- Fino Payments Bank received RBI approval to convert into a small finance bank

- Conversion allows Fino to expand lending, remove deposit caps, and issue credit cards

- Fino targets Rs 5,000 crore lending AUM and 20-25% topline from loans by FY28-30

In a landmark achievement for Fino Payments Bank, the lender has received 'in-principle' approval from the Reserve Bank of India to transition into a small finance bank, essentially becoming the first payments bank to do so.

Fino Payments Bank had applied for a small finance bank licence back in October 2023, and the RBI approval could go a long way in boosting the lender's prospects, once it turns into an SFB.

Benefits Of Becoming An SFB

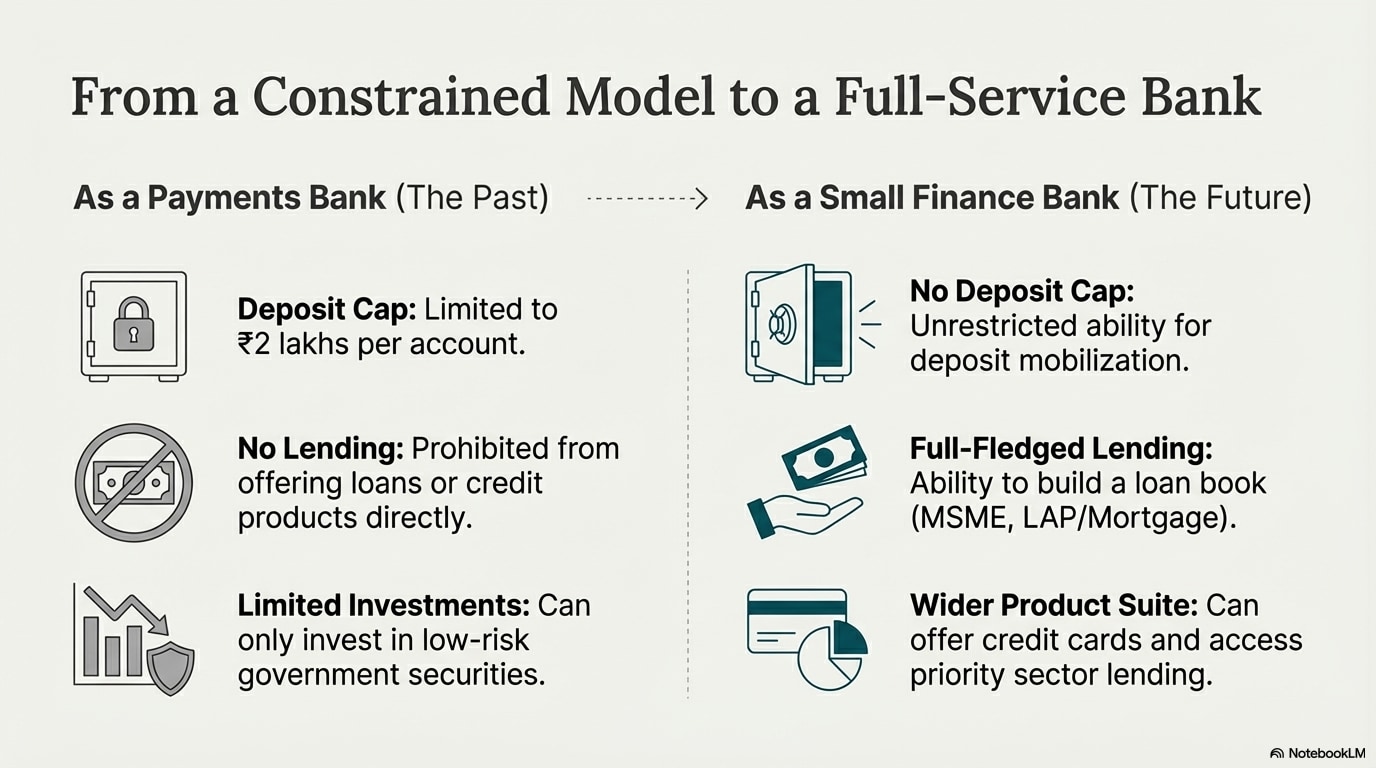

The conversion to a small finance bank could unlock a myriad of opportunities for Fino Payments Bank, especially in terms of operational capabilities - some of which were previously limited under a payments bank license.

One of the biggest benefits could come in the form of the bank's lending operations, with Fino now eligible to build a full-fledged lending business, specifically targeting MSME and LAP/mortgage segments.

Obtaining an SFB license also means the deposit cap will be removed, thus allowing the bank to strengthen its liability franchise.

Moreover, the bank now gains the authority to issue credit cards and access some of the Priority Sector Lending (PSL) opportunities.

Not to mention, becoming a small finance bank simply launches a wider product suite for Fino Payments Bank, thus allowing the company to serve a broader range of customers.

Benefits of becoming an SFB: What changes. (Photo: Notebook LM)

Strategy & Outlook

According to management, Fino Payments Bank is targeting a lending assets under management (AUM) of Rs 5,000 crore during FY28-30. The lending segment itself is expected to contribute 20-25% to the topline within the first three years of SFB operations, the company adds.

Speaking to NDTV Profit, the management also stressed tech Platforms, distribution channels and lower cost of funds to aid transition to SFB.

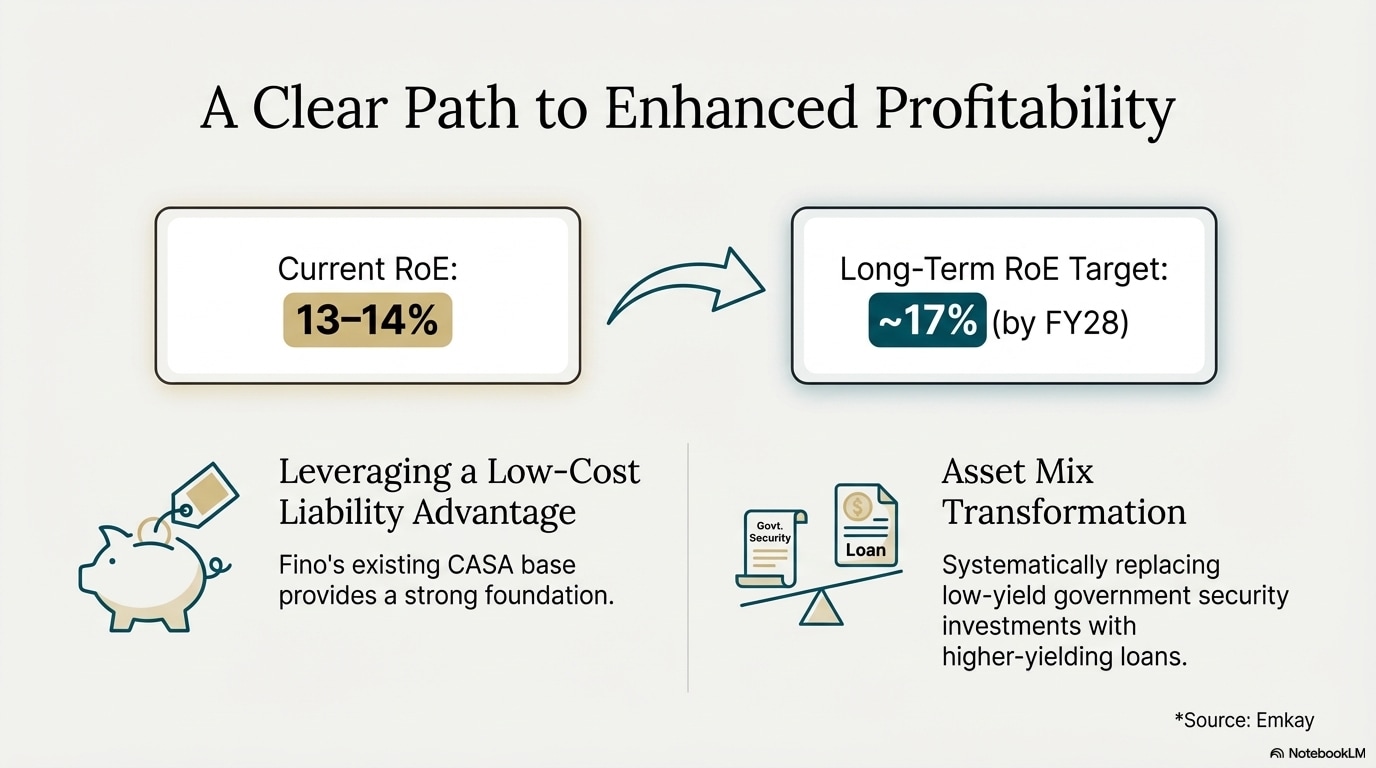

Meanwhile, Emkay has maintained an 'add' rating on Fino Payments Bank, notably raising the target price from Rs 300 to Rs 330.

The shift to SFB could improve margins and return on equity, which could rise up to 17% by FY28, up from 13-14% right now. This is largely on account of low-yield investments being replaced by higher-yielding loans.

An enhanced path to profitability for Fino? (Photo: Notebook LM)

Key Risks

Not everything is rosy for Fino Payments Bank, however. In fact, the transition to SFB will bring in its own set of challenges for the management.

For one, the lender will face interim headwinds in FY26-27 in the form of higher operating expenses as well as the discontinuation of the Business Correspondent segment.

A lack of lending DNA and intensified competition from smaller banks and non-banks may also weigh on Fino.

RBI, meanwhile, has also mandated that large investors such as BPCL and Blackstone reduce their stake within an 18-month window, thus adding to the pressure.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.