Morgan Stanley has raised the target price of Exide Industries Ltd. as it expects the company to emerge as the top player in the battery cell business on the back of supporting environment. The brokerage reiterated an 'overweight' rating on Exide and revised the target price to Rs 485 apiece from Rs 373, implying a potential upside of 22% from the previous close.

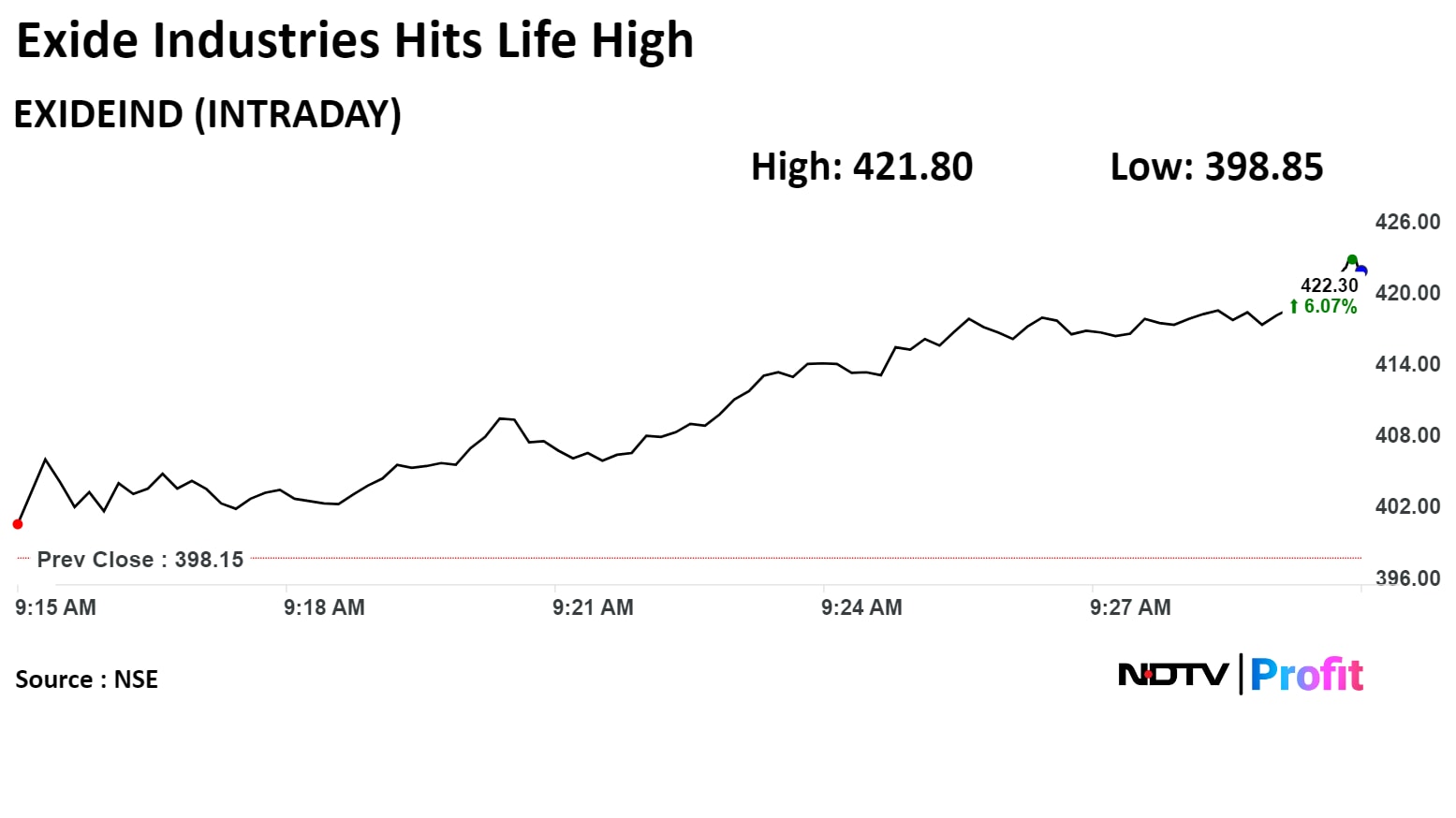

The stock opened with a sharp spike on Monday rallying over 5%. In the past month, the share price has shot up 36% while over a six-month period it has rallied over 57%.

Target Price Rationale

Supportive policies from the government, decline in battery cost and demand pull from electric vehicles and industrial segment will drive India's demand of lithium batteries to 150 gigawatt hours. This will represent a $13-billion total market addressable for Exide to leverage, according to Morgan Stanley.

It expects the margin of Exide's core lead-acid business to expand 13.5% and the cash flow to support further investment in the lithium business. Robust expansion of lithium battery business, validation of technology advancement through order win from Hyundai Motor India Ltd. and Kia India Pvt. will aid in re-rating of its lithium battery business, according to a note on Sunday.

Exide is a $4-billion market-cap company, which has underperformed the NSE Nifty 50 by 30% over 2018–2023 as market de-rated its lead-acid battery business. The battery-maker can also benefit from its early-mover strategy by becoming more competitive than peers to attract more orders, the brokerage said.

However, Morgan Stanley also cautioned about the company's growth in case the industry's overcapacity phase comes fast, raw-material costs increase and regulatory risks.

Due to the evolving nature of battery technology, any material change in it could lead to capital-expenditure loss. There can be a threat to Exide's growth if electric-vehicle penetration is slow and from any regulatory change.

Bull Case

In bull case, Exide Industries can move 88% up, Morgan Stanley said. The rationale behind is first-mover advantage, expansion of capacity, and re-rating of business.

Bear Case

In case of a fall, Morgan Stanley sees a 30% decline in the stock compared to the stock's Friday's closing price. It cited Exide Industries' steady revenue rise, but weak margin, aggressive ramp-up by peers and no incremental order win in the upcoming year.

Key Takeaways

Morgan Stanley reiterates 'overweight' rating on Exide and raised target price to Rs 485 apiece from Rs 373.

The latest target price implies a 22% upside potential from Friday's closing price.

Exide is emerging as the regional leader in battery cell localisation.

The total addressable market in the lithium battery segment for Exide will increase to $13 billion by 2030 on the back of supportive government policies, demand pull from expansion of electric vehicles.

Morgan Stanley's bull case is built on Exide's first-mover's advantage and aggressive capacity ramp-up.

Its lead-acid business to see margin expansion of 13.5%, according to Morgan Stanley.

Key risks: Industry overcapacity, price rise of raw materials, technology disruptions, regulatory risks.

Exide's stock rose as much as 6.4% during the day to an all-time high of Rs 423.65 apiece on the NSE. It was trading 4.09% higher at Rs 414.45 per share, compared to a 0.73% decline in the benchmark Nifty 50 as of 10:10 a.m.

The share price has risen 120.41% in the last 12 months. The total traded volume so far in the day stood at 27 times its 30-day average. The relative strength index was at 85.97, implying that stock may be overbought.

Fifteen out of the 24 analysts tracking the company have a 'buy' rating on the stock, four recommend 'hold' and five suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 13.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.