(Bloomberg) -- The upward march in global stock markets continued on Tuesday, with European equities following Asian peers higher as investors bet this earnings season will underpin the rally. The yen was the only G10 currency to rise against the dollar after the Bank of Japan pared bond purchases.

The Stoxx Europe 600 index rose as data showed German industrial production rebounded in November, and as the common currency declined. The pound fell as a reshuffle of senior U.K. government ministers descended into chaos, and China's yuan dropped after the central bank was said to have effectively removed an adjustment mechanism used for its currency fixing. Oil pared an earlier gain that took it above

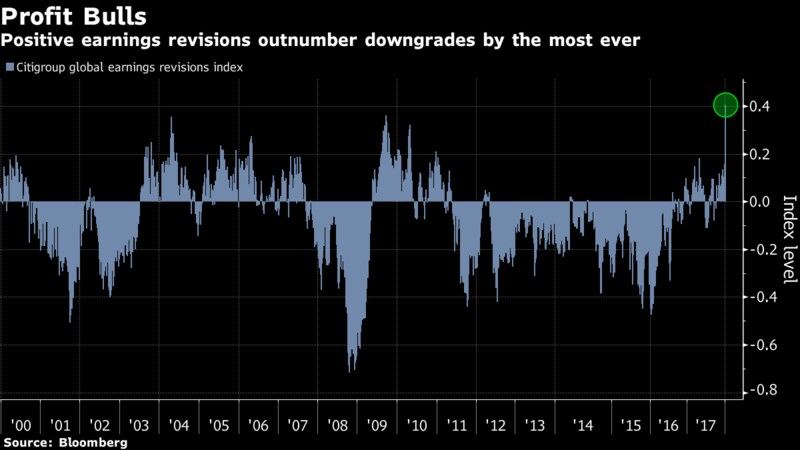

Earnings reports due this week from banks including JPMorgan Chase & Co. and Wells Fargo & Co. will dominate the market's focus as traders look for more reasons to chase stocks trading at or near record highs. Analysts who raised profit estimates for companies around the world last week outnumbered those cutting them by the biggest margin since Citigroup Inc. began compiling the data 18 years ago.

Equity levels were tested in Asian trading hours when Samsung Electronics Co. missed profit forecasts and the BOJ announcement hit Japanese shares, underscoring how the rollback of central bank stimulus could affect markets. But most of the region's major gauges still ended in the green.

Here are some of the main events to watch for this week:

- Eurozone unemployment rate data for November due at 10 a.m. London on Tuesday.

- U.S. inflation data are forecast to show price pressures remain muted, giving hawks little reason to argue for faster tightening.

- St. Louis Fed bank President James Bullard and head of the New York Fed Bill Dudley are among central bankers scheduled to speak.

- China producer and consumer prices data come Wednesday, while a reading on the country's money supply is expected in coming days.

- Talks between South Korea and North Korea are set to take place Tuesday.

Terminal users can read more in our markets blog.

These are the main moves in markets:

Stocks

- The Stoxx Europe 600 Index climbed 0.4 percent as of 10:56 a.m. London time, hitting the highest in more than two years with its fifth consecutive advance.

- The MSCI All-Country World Index climbed less than 0.05 percent, reaching the highest on record with its sixth consecutive advance.

- The U.K.'s FTSE 100 Index gained 0.4 percent to the highest on record.

- Germany's DAX Index jumped 0.2 percent, reaching the highest in two months on its fifth consecutive advance.

- The MSCI Emerging Market Index sank 0.2 percent, the first retreat in more than a week and the largest decrease in two weeks.

- Futures on the S&P 500 Index rose 0.1 percent.

- The MSCI Asia Pacific Index rose 0.2 percent, hitting the highest on record with its sixth straight advance.

- Japan's Nikkei 225 Stock Average gained 0.6 percent to the highest in more than 26 years.

Currencies

- The Bloomberg Dollar Spot Index climbed 0.2 percent to the highest in more than a week.

- The euro declined 0.3 percent to $1.1929, the weakest in almost two weeks.

- The British pound dipped 0.3 percent to $1.3534.

Bonds

- The yield on 10-year Treasuries rose one basis point to 2.49 percent, the highest in almost three weeks.

- The yield on two-year Treasuries decreased less than one basis point to 1.95 percent, the largest dip in more than a week.

- Germany's 10-year yield dipped one basis point to 0.43 percent, the lowest in more than a week.

- Britain's 10-year yield gained one basis point to 1.245 percent, the highest in a week.

Commodities

- Gold sank 0.4 percent to $1,315.07 an ounce, the biggest dip in more than four weeks.

- West Texas Intermediate crude climbed 0.3 percent to $61.90 a barrel.

— With assistance by Cecile Vannucci, Yvonne Man, Sofia Horta E Costa, and Adam Haigh

©2018 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.