The US Federal Reserve's monetary policy is among the most important factors in global capital markets. Borrowing costs in the world's largest economy, set by the central bank on a bimonthly basis, have a large bearing on the movement of money (read dollars) in the global financial system.

The Federal Open Market Committee (FOMC), headed by the Fed Chairman, decides on the interest rate. When rates are cut, money typically moves out of safe dollar assets like US Treasury bonds into riskier, high-return bets in emerging markets, including India.

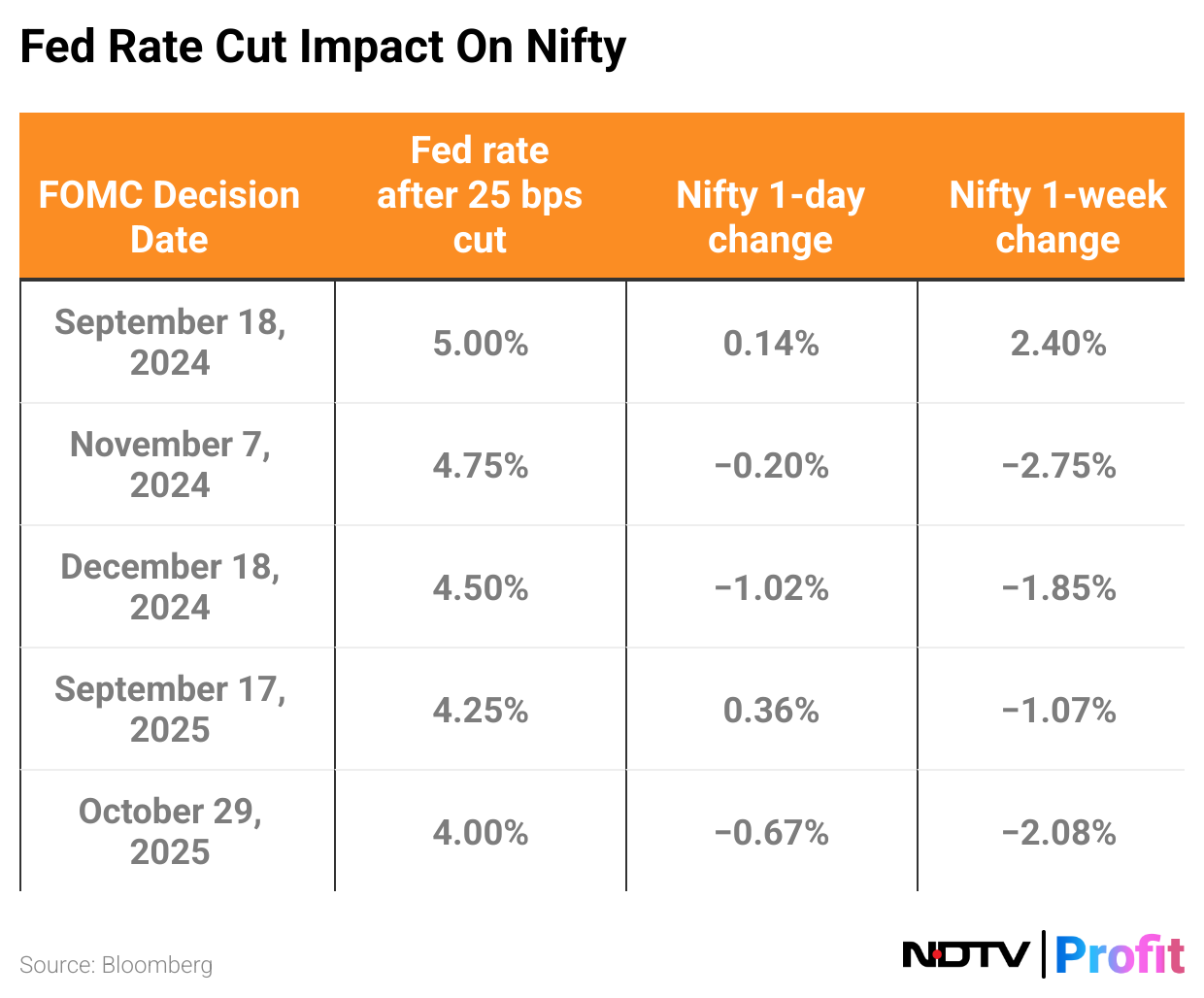

The FOMC is widely expected to deliver its third straight interest rate cut later on Wednesday. The last five instances of US Fed rate cuts show that India's benchmark Nifty 50 index declined three times on the immediate next day, and lost in four of five instances within a week.

To be sure, Indian markets during this period were also influenced by other global as well as domestic factors.

The rate-setting FOMC is split between members who favour cuts as a way to head off further weakness in the labour market against those who think easing has gone far enough and threatens to aggravate inflation, according to a CNBC International report.

A 25 basis points cut this time will take the key interest rate down to a range of 3.5%-3.75%, a multi-year low.

Fed Chair Jerome Powell's post-decision speech and news conference will also be closely tracked to understand the central bank's thinking.

Where Indian Markets Are

Indian equities ended lower for the third consecutive session on Wednesday, with benchmark indices giving up early gains as traders booked profits ahead of the FOMC's policy outcome later in the day.

The Nifty declined 82 points, or 0.32%, to close at 25,758, whereas the BSE Sensex shed 275 points to settle at 84,391.27.

Broader market witnessed sharper declines with Nifty Midcap100 and Smallcap100 falling by 1.1% and 0.9% respectively. Amongst sectors, IT and financial service indices were the top losers, declining over 0.8% each. Meanwhile, the metal stocks gained 0.5% amid rising prices of precious metals.

Analysts expect the markets to track global cues with focus on the US monetary policy decision and FOMC commentary giving insights into the US economic outlook.

Technical charts indicate the Nifty is under selling pressure at higher levels as the index consolidates in a 25,700–26,200 range ahead of the US FOMC meeting, according to Bajaj Broking. The key support lies around 25,700–25,800.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.