Shares of eMudhra Ltd. fell over 18% on Wednesday to hit over a seven-month low after it posted a dip in its net profit for the quarter ended December 2024. In addition, the shares were trading at a high volume.

The digital certificate provider reported a 4.6% decline in net profit to Rs 20.9 crore in the third quarter, compared to Rs 21.9 crore in the previous quarter of this fiscal, according to its stock exchange notification.

Revenue decreased 1.7% year-on-year for the three months ended December, reaching Rs 139 crore. Operating income, or earnings before interest, taxes, depreciation, and amortisation, fell 9.88% year-on-year to Rs 23.7 crore. Ebitda margin contracted to 17.1% from 18.6% in the same period the previous quarter.

During the third quarter, deal closures and growth in America, MEA region and Asia Pacific was strong resulting in strong overseas markets. "Global opportunities continue to be characterised by need for usage of identity backed digital signatures and increased usage of automation in key public infrastructure as part of user and device security," said V. Srinivasan, executive chairman, eMudhra.

The Indian business was good due to deal wins in identity and access management solutions. The enterprise revenue split between India and the international market was at 32:68, he added.

The revenue split between the cyber security and paperless segments was at 70:30.

eMudhra Share Price Today

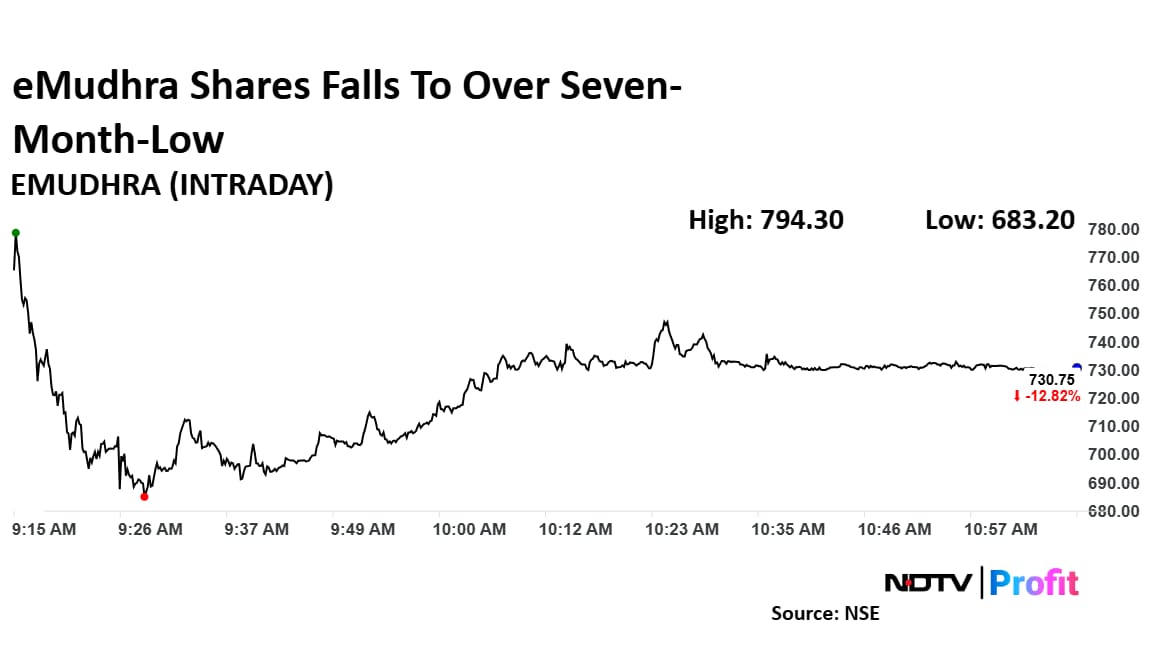

Shares of eMudhra fell as much as 18.49% to Rs 683.20 apiece, the lowest level since June 2024. It pared losses to trade 12.85% lower at Rs 730.50 apiece, as of 11:05 a.m. This compares to a 0.68% advance in the NSE Nifty 50.

The stock has risen 60.30% in the last 12 months. Total traded volume so far in the day stood at 20 times its 30-day average. The relative strength index was at 25 indicating it is oversold.

One analyst tracking the company maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 36.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.