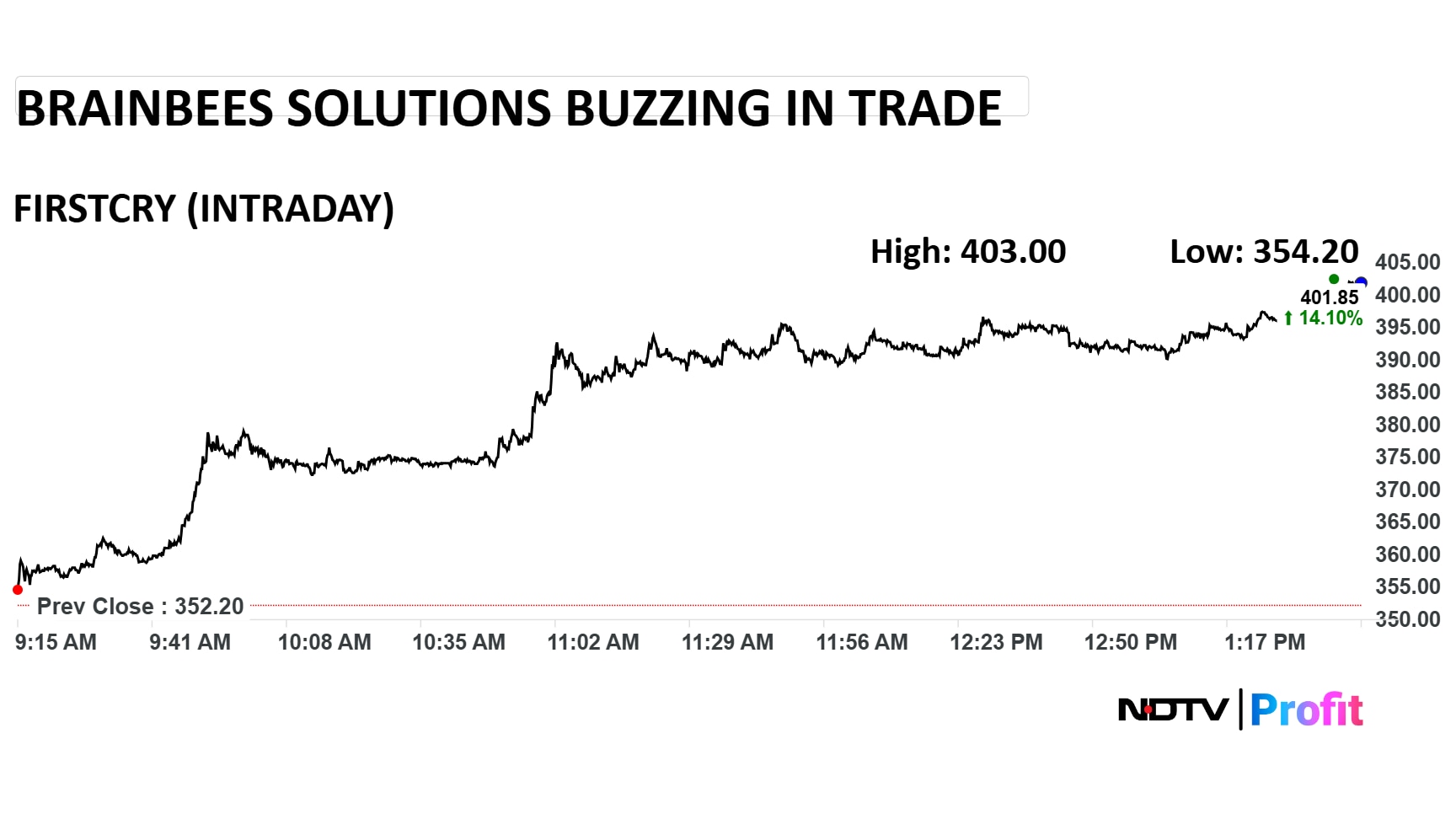

Shares of FirstCry parent company Brainbees Solutions are buzzing in trade today, rising as much as 14% on the back of GST relief on some of the main products it sells. Brainbees stock reached an intraday high of Rs 403 and is trading on high volumes on Friday's trade.

For a stock that has given a negative 40% return to shareholders since listing, the surge in trade today comes on the back of the government's GST relief on most consumer goods. As part of the sweeping GST changes, the government has reduced rates on personal baby care and beauty products, which serve as the main product offers for FirstCry, a retail company focused on infant, maternity and children's products.

(Photo: NDTV Profit)

How GST Relief Aids Brain

GST Council on Sept. 3 approved a uniform 5% GST on some of the consumer essentials, including milk products, talcum powder, shampoo and even toothpaste. This is down from the earlier rate of 18%, meaning the majority of FirstCry's products are set to become cheaper.

GST Council has also reduced GST on all napkins and napkin liners for babies and clinical diapers. They are going to attract a GST of only 5% as opposed to 12% earlier.

In addition to baby and beauty products, FirstCry also sells stationery, board games and other items. In terms of stationery, there will be no GST charged on products such as pencils, crayons, pastels, drawing charcoals and tailor's chalk, and geometry boxes. This compares to a previous GST of 5%.

Toys are also set to get cheaper, down from 12% earlier to just 5%. The same can be said for board games, including chess. All of this will serve as a major boost for consumers, but even more so for FirstCry, given their strong presence in the segment.

Good Days Ahead For FirstCry?

Cheaper rate of products will likely lead to more consumption, thus aiding the revenue for First Cry.

In the first quarter of the ongoing financial year, Brainbees Solutions registered a topline of Rs 1,863 crore, up 12% on a year-on-year basis.

Although the company also narrowed the losses to Rs 46 crores, margins took a 110 basis point hit.

Brainbees Solutions Q1 Earnings

Net Loss Of Rs 46.4 Cr Vs Loss Of Rs 56.7 Cr (Cons, YoY)

Revenue [GU] 12.7% At Rs 1,863 Cr Vs Rs 1,652 Cr (Cons, YoY)

EBITDA [RD] 32.6% At Rs 33.1 Cr Vs Rs 49.2 Cr (Cons, YoY)

Margin At 1.8% Vs 2.9% (Cons, YoY)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.