Exide Industries Ltd.'s share price rose nearly 4% on Friday after Hyundai Motor India Ltd. signed a binding term sheet with its subsidiary, Exide Energy Solutions Ltd.

Hyundai is likely to be the first Indian carmaker to use made-in-India battery cells unless Maruti Suzuki India Ltd. beats it to it.

The term sheet also stated that Hyundai Motor India will onboard EESL as a supplier of lithium-ion cells and battery packs for use in its electric vehicles. The end-product will be sold exclusively in the Indian auto market, according to the exchange filing on Thursday.

On Nov. 26, Exide Industries announced it was adding an investment of around Rs 100 crore into EESL. With the fresh infusion of funds, the total investment made by the company in its arm now stands at Rs 3,052 crore.

The energy solutions business is in the process of setting up a green field plant in Bengaluru to manufacture and sell lithium-ion battery cells, modules and pack business. The fresh investment is aimed at meeting the various funding requirements for this project, Exide Industries said in the exchange filing.

Notably, EESL was incorporated on March 24, 2022, and is engaged in the business of manufacturing and selling lithium-ion battery cells, modules and packs for India's electric vehicle market and stationary applications.

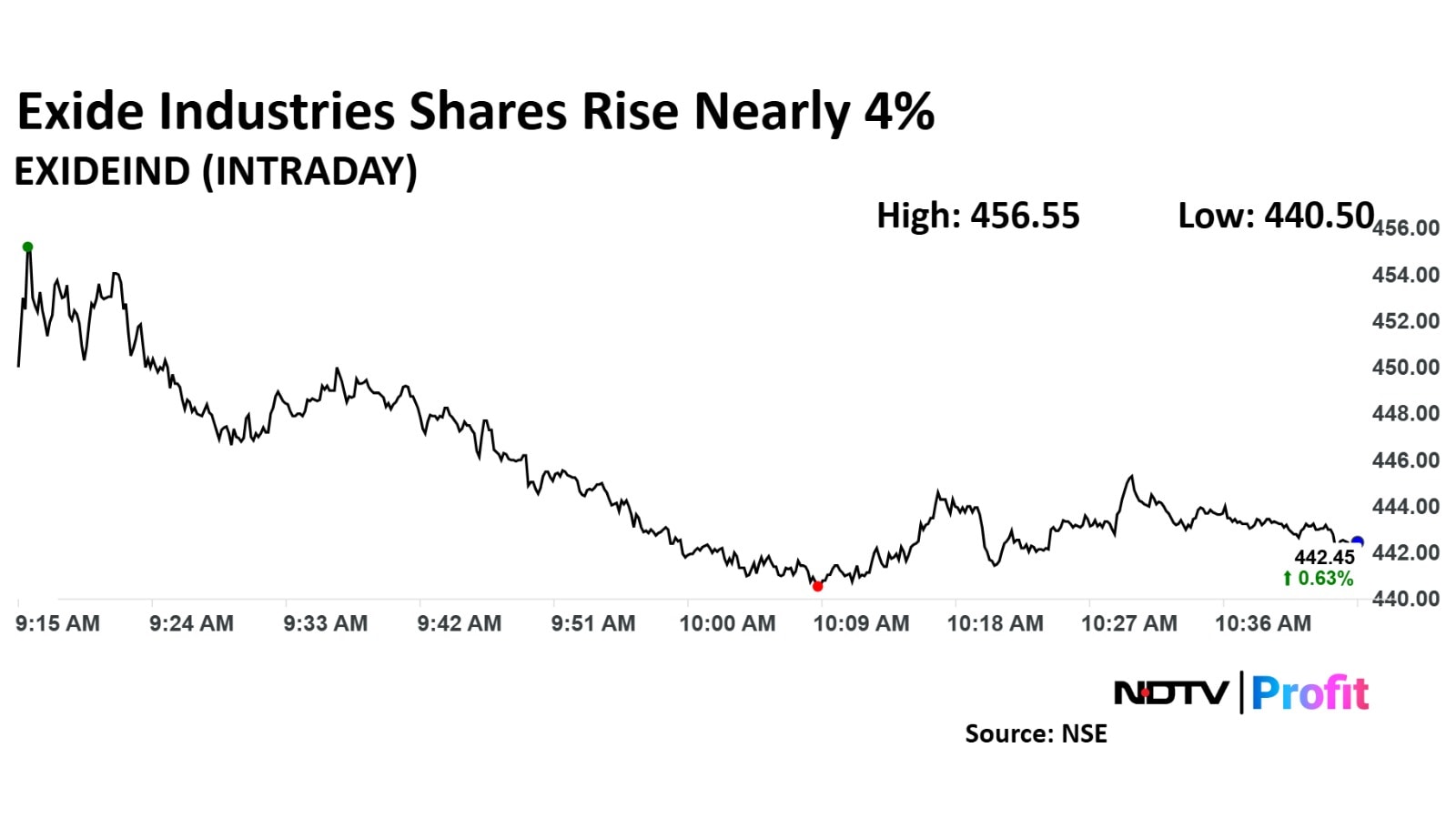

Exide Industries Share Price Today

Exide Industries stock fell as much as 3.83% during the day to Rs 456.55 apiece on the NSE. It was trading 0.49% higher at Rs 441.85 apiece, compared to a 0.13% decline in the benchmark Nifty 50 as of 10:48 a.m.

It has risen 54.16% in the last 12 months and 39.42% on a year-to-date basis. The total traded volume so far in the day stood at 4.4 times its 30-day average. The relative strength index was at 44.43.

Ten out of the 22 analysts tracking the battery-maker have a 'buy' rating on the stock, six recommend a 'hold' and six suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 462.39, implying an upside of 4.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.