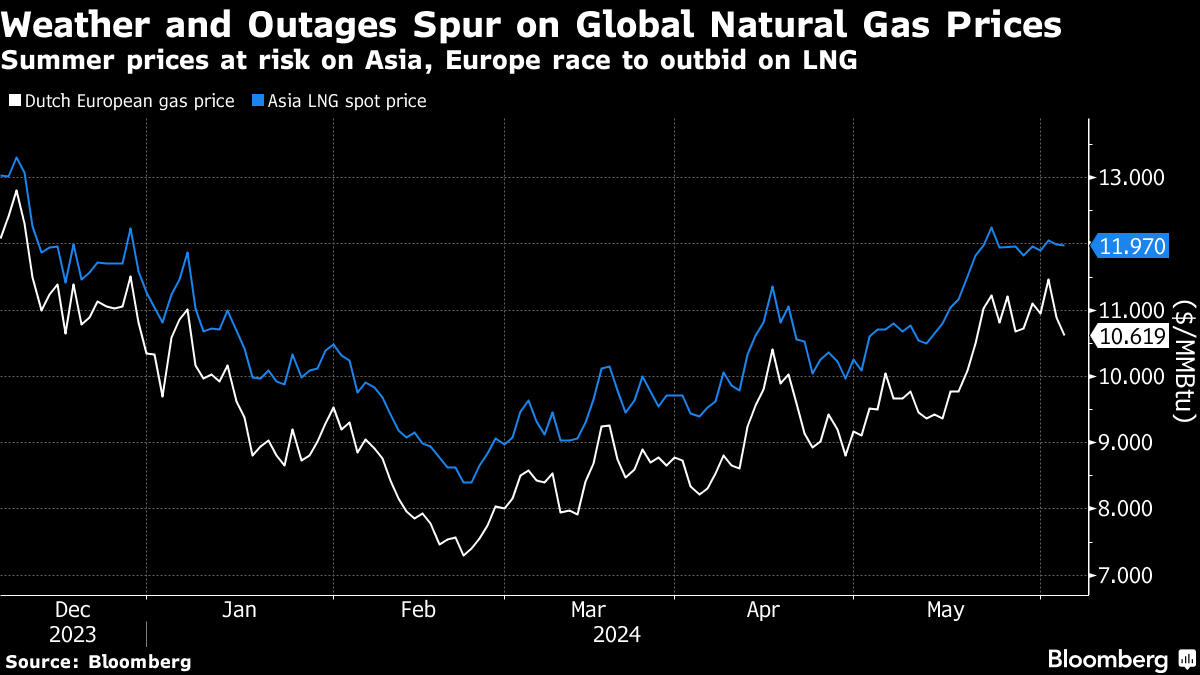

Natural Gas

Global gas markets are at risk to supply disruptions and increased power consumption as summer demand kicks into higher gear. Traders are on edge for any sustained global disruption, especially after facing aftershocks from last week's unexpected outage in Norway. The threat of supply cuts elsewhere, geopolitical woes and stiff competition for liquefied natural gas cargoes are also sources of volatility that could drive up the benchmark Dutch gas price and Asian spot LNG.

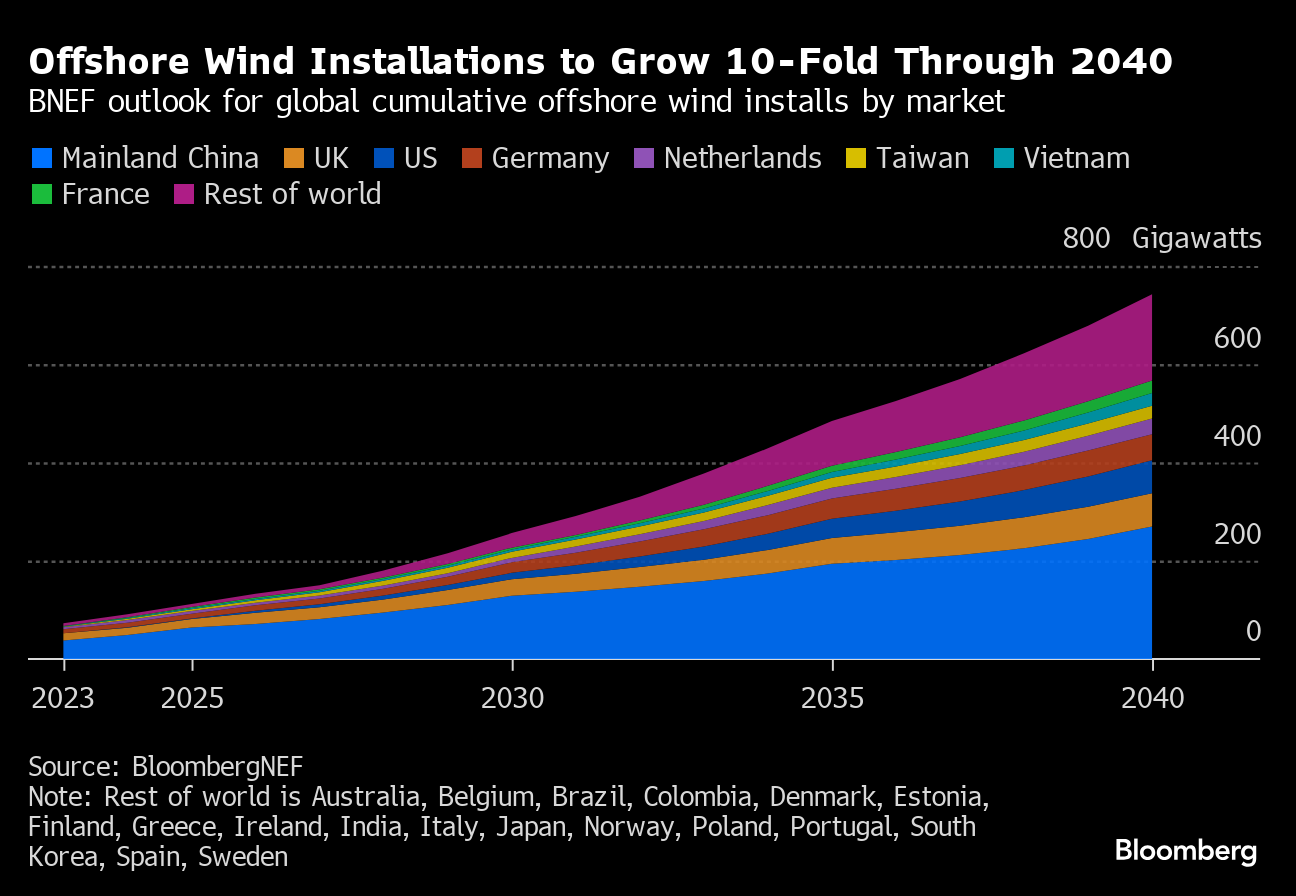

Offshore Wind

Offshore wind additions are set to hit a new high this year, as several new markets including the US, France and Taiwan ramp up installations. There will be 18.3 gigawatts of offshore wind capacity commissioned in 2024, a new record, according to BloombergNEF. The milestone comes as offshore wind auctions are set to boom, supporting a strong growth trajectory, and capacity is on track for a 10-fold increase by 2040 to reach 742 gigawatts.

--With assistance from Doug Alexander and Michael Hirtzer.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.